How to Earn Income When Even Junk Is Losing Its Value

|

Tell me something …

If you were a bank and a high-risk, credit-challenged company asked for a loan, what kind of interest rate would you ask for in return?

That’s assuming you even approve their request.

Let’s say you do. What percentage would you think is “fair” enough to compensate you for the very real possibility that the company won’t be able to pay you back?

Seven percent? Nine percent? Eleven percent?

How about FOUR PERCENT? As in, not even enough to cover inflation, much less credit risk.

• It sounds crazy. But it’s reality … and it’s happening right now.

That’s thanks to the “Money Flood” — the enormous wave of cheap liquidity the Federal Reserve and fiscal policymakers are pumping into the economy.

And it’s blocking you from generating respectable income for a reasonable amount of risk.

• But even among those who have been willing to take on more risk to generate fatter yields, the rewards just aren’t there anymore.

See for yourself …

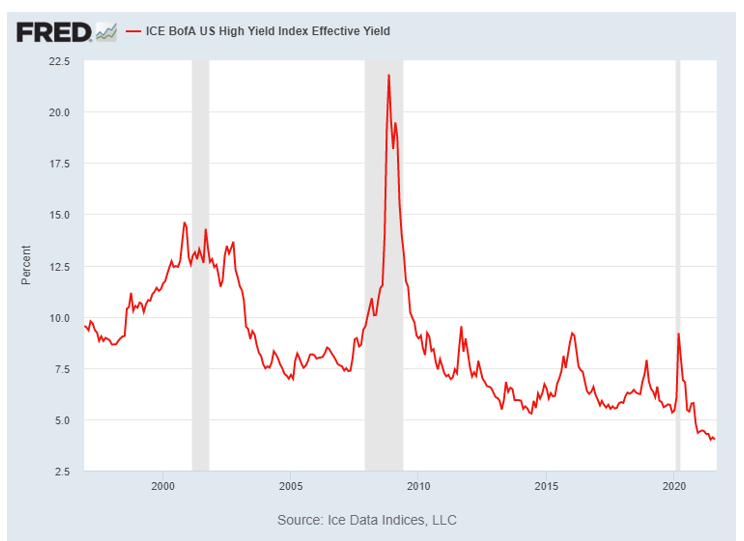

This chart shows the average yield offered up by high-yield bonds. Also known as “junk” bonds, these securities are issued by companies with higher debt levels, weaker cash flows, past defaults and/or other credit blemishes on their records.

|

| Source: St. Louis Fed |

Those gray bars represent dates when the U.S. economy was shrinking.

You can see that yields spike during times of panic and recession. But even if you exclude those panicky periods …

• You could expect to get a mid- to high-single-digit yield by lending to riskier companies over the past couple of decades.

But not anymore.

Now the average yield has sunk to around 4%. Not only is that the lowest on record, it’s BELOW the current 5.4% consumer inflation rate.

In other words …

• Now you’re actually LOSING MONEY on an inflation-adjusted basis when you buy a typical junk bond or a fund that invests in them.

What if you’d rather avoid credit risk altogether and buy a 10-year U.S. Treasury? Forget it!

Those yield around 1.3% right now. That’s good for a NEGATIVE real yield of 4.1% (the nominal yield of 1.3% minus the 5.4% inflation rate).

Many traditional ways of generating income from the markets aren’t working, or at least not working well. Investors are starting to realize, now more than ever, it’s time for a radical reconsideration when it comes to boosting their income investments.

The Good News

There are other methodologies and strategies to help you come out ahead.

Here's what you can do right now to put yourself on a more consistent — and potentially much more rewarding — income path.

• Watch the income-focused video segment I just recorded with Jessica Borg. It’s available online here, and it delves into many of my favorite solutions for this income-challenged market.

What’s the Bottom line? I can’t help it if Wall Street wants to lend junky companies billions of dollars at rock-bottom rates. But I can try to help you find better alternatives and strategies to maximize YOUR income in more-sensible ways.

Until next time,

Mike Larson