Inflation: The Silent Thief That’s Stealing Your Money

|

When it comes to saving and investing, there’s something worse than losing money.

That is, losing money when you think you’re making it.

That’s exactly what is happening to you right now, thanks to the silent thief known as inflation.

Consider this story in The New York Times from Monday. It’s all about an idea championed in many policy circles these days:

Let the economy “run hot” and it’ll work out great for Main Street. They’ll have more job opportunities. They’ll make more money. They’ll end up better off.

Certainly, the Federal Reserve has adopted this view.

Policymakers have taken many opportunities to highlight their determination to keep monetary policy very easy in order to bolster employment.

If prices rise a bit faster? Well, no big deal. That’s a GOOD thing.

So, how is it working out?

The NYT story chronicles how private-sector wages and salaries rose a respectable 3.6% year –over year in the second quarter. That sounds great ... until you consider consumer inflation jumped 4.8% in the same quarter.

Or in simple terms, Americans LOST 1.2 percentage points of purchasing power!

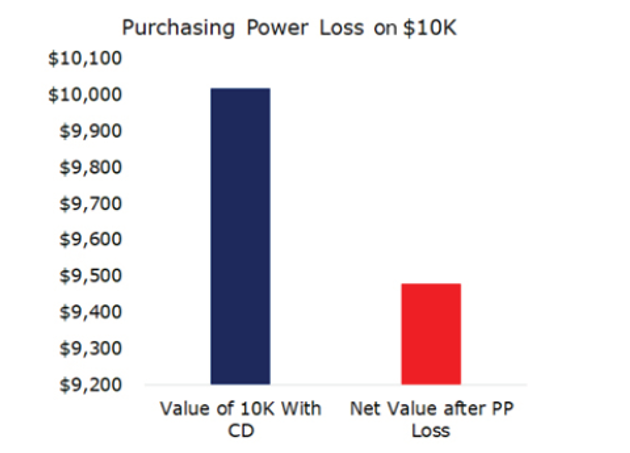

That’s just their income from work, by the way. Martin Weiss did a great job of chronicling the impact of inflation on income from their investments earlier this week.

|

What Martin and I want you to take away from this data is this …

With nominal yields on so many fixed-income investments like Treasurys so low ...

Yields on bank offerings like CDs paying even more pitiful ...

And inflation rates so elevated ...

You’re effectively LOSING money on an inflation-adjusted basis every single time you put a dollar into those assets.

Fortunately, there are ways to fight back. To generate solid income payouts despite the dismal income backdrop.

That’s why I encourage you to check out Martin’s “America at the Crossroads,” right away.

In it, he shows you an obscure market anomaly that nearly any investor can take advantage of … starting as soon as this week!

I’m confident you’ll be glad you did ... because it can help you usher that silent thief out the front door!

Until next time,

Mike Larson