How long does the typical retirement last? According to the U.S. Census Bureau, the average American retirees at 63 and spends another 18 years in retirement (bringing them to 81).

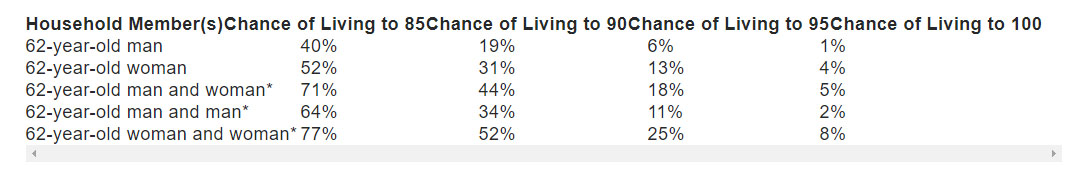

That’s average ... so half of you will exceed the average. For example, a man retiring at age 62 will have a 1-in-5 chance of living to age 90, which translates into a 28-year retirement. Heck, there’s even a 1-in-20 chance of making it to age 95 — a 33-year retirement.

How about collecting Social Security? The earliest you can claim Social Security benefits is 62, and guess what age most Americans start receiving a government check? The most common is 62. Yup, the typical American starts to collect as soon as he or she possibly can!

|

And the average monthly Social Security payment is just $1,404, or almost $17,000 per year. Of course, your payment could be higher if you have earned above-average wages over your lifetime.

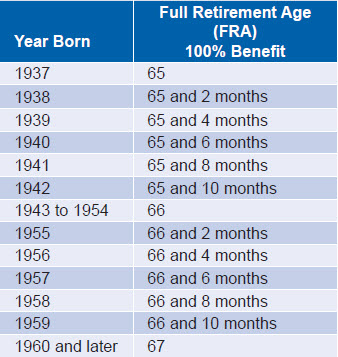

Starting to collect Social Security at age 62 may sound nice, but there are consequences. To receive “full” benefits, you’ll need to wait until full retirement age (between 65 to 67 depending on the you were born).

|

And if you delay claiming a Social Security check past your full retirement age, you’ll receive a bonus on top of your full benefits for every month that you wait until age 70. At that time, you max out your Social Security check.

What’s the best age to start collecting Social Security? The answer is different for everybody, because it depends on your personal situation. But here are the most important things to remember ...

Age 62: Pros and Cons

The Center for Retirement Research at Boston College reports that 48% of women and 42% of men start collecting benefits at age 62.

By claiming benefits at age 62, your Social Security check will be smaller, but you’ll receive more of them. Conversely, the longer you wait to claim Social Security, the longer it will take for your increased benefit amount to make up for the checks you missed out on.

A lot of people want to start enjoying their golden years as soon as possible — but there are also large numbers of people that retire early because of health reasons. A retirement survey from Nationwide Insurance found that 37% of retirees cited health issues as a reason to start collecting Social Security.

Remember: Starting at age 62 results in a permanent decrease in your monthly check. For example, if your full retirement age is 66, your monthly check will be 25% smaller if you start collecting at age 62.

Age 70: Pros and Cons

The biggest advantage of waiting to age 70 is that you get a much larger monthly check. For example, if your full retirement age is 66 and you wait until you’re 70 years old, you’ll receive 132% of you full retirement benefit.

If your full monthly Social Security retirement benefit is $1,400 a month (the average), waiting to age 70 results in a $1,848 monthly check compared to a $1,050 one for the same person starting at age 62. That’s an extra $9,576 a year.

|

And if you continue to work until age 70, you should have also been able to build up an even bigger retirement nest egg. A 62-year old with $300,000 that saves an additional $100 a month with an average return of 7% a year will have an extra $528,000 at age 70.

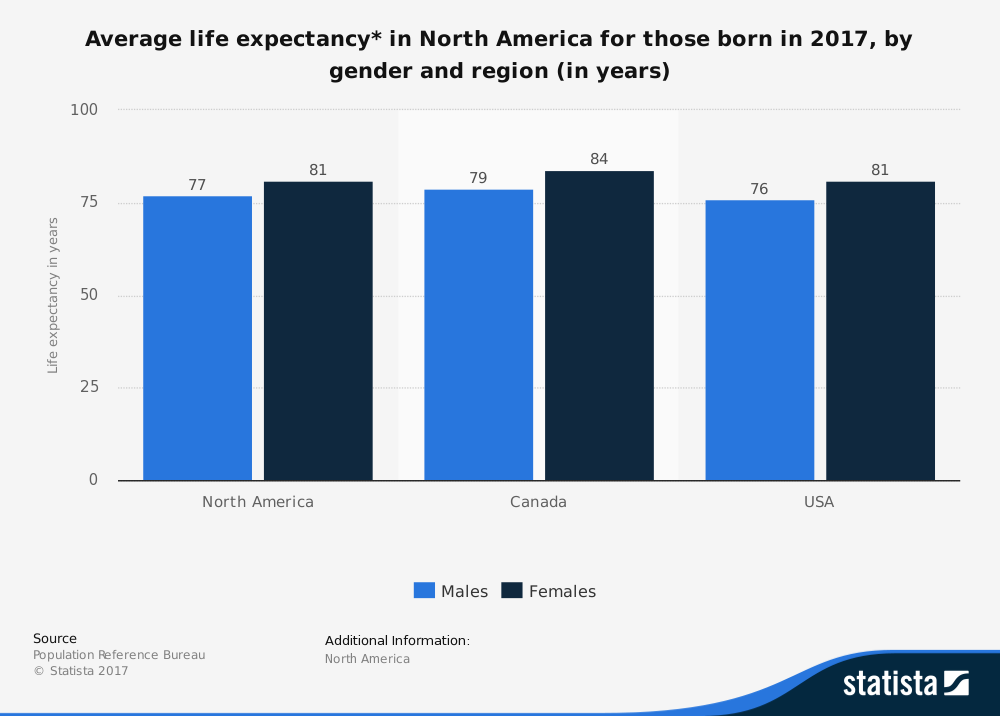

Of course, none of us are guaranteed to live until age 70. But with the average life expectancies for men and women turning 65 today at 84 and 86, the odds are good that you’ll enjoy a long healthy retirement.

Moreover, medical advances may make it possible for us to live even longer. In fact, one of the least understood but biggest financial risks that you will face in retirement is living longer than your savings.

If you are healthy and have a family history of long lives, you should consider longevity insurance. One way to protect against the financial risk of living too long is by investing in an immediate annuity. Immediate annuities pay a monthly benefit — like Social Security — for as long as you live.

But before you buy any insurance product — annuities included — I strongly recommend you check the Weiss Safety Rating of the company selling it. You can do so by going to https://www.weissratings.com/ and searching for it by entering its name in the drop-down menu at the top of the page.

Alternatively, you can use the drop-down menu under the “Safety Ratings” tab at the top of the screen to select “Insurance Companies.” That will take you to a page with a wealth of data about various insurers, and allow you to use our Screener tool to find specific ones in your state that merit our highest safety Ratings.

Best wishes,

Tony Sagami