|

I have to stop drinking Diet Pepsi while I'm looking at the news on my computer. It's too darn hard to clean it off my screen/keyboard after I read an article that makes me spit up my soda.

That's exactly what happened when I read this headline.

|

McDonald's (MCD) already has an active Senior Community Service Employment Program, but now it is asking AARP to help it find a quarter-million more senior citizen to hire.

McDonald's isn't the only fast food company eager to hire seniors who aren't of the high-school or college variety …

Taco Bell held 600 "hiring parties" in April alone. Although these parties were open to applicants of any age, the company was specifically targeting seniors to fill the 100,000 new jobs it will create through 2022.

Another 1,000 companies have signed up for AARP's employer pledge program to "recognize the value of experienced workers" and "recruit across diverse age groups."

|

| Senior discounts and employee discounts are often the same thing at a growing number of restaurants. |

The reasons for the senior push are complex. The two obvious reasons are that the majority of teens/millennials think fast-food jobs are beneath them. And unemployment at an all-time low makes it hard to fill low-wage jobs in an industry with a 150% turnover rate.

However, I think the primary reason why senior citizens are working is that they can't afford not to.

Now, there is nothing wrong with getting an honest day's pay for an honest day's work. But the reality is that most Americans working past the age of 65 are doing so because they have to … not because they want to.

Related post: Can you afford your 8,000 days of retirement?

According to the National Council on Aging, one-third of senior citizens have no savings and don't have enough income to meet their essential living expenses.

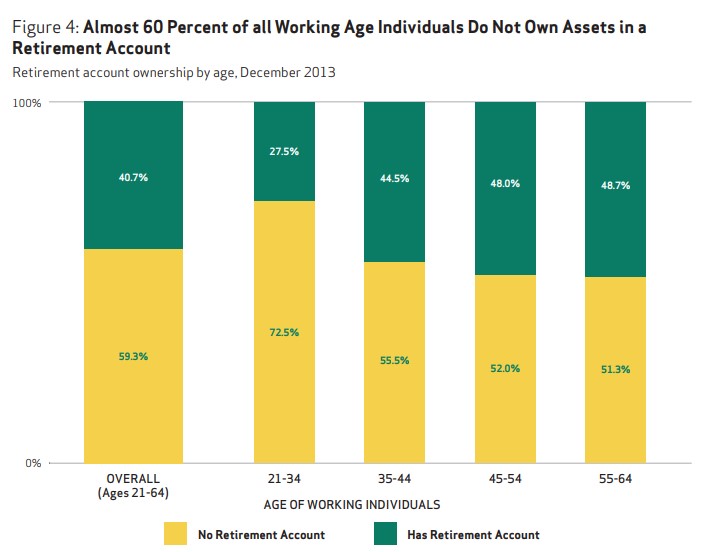

In fact, Fidelity says that 60% of all 18- to 65-year-olds have ZERO money in a retirement account. Zero!

|

No wonder 69% of baby boomers surveyed by the Transamerica Center for Retirement Studies said they planned to keep working past 65. Why? Because of financial need.

Last week I wrote about how Dr. Martin Weiss and I have no plans on retiring anytime soon, but that is because we love what we do. But judging from the Transamerica, McDonald's and Fidelity news, a whole lot of Americans will be working past age 65 because of necessity; not because they want to.

Don't let that become your future. Whether you're 65, 45 or 25 years old, the three basic rules for financial independence don't change.

- Live below your means

- Pay yourself first

- Avoid debt like the plague

And I might throw in a fourth: Have a disciplined investment strategy to make your money work hard so you someday don't have to.

In the Weiss Ultimate Portfolio, I put a chunk of Martin's retirement money to work in stocks with excellent Weiss Ratings. We invest in solid, liquid stocks and ETFs, which makes this strategy suitable for your life savings, including IRAs or other retirement accounts.

And today, I'll be releasing a brand-new round of trades. Get your name on the list now and, once you've subscribed, keep an eye on your inbox later today for four brand-new moves you can make right away.

Best wishes,

Tony Sagami