Housing Data Builds Solid Times for Home Depot and Lowe’s

The latest data released by the U.S. Department of Commerce showed a 16.6 percent increase in new home sales and a 3.6 percent increase in new residential construction permits for the month of April. Indicating that more homes are being built and sold and homeowners will go to Home Depot (HD), Lowe’s (LOW) or ACE Hardware (not publicly traded) to work on making it their own.

The positive development in the housing market may have been the key to a good start to 2016 for home improvement retailers, while most of their peers that sell other consumer discretionary goods reported some very disappointing results. Both, Home Depot and Lowe's, have above average performance in numerous areas of the consumer discretionary sector.

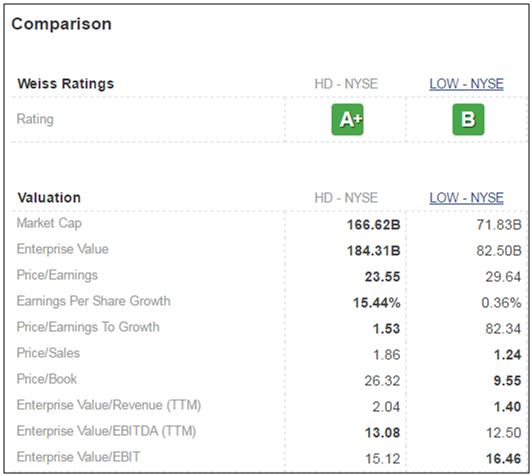

Home Depot stock was upgraded to an A+ (BUY) by Weiss on May 16 and Lowe’s continued to hold the B rating (BUY) issued back in February 2016.

A side by side comparison shows Home Depot in the lead in most areas.

While Home Depot has a market capitalization of $166.6 billion and total assets of $44.6 billion, Lowe’s reports $71.8 billion market capitalization and $31.3 billion in total assets. Home Depot also has a 7.9 percent profit margin as compared to 4.3 percent for Lowe’s.

The one, three, and five-year total returns for both companies are strong and 2016 looking good too with a year-to-date margin of 2.8 percent for Home Depot and 7.6 percent for Lowe’s. Home Depot ended the week up 1.9 percent at $133.94 per share and Lowe’s was also up 1.9 percent trading at $80.35 per share.

Overall, Home Depot is the top dog amongst the home improvement retailers, but if the housing market stays up and more people are able to buy homes, the good business may continue for all.

AT&T (T) surprised everyone at the Yahoo (YHOO) bidding table by making an offer to purchase the company’s core internet business last Wednesday. It was reported that AT&T wasn’t initially interested in Yahoo and that Verizon (VZ) was the front-runner to make the deal with a struggling internet search and advertising provider.

Yahoo is having hard time competing with Google (GOOGL), Microsoft (MSFT), Facebook (FB) and is losing money. AT&T and Verizon are interested in the company because they are both looking to boost their subscriber growth by increasing web advertising.

AT&T, rated B by Weiss, is the larger bidder of the two, with market capitalization of $240 billion representing 7.7 percent of the telecommunications sector. Verizon represents 6.6 percent of the sector with market capitalization of $206.3 billion and holds a B investment rating from Weiss.

Besides Verizon and AT&T, there are other companies in the game to win the bidding war.

Out of 1,629 Weiss rated ETFs, 99 or 6.1 percent are rated A or B with a recommendation to BUY.

A majority of the funds fall under the HOLD or SELL category, currently there are 722 or 44.3 percent of ETFs with a recommendation to HOLD and 808 or 49.6 percent to SELL.

If you currently invest or plan on investing, you can follow rating changes on all funds to help you make better financial decisions.

You can easily access the list of all upgrades or downgrades.

Some investors look for consistency and stability when investing their money. Although a more volatile investment option may result in a greater reward, the risk involved may keep you awake at night wishing you had picked something different.

If you don’t like surprises you might want to consider investments with a beta of less than 1, meaning that it is expected to be less volatile than the market. A beta larger than 1 means more volatility.

We have prepared a list of all BUY mutual funds with a beta of 0.5 or less to identify the least volatile investments. You may adjust it in the screener by dragging the handle or simply typing in the desired beta amounts.

Be sure to check out Weiss Ratings’ tools and analysis on all rated mutual funds.

According to the FDIC’s latest qualitative research on “Bank Efforts to Serve Unbanked and Underbanked Consumers” there were about 7 percent of U.S. households without a checking or savings account (unbanked) in 2013 and from the ones that did have a bank account, 20 percent used other financial services, such as check cashing stores and payday loan providers, to meet their needs (underbanked).

The study focused on experiences and views from bankers, consumers and consumer counselors in an effort to inform banks to develop sustainable relationships with unbanked, underbanked, and low- and-moderate income (LMI) consumers.

With safety ratings and analysis on over 6,000 banks, Weiss Ratings can help you find the right financial institution.

Credit unions are known for their small size and the limited number of members they serve. Credit unions with less than $100 million in assets are considered small, but there are some that are truly tiny with only thousands of dollars in assets.

Below are the 10 smallest credit unions in the country.

Credit Union Name |

Domicile City and State |

Total Assets in $ Thousands |

Weiss Safety Rating |

| Fannie B Peck Of Bethel Ame Church CU | Detroit, MI | 2 | D+ |

| Holy Trinity Baptist FCU | Philadelphia, PA | 21 | B- |

| Youngstown Firefighters CU | Youngstown, OH | 25 | D |

| Star CU | Madison, WI | 35 | B- |

| Imperial CU | Springfield, IL | 35 | D- |

| Mcdowell County FCU | Welch, WV | 36 | C- |

| Holsey Temple FCU | Philadelphia, PA | 36 | D+ |

| Allen Ame FCU | Philadelphia, PA | 36 | D- |

| Langston Bag Co Empl Savings Assn CU | Memphis, TN | 46 | C |

| Cosmopolitan FCU | Chicago, IL | 55 | D+ |

Click on the name to check out their individual page with Weiss Ratings’ tools and analysis.

To access the full list of all credit unions sorted by the total asset size, click here.

Find a recommended insurer in your state. Simply select the type of insurance you need and the state that you live in and a list will populate with all recommended companies that fit the request.

All of these insurers have a Weiss Safety Rating of B+ or higher.

You may also check out all Weiss rated insurers and see the tools and analysis available.

Weiss Insurance Screener allows you to slice and dice thousands of insurance companies to find only the best … or the worst.

If you need help using our screener, click here for help.