How to Avoid Stocks that Crash and Pick Stocks that Soar

|

I’m writing to you this morning for one simple reason:

I want to make sure you’re NOT picking stocks randomly …

NOT getting stuck in stocks that crash and burn, and …

NOT missing out on stocks that soar to the stratosphere.

Needless to say, no one can be right about all stocks all time.

But there’s one unusually accurate stock-picking tool that you may be underusing, or perhaps not using at all.

You already have immediate access. It’s available to you 24/7. And I’ll give you specific instructions on how to use it in just a moment.

But first, a few words on its track record.

Stocks That Crashed and Burned

Based on this tool, months before the Great Debt Crisis of 2008, we issued “Sell” signals on the following list of 25 prominent U.S. companies, telling investors “not to touch them with a ten-foot pole.”

Aames Investment

Accredited Home Lenders

Beazer Homes USA

Countrywide Financial

DR Horton

Fannie Mae

Freddie Mac

Fidelity National Financial

Fremont General

General Motors

Golden West Financial

H&R Block

KB Home

MDC Holdings

MGIC Investment

New Century Financial

Novastar Financial

PHH Corp

PMI Group

Pulte Homes

Radian Group

Ryland Group

Toll Brothers

Washington Mutual

Wells Fargo & Company

By yearend 2008, 11 of the 25 companies had filed for bankruptcy, had required a government bailout or were forced into a shotgun marriage with competitors that bought them out.

Many lost more than nine-tenths of their value.

Even including the few stocks on the list that outperformed the market, their average decline was 81.3%.

Stocks That Soared to the Stratosphere

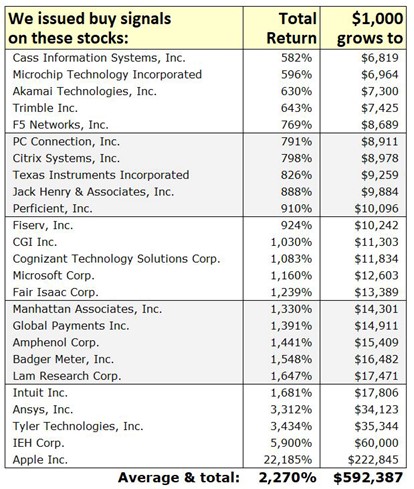

A few months earlier, we used the same tool to issue a series of “Buy” signals on the following 25 tech stocks:

|

If you had followed our signals, you would have never sold any of these stocks. You’d still be holding them to this very day.

Including price appreciation and dividends, you would have made 630% in Akamai Technologies, 769% in F5 Networks, a 798% in Citrix Systems, 826% in Texas Instruments, 1,160% in Microsoft, 1,681% in Intuit, 3,312% in Ansys, 5,900% in IEH Corp. and 22,185% in Apple, just to mention a few.

In many cases, you would have gotten new “Buy” signals along the way.

But even assuming you just invested an initial $1,000 in each ($25,000 in all) and never added a penny more to your holdings, you’d have a total of $592,387 today.

The smallest winner on this list, Cass Information Systems, gained 582%, turning an initial $1,000 investment into $6,819.

The largest winner was Apple, turning $1,000 into $222,845.

On average, the return was 2,270%.

What Is This Tool?

You may have guessed it by now.

If not, let me take this opportunity to reintroduce you to the Weiss Stock Ratings.

|

To start using our ratings immediately …

1. Go to www.weissratings.com

2. If you haven’t done so already, sign up for free. (See “Sign in or sign up” in upper right corner of your screen.)

3. At the top center of your screen, use the tool “Search by name or symbol.” (To better limit your search, click on the down arrow and select “Stocks.”

4. To get upgrade and downgrade alerts, create your personal Watchlist and add as many stocks as you want. No limit! (See “My Watchlist.”)

Then, tomorrow, stand by for an educational video I just recorded over the weekend, “America at a Crossroads.”

Good luck and God bless!

Martin