In this case it should be dry in a year or so. In a week when it was revealed by scientists that paint containing different sizes of particles could lead to layering as it dried the coming together of two paint and coating giants, Sherwin-Williams Company (SHW) and Valspar Corporation (VAL) starts to look quite exciting. The deal is expected to close in early 2017.

Valspar agreed to be purchased by its rival Sherwin-Williams for $113 billion. The two companies plan to combine each other’s competitive advantages to boost sales and increase market penetration.

The announcement made Valspar investors a good chunk of change in just one day. The company ended the day trading at $83.83 per share on Friday, March 18, down one percent from the day before; just to see the price skyrocket to $103.22 per share by the end of business day on Monday, March 21st.

On the other hand, Sherwin-Williams stock price did not start the week on such a good note dropping 5 percent to $273.29 per share throughout the day on Monday. But, despite the drop, Sherwin-Williams has performed very well over the years, recording around a 260% five-year total return, profit margin of 9.92% and most recent quarterly dividend of $0.84.

Visit Weiss Ratings’ website to follow these two companies or choose from thousands of other rated stocks.

Be sure to utilize our Comparison tool to set your investments side by side and take a closer look.

Stocks

See the biggest gainers and losers amongst the Weiss rated stocks, in addition, you may check out all stocks considered to be a BUY, HOLD or SELL based on Weiss Investment Ratings.

Make better investment decisions by utilizing our powerful Stocks Screener to dissect thousands of stocks.

ETFs

Recently Weiss Ratings upgraded investment ratings of 297 ETFs and downgraded 1,003. There are 65 ETFs in the BUY universe, 621 in HOLD, and 978 in SELL.

Click here to see analysis and reports on hundreds of exchange traded funds. Select any ETF and check out its summary page, top holdings, similar ETFs, price history, NAV History, industry and individual comparison tools.

Mutual Funds

Cheap, good returns, no initial investment and highly rated mutual fund…how can you find one of these amongst the thousands that are out there?

Weiss Ratings makes it easy for you.

We’ve compiled a list of mutual funds with $0 minimum initial investment, rated B or higher by Weiss, one-year total return of 5 percent or more and with expense ratio of 0.5 percent or less.

But this is just what we’ve picked; you can customize your selection in any way you want. Simply “Add Criteria” in the screener and find the best fund for you.

Banks

Every quarter, Weiss Ratings analyzes data of thousands of U.S. banks assigning them a Weiss Safety Rating. Based on the analysis, some receive a better letter grade than before, some slide down a bit, while others remain unchanged.

Check out the most recent (Q4, 2015) bank rating changes here. You may customize this list by removing downgrades or upgrades by simply clicking on the X right next to it in the selected criteria box. You may also insert additional criteria for further analysis.

The graph below shows the number of upgraded and downgraded banks from Q3, 2013 to Q4, 2015.

Click here to learn more about the meaning of Weiss Safety Ratings and scroll down to the middle of the page to see Ratings Definitions for Depository Institutions.

On this page you will also find explanation of all Weiss Ratings, so take a look!

Credit Unions

The credit union industry ended the year recording 10.93 net worth ratio, nearly identical to 10.97 for 2014. The aggregate net worth is well above the NCUA’s (National Credit Union Administration) set 7 percent of a well capitalized credit union suggesting that the industry is doing well overall.

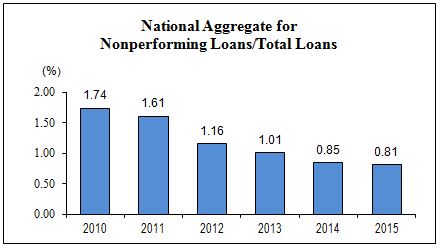

The national aggregate for non-performing loans have also improved over the last six years, dropping to 0.81 percent in 2015 from the high of 1.74 percent in 2010.

The changes from 2014 to 2015 indicate that credit unions are no longer in the stages of drastic improvement and are now leveling to maintain satisfactory ratios and build on stability.

Go to www.weissratings.com to research and compare thousands of credit unions.

Insurance

Adequate capital is one of the most important pieces of any insurance business; it provides a cushion when the times get difficult, ensures the policyholder’s pay out and it can be used to expand and improve business. An insurer without capital cannot continue its operations due to its inability to pay out the cash and oftentimes the regulators must take over.

There are 58 Weiss recommended insurance companies with $10 billion or more in capital. The list includes all three Weiss rated industries: Property and Casualty, Life and Annuity, and Health.

Weiss issues safety ratings on over 3,600 insurance companies; browse them all on the Weiss Ratings website to find the best.

Utilize the Insurance Screener to narrow down your search. Simply click on “Add Criteria” and begin slicing and dicing thousands of insurers.