|

“The near-term outlook remains highly uncertain.” — The World Bank 2021 Annual Forecast |

|

Like millions of Americans, I’m anxiously awaiting my turn to get vaccinated.

My twin grandsons were born in October 2020, and I’ve yet to hold them in my arms. I can’t get vaccinated fast enough.

Unfortunately, it looks like I’ll have to wait until April or May.

Vaccinating hundreds of millions of Americans in a short period of time is a massive undertaking. Some states are doing (much) better than others, while in those others, legitimate bottlenecks and sheer incompetence have left millions of doses sitting unused in freezers.

The bad news is the situation is even more chaotic and uneven around the globe. Uncertainly surrounding vaccination prompted the World Bank to release a new study on its impact on economic growth.

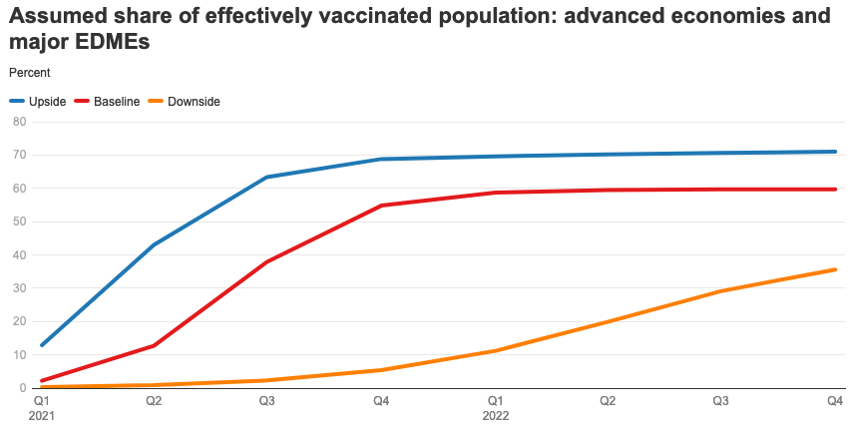

The World Bank considered four different vaccination scenarios and the impact on economic growth:

Upside Scenario. Vaccine campaigns proceed swiftly, with wide public cooperation, allowing governments to roll back their precautionary measures. Economic uncertainty dissipates, and 2021 sees 5% global gross domestic product (GDP) growth.

Baseline Scenario. Caseloads fall in major economies as inoculations proceed, with social distancing measures gradually reduced. Economic activity recovers as household consumption returns, and the world sees 4% growth in 2021 and 3.8% in 2022.

|

| Source: World Bank |

Downside Scenario. Cases remain high as supply bottlenecks and logistical problems slow vaccine deployment. Activity remains depressed as households continue to fear contact-intensive services. Global growth falls to 1.6% in 2021 and 2.5% in 2022.

Severe Downside Scenario. As in the downside scenario, the pandemic is difficult to manage and vaccine distribution is slow. The world would fall into a recession and the world economy would suffer negative growth in 2021.

There’s no question that the faster the world gets vaccinated, the faster the global economy will return to normal.

In its best-case, “Upside” scenario, the World Bank forecast that global GDP growth could accelerate to 5% this year. On the other hand, a scenario defined by delays and rising infections would stunt global growth to a measly 1.6% in 2021. The “Baseline” scenario, the second-best outcome, is 4% growth, but that’s down from a previous forecast of 4.2%.

Indeed, the primary takeaway from the World Bank’s update is that global economic growth is a prisoner to the vaccine rollout.

Of course, progress won’t be equal throughout the world, and my guess is we’ll end up somewhere between “Baseline” and “Downside.”

I say that because I have little faith in the government to get anything right — let alone be efficient. About the only thing our government is proficient at is waging war (and, at that, going only halfway; I have in mind the still-recent Veteran’s Administration fiasco).

I expect to see lots of distribution screwups. And that’s why I doubt we’ll see 4% growth this year.

That doesn’t mean the stock market is going lower. In fact, I think it’s likely the stock market continues to rally even if the economy stalls.

|

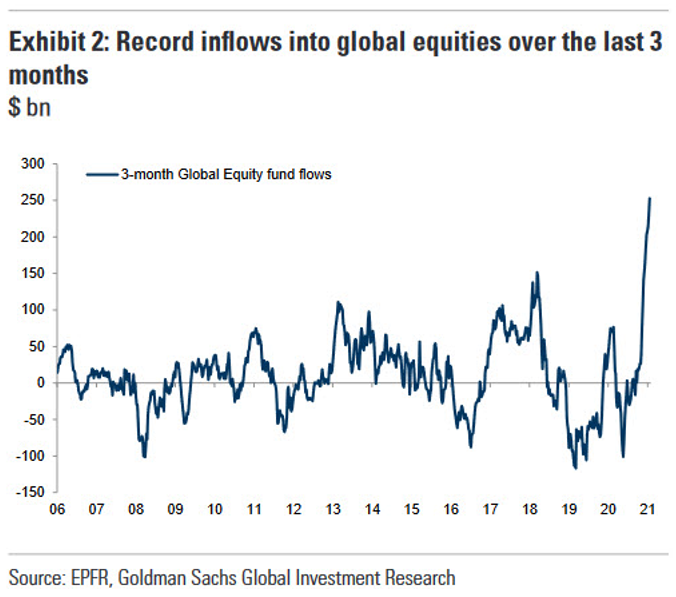

M2 money supply — a measure that includes cash, checking deposits and “near” money — is up 26% in the last 12 months. And giant chunks of that printed money from the Federal Reserve and borrow-spend Congress are finding their way into the stock market.

Fund flows, not fundamentals, are driving the stock market higher ... and the flow of money into stocks is stronger than ever.

Those gushing fund flows don’t mean the stock market won’t occasionally stub its toe.

But it does mean that the long-term path is still higher ... regardless of the speed of the vaccine rollout.

Best wishes,

Tony