Let’s Maximize Our Return on the Defense-Spending Dollar

|

I turned 18 years old on Sept. 17, 1975, a long-haired punk listening to Woodstock-era music and hanging with my friends.

Like many kids back then, I wanted no part of getting shot in Vietnam. The idea probably wouldn’t have penetrated my David-Cassidy-like ‘do, anyway.

I wasn’t going to volunteer for military service. But the threat of “the draft” had only recently gone away — in the spring before my senior year of high school.

|

Before registration with the Selective Service System was suspended on April 1, 1975, me and my guys were all nervous wrecks, all day, every day.

The U.S. military became an all-volunteer force after that. With the wind-down of the war in Vietnam, our country simply needed fewer soldiers. And the size of our military has been shrinking ever since.

The U.S. Navy fleet was more than 1,000 ships strong in 1955. But it’s shrunk to only 270 today. Similarly, the number of Air Force fighter and attack aircraft has dropped from some 4,400 in 1985 to 2,000 today.

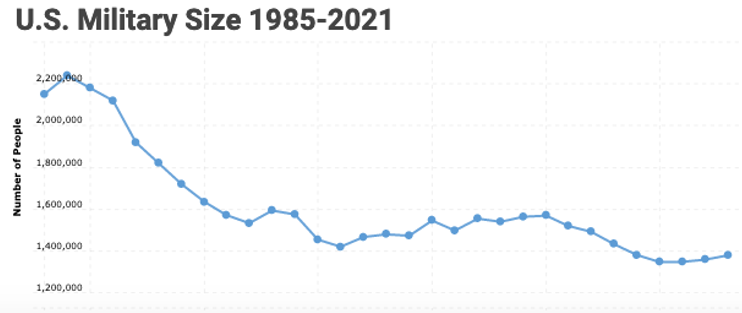

Military personal has dropped too.

In the mid-1950s, there were approximately 2.9 million active-duty troops. By my senior year in high school, that number had dropped to 2.1 million. Today, we have only 1.3 million active-duty service members.

|

| Source: Macrotrends |

While the size of our standing army has shrunk, the amount we spend on defense has skyrocketed. For fiscal year 2021, our national defense budget is $704 billion.

In good times, bad times or during the coronavirus pandemic, our military must protect the public ... so while everyone else is tightening their belts and suffering from a dramatic drop in revenues, the government has not only continued to spend like drunken sailors, they are spending more than ever.

Route 495 is a 60-mile-long highway that encircles the District of Columbia. Local drivers call it “the Beltway,” and it’s home to hundreds of companies that feed off government business.

They’re pejoratively called “Beltway Bandits.”

There are hundreds of corporate pigs lined up to feed on the government trough and live off the largess of the taxpayer-funded spending. These bandits deploy retired Congressional, White House and Pentagon officials, who turn their insider experience into revenue by working directly for them or serving on their boards.

Sleezy? Perhaps. But, from an investor’s standpoint, these businesses are cash machines. Defense contractors are some of the most reliably profitable companies in the world.

With bombs dropping on Syria and tensions tightening with China, this may be a great time to invest in stocks related to the good, old military-industrial complex.

The most efficient way to invest in defense contractors is through the following exchange-traded funds (ETFs):

• iShares U.S. Aerospace & Defense ETF (BATS: ITA)

• SPDR S&P Aerospace & Defense ETF (NYSE: XAR)

• Invesco Aerospace & Defense ETF (NYSE: PPA)

These ETFs own stocks like Raytheon Technologies Corp. (NYSE: RTX), Lockheed Martin Corp. (NYSE: LMT), General Dynamics Corp. (NYSE: GD), Northrup Grumman Corp. (NYSE: NOC) and The Boeing Company (NYSE: BA).

The military-industrial complex is real.

It’s still growing, 60 years after President Dwight Eisenhower identified it.

And it’s more profitable than ever.

Best,

Tony