How To Set Up Super Savings Accounts for Kids With Special

|

| By Tony Sagami |

Being a farmer’s son wasn’t easy.

My father expected us to work long hours, just like he did. That wasn’t fun. But the worst part was that our rural farm was so remote that growing up, I didn’t have anyone to play with when I wasn’t working.

That changed midway through elementary school when I was in third or fourth grade. A family with two boys about my age moved just five minutes away, and I finally had someone to play with.

I became fast friends with the older boy. But his younger brother never came outside to play, and it made zero sense to me. “My brother is different,” said my friend, and I could tell he didn’t want to talk about it.

His younger brother was severely autistic, which is why he never played with us.

The medical community didn’t really understand it back then, either, so care options weren’t as effective but still cost his family a small fortune.

|

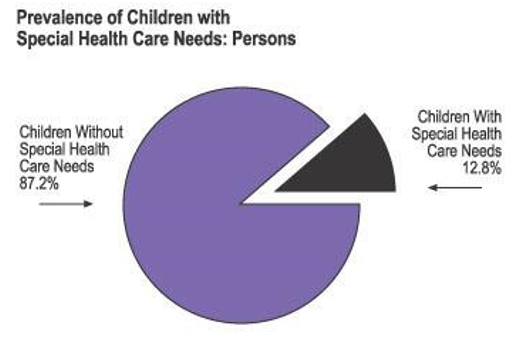

| Source: SLAITS, Centers for Disease Control |

As a father, I’m blessed that all my children are healthy. However, an estimated 9 million American children under the age of 19 (that’s 13% of that subpopulation) have what today we call “special needs.”

Raising a child with special needs can be costly. In fact, the U.S. Congress created a special type of Health Savings Account (HSA) to help parents set aside money to reduce the costs of raising a special needs child.

ABLE (Achieving a Better Life Experience) accounts were created in 2014. They’re similar to 529 College Savings plans in that parents can save money in a tax-advantaged way.

Parents can contribute up to $15,000 a year to an ABLE account. Those contributions are not tax-deductible, but all investment earnings grow without taxation and may be withdrawn completely tax-free as long as the dollars are used for “qualified disability expenses.”

• Medical treatment

• Education, tutoring and job training

• Special-needs transportation

• Assistive technology

• Housing

• Legal and administrative fees

Many children with special needs qualify for government assistance, and a very important feature of ABLE accounts is that the first $100,000 is not treated as personal assets of the special needs child.

Why is this important?

Federal law generally bars individuals from receiving government assistance, such as Medicaid and Social Security disability payments, if they have more than $2,000 worth of financial assets.

ABLE accounts are essentially the same as a Roth IRA: not tax-deductible going in, but not taxed on growth and no tax whatsoever when you take the money out, provided the dollars are used for qualifying disability expenses.

For parents of children with special needs, this is a complete game-changer that can provide for their children for the long term.

|

An individual can only own one ABLE account, but you don’t have to be a parent to make a contribution. Grandparents, uncles, aunts or anybody that loves the child may contribute as long as the collective contributions stay below $15,000 per year.

Most brokerage firms offer ABLE accounts, and you can self-direct how the funds are invested — stocks, bonds, exchange-traded funds (ETFs), mutual funds and/or certificates of deposit (CDs). You control how the money is invested.

ABLE accounts could help many of these 9 million special needs children in America finance their independence.

Indeed, one of those millions is part of my family. And he has an ABLE account.

Best,

Tony Sagami