Income Investors Getting Creamed! Here’s How to Fight Back…

|

If you’re like most income investors, I doubt you’re very happy.

Remember the days when you used to complain about the meager 3% you could get on a one-year CD?

Well, now you’d be lucky to get anything better than 0.3%, according to Bankrate.

With inflation running at 2%, that means you lose 1.7%. Guaranteed!

Want to try going for longer term to see if you can do better?

|

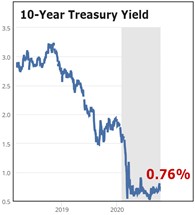

Fat chance! Even if you buy a 10-year Treasury note, all you get is a meager 0.76%!

“Oh, great!” you say with sarcasm. “Now, I lose ‘only’ 1.24% per year.”

Also guaranteed. And now locked in for ten long years!

No wonder many investors are drawn to flashy, whiz-bang stocks that get a ton of press!

Think Tesla, Inc. (Nasdaq: TSLA), Salesforce.com, Inc. (NYSE: CRM) or even Zoom Video Communications, Inc. (Nasdaq ZM).

But paying through the nose for wildly popular stocks isn’t exactly a solid path to investment success.

Even in good times, it’s the wrong place for income investors. And in crazy times like these, no way, José! When the tide shifts, as it always does, it’s the highest of high-flyers that get hit the hardest.

Just look at what happened to investors who jumped into the two major ride-sharing IPOs.

Uber Technologies, Inc. (NYSE: UBER, Rated “D”) and Lyft, Inc. (Nasdaq: LYFT, Rated “D”) were touted as big winners in a gig economy, and investors bid their shares up sharply right out of the gate.

But Uber has gone nowhere for 17 months and counting. And after popping to almost $89 on opening day, Lyft has sunk all the way back down to around $25.

They try to blame it on COVID-19. But the fact is, neither of these companies managed to turn an operating profit in the years before COVID-19 either.

That’s what investors get when they pay top dollar for overpriced stocks that lack solid earnings or dividend payouts. Outsized gains morph into outsized losses in a snap.

Look no further than Nikola Corp. (Nasdaq: NKLA). The Tesla-wannabe soared this spring amid an onslaught of hype. But in just the last three months, it has lost almost half its value.

This is ridiculous. If you’re an income investor, you deserve a better. A lot better!

To sleep nights, you shouldn’t have to give up your yield — let alone LOSE 1.7% or 1.2% on your money year after year.

At the same time, to go for a decent return, you shouldn’t have to watch in horror when your Lyft shares plunge from $89 to $25.

And, the fact is, you don’t have to!

Thanks to our just-released income breakthrough, you can have your cake and eat it too:

- Instant cash payouts of $1,000 (or multiples of $1,000).

- A 99.7% success rate.

- Nearly every Friday from now on.

- Regardless of what banks or the Treasury pay you, regardless of what happens with risky stocks.

Martin tells you all about it in this video.

But please be aware of this scheduling note:

I will send out a trade alert for our next $1,000 instant payout this coming Friday morning.

So if you want to get on the distribution list, you’ll need to watch the video and make a decision before 11:59 p.m. EST tomorrow (Thursday, Oct. 22.)

Until next time,

Mike Larson