Heads Up: Historic Shocker to Hit Stock Market This Friday

|

It will be the worst number ever.

It will hit the market like a nuclear bomb.

And investors will probably begin reacting to the expected shock even before it’s actually released.

It’s is a big part of what Fed Chairman Powell recently called “economic data for the second quarter that is worse than any data we have seen” …

And what former White House economic advisor Nouriel Roubini called “a perfect storm that sweeps the entire global economy into a decade of despair.”

|

I’m talking about the U.S. Department of Labor’s jobless report that will be released at 8:30 a.m. this coming Friday.

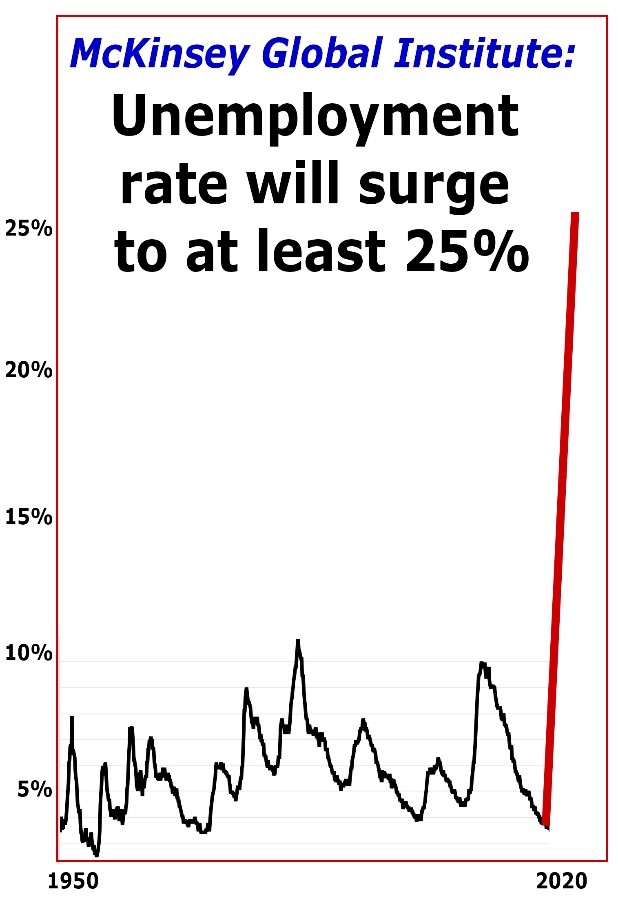

Here’s what the U.S. unemployment history looks like right now →

Even in the worst single month of the postwar era, it never rose above 11%.

Even in the Great Recession, the peak was 10%.

And in the latest release for March, it just began to rise from half-century lows.

|

But now, based on a recent study by McKinsey Global Institute, this is what it’s going to look like very soon, starting with the big shocker that’s about to hit the market on Friday →

Over 30 million workers have already lost their jobs in just the first six weeks of this crisis.

And McKinsey estimates that the total number of unemployed will be between 41 million to 55 million.

Even assuming the lower end of that range, with a current work force of 146 million, the unemployment will be 25%.

This Friday’s Labor Department release will not reflect all the unemployed because of the way they estimate the number. So, it will probably be closer to 16% or 17%.

But here’s the biggie: In all of U.S. history, the steepest unemployment surge on record took place immediately after World War II, when 1.96 million jobs were suddenly eliminated. This time, we’re looking at a shock to the economy which is at least 10 times larger.

All this raises tough questions for anyone in the stock market …

Question #1

How Much Money Could You Lose?

For a reasoned answer, ignore the lame assurances from Wall Street … and turn a deaf ear to end-of-America predictions on the Internet. Instead, just look at the facts …

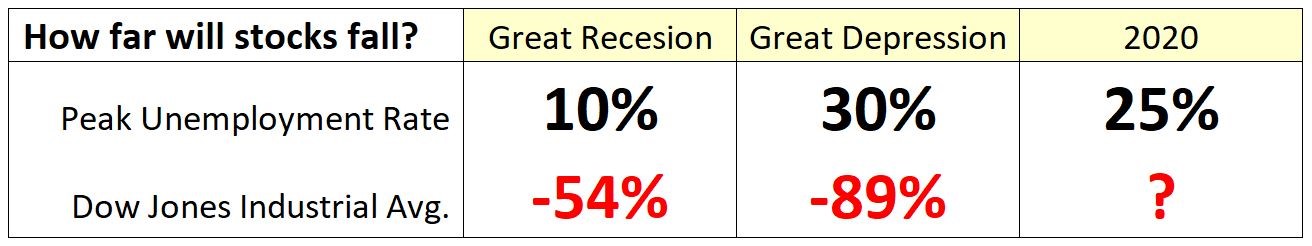

• In the Great Recession, the peak unemployment rate was 10%, and the Dow Jones Industrials fell nearly 54% from peak to trough.

• In the Great Depression, the peak unemployment rate was nearly 30%, and the Dow fell 89%.

• Now, in this crisis, peak unemployment will be at least 25%.

|

Threrefore, you could easily lose a lot MORE than the 53% investors lost in the Great Recession. And it’s also quite possible you could lose as much as the 89% that investors lost in the Great Depression.

Question #2

How Long Would You Have to Wait

To Recoup Your Stock Market Losses?

Again, history helps provide some parameters:

In 1929, the Dow peaked on Sept. 3 of that year. Then, after the crash, it did not rully recover until Nov. 23, 1954.

That was more than 25 years later.

I don’t think investors will have to wait that long this time.

But if you decide to just hang on … if you take no action to reduce your exposure or hedge your risk right now, you may have to wait for a long, long time.

Question #3

What Can You Do about This Right Now?

That’s easy: Just join me online this coming Wednesday, May 6 at 2 p.m. Eastern. During this new, one-hour emergency session …

I will give you the true facts about what’s happening right now that most investors are missing.

I will tell you what’s likely in May, through the summer and beyond.

I will give you immediate steps you can take to protect your wealth based on fresh new data we’ve just gathered this week.

I will explain how to profit directly from the decline with choice bear-market investments. (Warning: When the stock market rally dies, it could be too late.)

And I will show you how much money you could make. (Brace yourself. Because the numbers are off the charts.)

If you’d like to come, please be so kind as to RSVP by clicking here.

And if you’d like to catch up with my most recent emergency briefing, go to this page.

Good luck and God bless!

Martin