Japanese Savings the Key to Higher Growth, Bigger Gains for You

|

I've always been a saver.

That's probably because my parents never had much money. In fact, I think most people would have described us as "poor" since my farmer father NEVER made more than $15,000 in a year, despite working 90-plus hours a week for his entire adult life.

But we never went hungry. And my father somehow, some way put his three children through college by following a deeply ingrained Japanese principle of "mottainai."

Mottainai is the Japanese equivalent of "waste not, want not." It represents a state of mind long rooted in Japanese culture of regret, even distaste, about squandering resources.

|

|

Japan's distaste for squandering resources, or mottainai, has helped them save a lot of money. Its public pension fund is the largest single owner of U.S. stocks! |

My mother would chastise me if I left even a single grain of rice in my bowl. Such wastefulness is mottainai!

Maybe that clean-your-plate attitude is why I'm such a fatso today!

My point is that my parents taught me to live below my means and to ALWAYS and REGULARLY save money for a rainy day. As you know, life is full of rainy days.

There were two separate and unconnected pieces of news last week that show the peril and opportunity of saving …

The first news was a new study from MagnifyMoney. It found that 29% of American households have less than $1,000 in a savings account. This means that even a modest emergency, such as an unexpected car repair or appliance replacement, would bust their bank account. Worse yet, it means that a lot of Americans couldn't afford to miss even one monthly paycheck.

Most Americans are simply lousy savers.

But guess who's not only a savings superpower, but also a top investor in U.S. stocks?

Take a look at this second piece of news … from Japan.

|

Japan is the third largest economy in the world — behind the U.S. and China. But it is No. 1 in the world when it comes to saving.

Japan owns ¥328 trillion of assets. Second-place Germany is the world's second-largest global creditor with ¥262 trillion, followed by China in third place with ¥205 trillion.

In fact, the Japanese public pension fund is the largest single owner of U.S. stocks! That's right. More than Vanguard, more than Fidelity, more than BlackRock and more than CalPERS, California's pension fund.

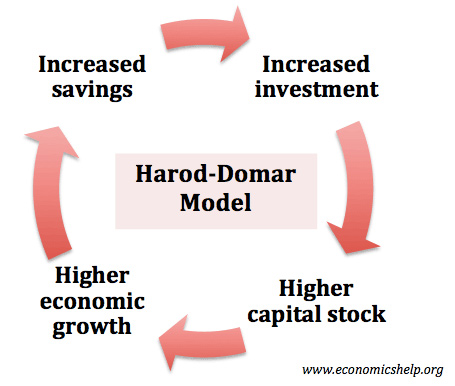

The savings rate is important because there is a STRONG relationship between a country's savings rate and economic growth. It's really quite simple: Higher savings = higher investment and higher economic growth.

|

In short, if you want to invest some of your savings and grow it, you should seriously consider adding some Japan to your portfolio.

There are dozens of Japan-focused ETFs to choose from, such as the iShares MSCI Japan ETF (EWJ) and WisdomTree Japan Hedged Equity Fund (DXJ).

Or if you are more of an individual stock investor, there are dozens of Japanese stocks listed on the NYSE and Nasdaq. Some of the biggest names include Canon (CAJ), Honda (HMC), Mitsubishi Financial (MUFG), Sony (SNE) and Toyota (TM).

Plus, Japanese stocks are cheap, trading at only 14 times earnings. And don't forget: Peace on the Korean Peninsula could trigger a significant rally for Japanese stocks.

Best wishes,

Tony Sagami