How to Make 111% (Or More) From a Turn in Oil

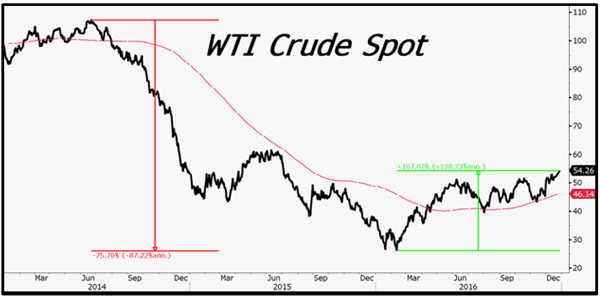

Oil has been on a tear, there’s no doubt about it -- doubling in price since its low of $26.05 reached in February of this year. But even after doubling, we’re still 57% below the highs (above $110, set back in 2014).

That plunge from the triple digits caused significant pain among smaller companies that depend on the price of oil to earn a profit. A whopping 179 stocks in our energy Ratings universe fell by more than 85%, to prices well below $10, through last December.

But rather than panic, I took advantage of those declines to help readers generate significant profits.

How so? I sensed the worst might be over for energy shares, particularly the smaller-capitalization exploration and production companies. After all, they sometimes move two to three times as much as the underlying commodity does.

One such company was Sanchez Energy, a low-cost oil and gas explorer from Texas that operates in the Eagle Ford Shale with ample assets and liquidity. I recommended my subscribers buy, and they were able to generate gains of 67.2%, 55.5% and 47.9% on separate occasions.

Sanchez wasn’t the only name. We also played Warren Resources, Callon Petroleum, Whiting Petroleum, and others to the tune of 111%, 40% and 35.6%, respectively. Shares of these small cap companies rise and fall with oil prices – but they had been beaten up so badly, they were no-brainers to me.

So what about the future? Well, despite the rise in oil prices, these companies still carry poor ratings due to their indebtedness, lower growth, and liquidity concerns. But price momentum is a leading indicator, and now the subindex in our model that tracks momentum and stock price performance is again pushing higher.

If oil continues its march higher on hopes of output cut implementation from both OPEC and non-OPEC countries (something that’s already been agreed to), I expect small cap energy stocks like these to benefit from higher prices, better earnings, and increased solvency prospects. So I’m closely eyeing new BUYS in the space.

To get more details on how you can benefit from a turn in oil using smaller capitalization stocks, click here to get on our VIP list. That will ensure you get one of the very first invitations to join my exciting service at a special discounted rate.