|

| By Tony Sagami |

Sure, I was in only in junior high, soon to make the leap to high school, so my experience was limited. But, still, it was the most horrifying string of words I’d ever heard in my life ...

“Your grandfather was a farmer, your father is a farmer and you’re going to be a farmer,” said my mother.

With that, Mom ordered me to join the Future Farmers of America (FFA) club in high school, and, of course, I hated it ... especially the part where we cleaned up the cow barn.

|

Indeed, I know what it’s like to shovel dung ... literally.

So, too, does Federal Reserve Chair Jerome Powell, if only in the figurative sense.

It’s the kind of smell that sticks with you, after years on the farm and/or decades listening to central bankers.

And it instills an instinct for countermeasures; we’ll get to one in a minute, but, first, we need to talk about the Fed Chair’s effluence.

Lately, Powell has been shoveling a mountain of manure about inflation.

He says the recent uptick is “transitory.”

“Our expectation,” said Powell, “is these high inflation readings now will abate.”

He’s still on the “easy money” trip because the economy is “a ways off” from reaching “substantial further progress” toward its goal of maximum employment.

Wrong! This rise in inflation is NOT transitory. And it’s going to get a lot worse.

David Stockman — the former director of the Office of Management and Budget under President Ronald Reagan — called the Fed’s “transitory” narrative a scam. I agree.

Consider ... ...

Retail Inflation. The headline Consumer Price Index (CPI) came in at 5% year over year, the highest reading in over a decade.

Energy commodities, gasoline in particular, jumped the most of any other measured item. Energy increased 54.5% year over year, gasoline 56.2%, as oil prices hit multiyear highs.

Even if you strip out energy and food prices, the “core” inflation rate jumped by 3.8%, which doesn’t sound alarming ... until you realize that’s the fastest rate in nearly 30 years.

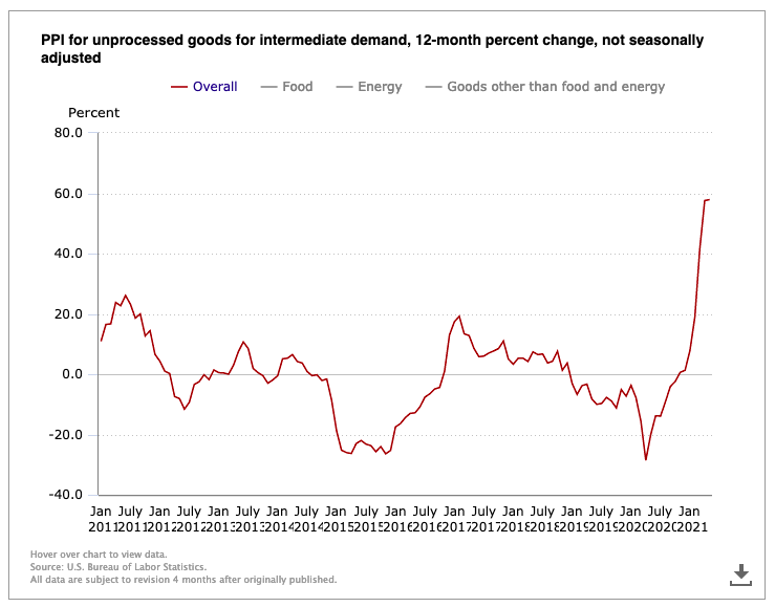

Wholesale Inflation. The 5% jump in CPI was alarming enough. But the even larger jump in the Producer Price Index (PPI) — which tracks wholesale prices — is an even louder inflation signal.

According to the Bureau of Labor Statistics, the PPI jumped by 6.6% in May, the largest one-month jump in history. Even if you strip out food and energy, wholesale prices still increased by 5.3% over the last 12 months.

|

But get this: The index for unprocessed goods, or raw materials, skyrocketed by 58%, the biggest jump since 1973.

With both consumer and whole prices rising at the fastest pace in more than a decade, we’re looking at Super Ball-level inflation.

Don’t take my word for it — listen to what America’s largest corporations are saying about price increases they’re being forced to pass on to you:

• Campbell Soup Company (NYSE: CPB) CEO Mark Clouse said his company is being “impacted by a rising inflationary environment.” He expects “sustained inflationary pressures through the remainder of the year.”

• The J.M. Smucker Company (NYSE: SJM) CEO Mark Smucker warned that “broad-based inflation is impacting many of the commodities, packaging materials and transportation channels that are important to our business.”

• Whirlpool Corp. (NYSE: WHR) CFO Jim Peters said, “We took price increases in every region of the world, that range from 5% to 12%. Those are driven by commodity cost increases.”

• Kimberly-Clark Corp. (NYSE: KMB) CEO Michael Hsu said that “sharp rises in input costs” are forcing us to raise prices “rapidly, especially with selling price increases to offset commodity headwinds.”

• The Procter & Gamble Company (NYSE: PG) COO Jon Moeller complained that “this is one of the bigger increases in commodity costs that we’ve seen over the period of time that I’ve been involved with this, which is a fairly long period of time.”

I could cite a couple hundred more companies. But the facts are clear: Inflation is becoming a serious problem.

The problem is that everyone born after 1981, including many of the youngsters managing other people’s money, have no idea what inflation looks like or feels like.

For the last 30-plus years, deflation has been the name of the game, and entrenched beliefs are hard to change.

For now, Wall Street is convinced the Fed has “Wizard of Oz”-type powers over inflation and believes our central bankers will be able to successfully contain it before it gets any worse than it already is.

“LOL,” as the kids today say ...

The problem for the Fed is that inflation has a mind of its own; it can get out of control faster than policymakers with preconceived ideas can change their minds.

So, here’s the thing: When the crowed finally wakes up to these inflation signals, it’s going to stampede into assets that do best during inflationary periods — precious metals, hard assets and natural resources — like there’s no tomorrow.

You want to get ahead of that stampede.

A great way to do so is by looking at my colleague Sean Brodrick’s Wealth Megatrends newsletter.

He has absolutely nailed the commodity and natural resource boom, and he’s helped make his subscribers a mountain of money.

Now, he’s prepared to help protect you from the ravages of inflation. Click here to learn more.

Best,

Tony Sagami