Holiday Shopping Season Looking Strong; Here’s How to Profit!

|

Yeah, I know it’s only September. But Corporate America is anticipating a gangbuster holiday spending spree, and this can give you an accurate peek at the health of the American consumer.

But you don't have to wait until the traditional holiday shopping season kicks off. Sure, "Black Friday" sales seem to start earlier every year. So, it's not surprising that one of the country's top shipping companies is already prepared to handle the rush.

But the boon it expects is much bigger than that …

FedEx (FDX) anticipates an avalanche of business coming its way — more than it's enjoyed during previous holiday seasons. That's why this year, the company is going way beyond making its existing employees work a bunch of overtime and hiring a bunch of temp workers for the busy holidays.

FedEx currently offers home delivery on Tuesday through Saturday. But it’s already started expanding to six days a week — and not for just the holiday season. In fact, FedEx will continue that six-days-a-week service permanently.

|

Why? There are about 14 million good reasons. Just ask Raj Subramaniam, the chief marketing officer, who said …

"The rise in demand for e-commerce goes beyond peak. It's a year-round phenomenon, and we are ready to meet that demand. FedEx Ground has operated six- and seven-day operations during the holidays for several years as e-commerce has grown. And thanks to strategic investments in our network, we are now well-positioned to operate six days a week in the U.S. all year to best serve the rapidly growing demand.”

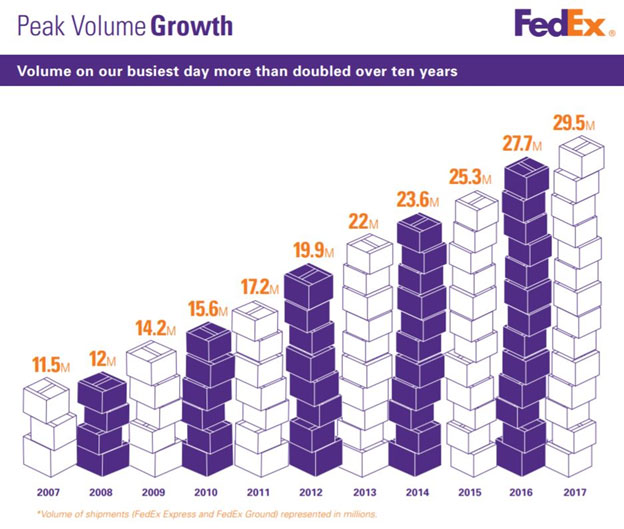

Indeed, E-commerce has been growing like mad. Ten years ago, the record one-day shipment volume was 12 million. Today, FedEx ships an average of 14 million packages a day.

|

Keep in mind, FedEx doesn’t make the products; it only ships them. And it knows its customers' needs. This clearly means that some retailers are similarly expecting a business bonanza.

For example, The Gap (GPS), Kohl’s (KSS), Macy’s (M) and Target (TGT) have all announced larger-than-ever holiday hiring plans.

FedEx didn’t come out and call this the Amazon.com (AMZN) effect … but it should have. Record shipping volume is going to translate into record revenues and record profits for Amazon … and for its various shipping partners.

Even more important is the fact that consumer spending accounts for 70% of Gross Domestic Product. So, the holiday spending boom will resonate throughout the economy and the markets.

|

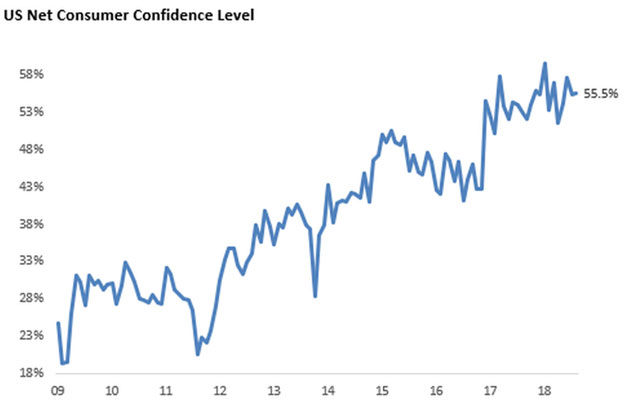

A Prosper Insights & Analytics monthly survey shows a supremely confident consumer. The percentage of Americans who described themselves as “confident” or “very confident” rose to 55.5% in August, which is almost double 2011's percentage.

Rising wages, record low unemployment and the Trump tax cuts all translate into larger paychecks for many Americans.

Deloitte Consulting publishes an annual holiday forecast, and it expects retail sales to exceed $1.1 trillion in the November-to-December season. That would be a 5% to 5.6% gain over 2017!

“Consumer sentiment and spending indicators provide a healthy outlook for retailers across channels with strong expectations for store-based and online retailers,” said Rod Sides of Deloitte.

You could make individual bets on the retailers you think will perform best. And you could use our proprietary Weiss Ratings stock screening tool to help you find the highest-rated performers.

If you’re more of an ETF investor, there are several investments that stand to benefit from strong holiday sales. They include:

• SPDR S&P Retail ETF (XRT)

• Amplify Online Retail ETF (IBUY)

• VanEck Vectors Retail ETF (RTH)

• ProShares Online Retail ETF (ONLN)

And if you'd rather make short-term bets by buying options, which can help you grow your wealth rapidly without tying up a big chunk of capital, my colleague Jon Markman's simple two-step options strategy hasn't had a single losing year since he started using it in 2012. See how you can use it to go for average annual gains of 99.3% when you click this link here.

Again, the holiday spending boom is more than just a payday for retailers. It’s the fuel that is going to keep the economy and the stock market rocking into 2019.

Best wishes,

Tony Sagami