Tesla Motors (TSLA) - a company with much hype from its investors, customers, and fans but not much to show for when it comes to profits has announced its latest addition to the family, the Model 3.

Tesla’s cutting-edge design and technology appeals to many who wish to reduce pollution, decrease oil consumption and save big by eliminating gas costs... but often the pockets of these dreamers are not deep enough to purchase a vehicle that runs around $100,000 a piece and contributing towards the green movement becomes just a bit harder.

With well below the industry average financial performance in many areas, Tesla is yet to prove itself as a profitable electric car business.

The company is expanding its factories and a more affordable everyday American vehicle - the Model 3 is Telsla’s attempt to become part of your everyday life.

According to Tesla the more affordable $35,000 price, reduced by any government incentives, of the Model 3 will significantly increase the market penetration and turn this electric show into some profits.

The problem is that the new car won’t be available until late 2017 and some of its competitors are already ahead of the game.

General Motors Company (GM) is one of them, starts production of the all electric Chevy Bolt later this year. The car is expected to sell in the $30,000 range after government incentives and will have a 200 mile range.

When it does start production Tesla’s marketing and eye-appealing vehicle design may prove to be successful in selling the product, but will it be enough to turn the company into a profitable business?

Elon Musk previously stated that the company would be profitable by the end of the first quarter of 2016 and although that remains to be seen, the consumption of cash as Tesla ramps up its investment in the development of the Model 3 and then starts production remains a concern.

The table shows Tesla’s inferior bottom line next to billions in competitor profits.

| Tesla Motors, Inc | General Motors Company | Toyota Motor Corporation |

Honda Motor Co., Ltd. | |

| Weiss Investment Rating (as of 3/31/2016) | D | C+ | C | C- |

| Ticker | TSLA | GM | TM | HMC |

| Market Capitalization $Billion | 30.0 | 48.0 | 161.9 | 47.9 |

| Assets $Billion | 8.1 | 194.5 | 407 | 154.6 |

| Revenue $Billion | 4.1 | 152.4 | 235.9 | 123.8 |

| Income $Billion | (0.9) | 9.7 | 19.3 | 4.3 |

The above table was compiled using Weiss Ratings comparison tool, you can compare up to four stocks side by side for an in-depth analysis.

Stocks

Weiss Ratings gives you the list of all stocks with the upcoming dividends … also check out the latest stock upgrades and downgrades.

Follow any stock you want by adding it to your Watchlist. Simply find the stock that you’re interested in, click on the ribbon with a white star, located to the right of the name in the search bar or right next to the letter rating on any other report, and it will be added to your Watchlist immediately.

To remove a stock from your Watchlist you simply click on the ribbon next to the company name. This can be done in the Watchlist, the individual stock page, or anywhere else the ribbon appears. Removal takes effect immediately but if you change your mind all you have to do is click on the ribbon again.

For additional tips on how to use the website, visit our Help section.

ETFs

Check out Weiss Ratings best and worst performing ETFs. Click on any one of them to access tools and reports that will help you to make better investment decisions.

Compare any ETF to the entire industry or to another three ETFs side by side.

Or, take a look at only the highest rated ETFs.

Mutual Funds

Weiss Ratings recently upgraded investment ratings on 4,174 mutual funds and downgraded 20,039.

There are 3,106 mutual funds in the Weiss BUY universe, 16,169 in HOLD and 9,346 in SELL.

Want to see where your money gets invested? Check out asset allocation under the “Summary Tab” of any mutual fund.

Banks

Looking for a bank to safeguard your hard earned cash? Check out Weiss Recommended Banks by State , the list contains only the highest rated institutions (B+ or higher) in each state.

Select your state from the drop down menu and click “View” to see recommended banks with branches in your state.

You may click on the header of each column to sort; you can arrange your list alphabetically by name, by rating, by domicile state, or by asset size.

Under each bank’s name you will see a domicile city and state which can be different from the state that you’ve picked. It simply means that the bank is headquartered somewhere else but has branches and operates in your state.

The “State” column also tells you in which state the bank is domiciled.

Check out Weiss Ratings bank glossary for definitions on State and States with Branches.

Credit Unions

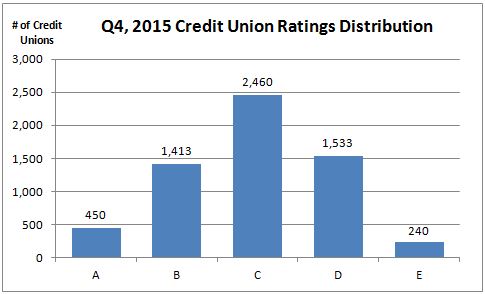

Weiss Ratings issues safety ratings on over 6,000 credit unions each quarter, empowering you to make better financial decisions through the use of our tools and reports.

Our Credit Unions Screener gives you the ability to slice and dice all Weiss rated credit unions. Take a look at them all; the best, the worst and the ones in between.

Below is the breakdown of how many credit unions there were in each ratings category in Q4, 2015.

Insurance

Check out Weiss Ratings’ strongest insurers and see if companies that you do business with are on that list.

You can “Add Criteria” to further narrow down your search … you may insert “Company Name” field where you can type an insurers name to find the one that you’re looking for.

Or, you can add “Industry” allowing yourself to see the main line of business of an insurer.

Or, you can simply go to our website and type name of a company in the search bar at the top of the page.

Failures

Institution Name |

Industry |

State |

Total Assets in Millions |

| Veterans Health Administration CU | Credit Union | MI | 2.03 |