How the President Plans to Keep This Bull Running Into 2020

|

When I was a rookie stockbroker in the 1980s, the Federal Reserve had just two mandates: promote full employment and keep inflation in check.

Not anymore.

Central bankers all over the world, including our Federal Reserve — have completely forgotten what their job is. They’re now deliriously desperate to keep asset prices — stocks and real estate — from falling.

In addition to manipulating interest rates, central bankers have expanded their monetary arsenal with all sorts of newfangled tricks like quantitative easing, Operation Twist and the most destructive tool of all ... negative interest rates.

|

These numbskulls must take after the "Wizard of Oz." They pretend to be “Great and Terrible,” but just like the Wizard, they’ll turn out to be completely powerless.

Central bankers aren’t the only policymakers who think they can avert an economic slowdown by pulling the right economic levers …

I’m talking about politicians. Nobody is more willing to use government powers than a politician seeking reelection. As you know, politicians will say and do anything to get — and stay — in office.

And with the 2020 U.S. presidential election coming up fast, you can bet Donald Trump is going to pull a bunch of governmental, political and economic levers.

All politics aside, Trump is unique in a way most investors don’t realize. What I’m talking about is how he views the stock market as a barometer of his success as a president.

Trump understands that he won’t get reelected without a strong stock market. And that is why I believe he is obsessed with it.

Every day, I think Trump wakes up and wonders what he can do to keep the bull market running. Sure, he’s already pushed through the largest tax cut in history and eliminated thousands of growth-killing regulations.

|

But he is ready to do even more.

That includes things like proposing more tax cuts — such as slashing Social Security payroll taxes. Obama pulled a similar move in 2011 when he lowered the payroll tax from 6.2% to 4.2%, which immediately increased every American's take-home paycheck.

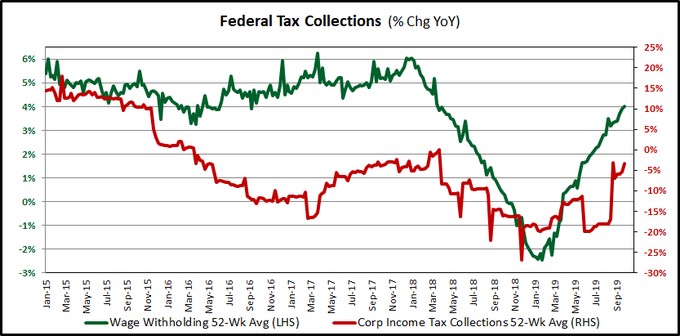

Or Trump could issue an executive order to the U.S. Treasury to index capital gains taxes to inflation. He can afford to do so because government revenues, both from individuals and businesses, are way up this year.

Trump could also continue to pressure the Fed for additional interest-rate cuts, as he has in the past.

Related post: Trump tweet steers the Fed into uncharted waters

Maybe he will launch massive public-works projects in crucial swing states. And maybe he will suddenly start to play nice with China and make all the trade-war fears go away.

The point is, there are lots of levers Trump can pull in his position to try and reignite the markets. And if the economy continues to slow, I’m betting he’ll try to pull several of them.

As an investor, you shouldn’t underestimate his determination.

Love him or hate him, Trump is the best friend a stock market investor could have. So, don’t let the naysayers scare you out of this stock market. Because it will go higher.

That is, if Donald Trump has anything to say about it.

Best wishes,

Tony Sagami

P.S. Stocks aren't the only thing going higher. My colleague Sean Brodrick is looking for gold to potentially double in value before 2021.

It's starting right now, and he’s picked out 3 stocks set to soar at least 250% on this rally! Watch Sean's brand-new video presentation for all the details you’ll need to profit from the coming gold rush.