|

Milton Friedman famously said, “inflation is a monetary phenomenon.” With the Federal Reserve still employing extraordinary measures such as quantitative easing (QE) and zero interest rate policy (ZIRP), that thumbnail description is popping up all over Twitter Inc. (NYSE: TWTR) and other places where hot takes rule.

And when you see the hottest monthly consumer price index (CPI) print in nearly 13 years, it’s pretty easy to make a Twitter-based “what you see is what you get” judgment.

That is, inflation is here. Indeed, the CPI for May was 5%. And, as The Wall Street Journal noted, “The core-price index, which excludes the often-volatile categories of food and energy, jumped 3.8% in May from the year before—the largest increase for that reading since June 1992.”

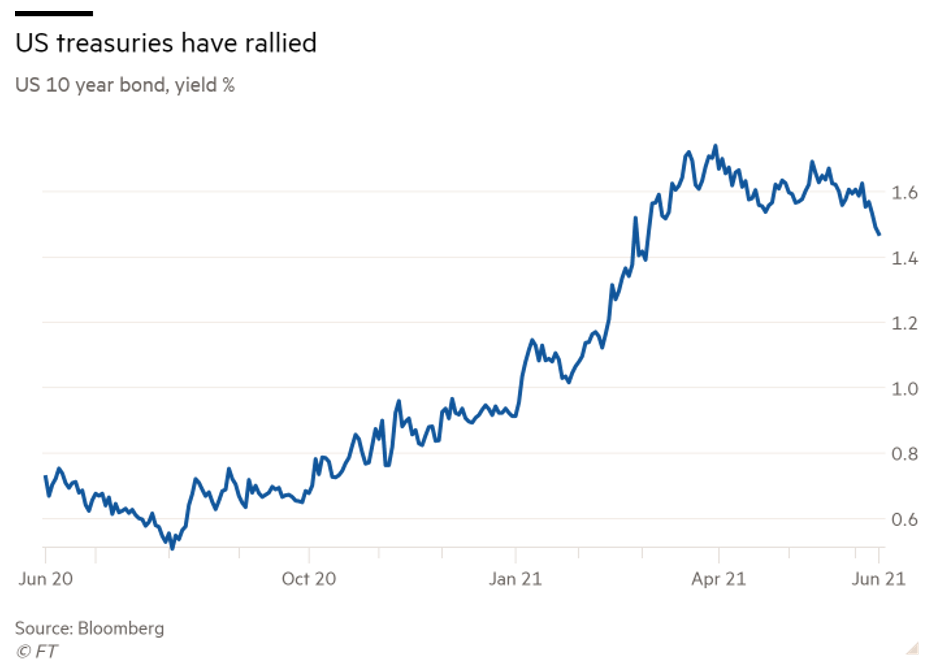

At the same time, though, the S&P 500 Index is cresting, posting a fresh high the very day the Labor Department released CPI data for May. And — get this — the yield on the 10-year U.S. Treasury note is at three-month lows.

|

Straight into the middle of this debate about inflation comes the June issue of Safe Money Report, wherein Mike Larson addresses head-on what all this means for investors.

Here’s Mike’s basic assessment of the state of play:

• The COVID-19 pandemic is on the wane, allowing the economy to keep normalizing.

• Markets have been on fire for more than a year, with everything from stocks to junk bonds to real estate to collectibles soaring in value.

• Yet rhetoric and monetary/fiscal policy are still firmly in “crisis” mode ... despite the buildup of long-term risks and negative side effects.

Now, here’s how he’s approaching it:

• Focus on higher-income, higher-rated stocks and exchange-traded funds (ETFs) that help you beat inflation and generate sustainable gains.

• Target companies that will get a share of money D.C. is doling out (i.e., infrastructure, materials, construction, cyclicals).

• Boost your allocation to precious metals and mining shares amid dollar debasement and “Money Flood” policymaking.

• Use other tactics like selling options for greater income in the “ZIRP Forever” world.

In fact, Mike discussed “Safe Money” strategies with Jessica in our May 30 issue. Click here to check it out.

As Mike notes in the June SMR, his approach has worked well – very well, in fact – amid what’s been an extraordinary market environment since February 2020.

It calls to mind another 20th-century economic luminary, John Maynard Keynes, famous (whether he did say it or not) for the quip “when the facts change, I change my mind.”

So, yes, “inflation is here.” That raises multiple questions, of course. But start with these, just to establish a frame and simplify the mosaic:

• How long will the factors causing these hot prints persist?

• Do I need to change my strategy?

Mike does a great job with sensitive matters such as these. Click here to learn more about “Safe Money” strategies.

Best,

David Dittman