|

| By Tony Sagami |

Special purpose acquisition companies, or SPACs, are the top scheme right now for get-rich-quick investors in the United States. In China, they use mutual funds.

It’s all about “fear of missing out,” or FOMO.

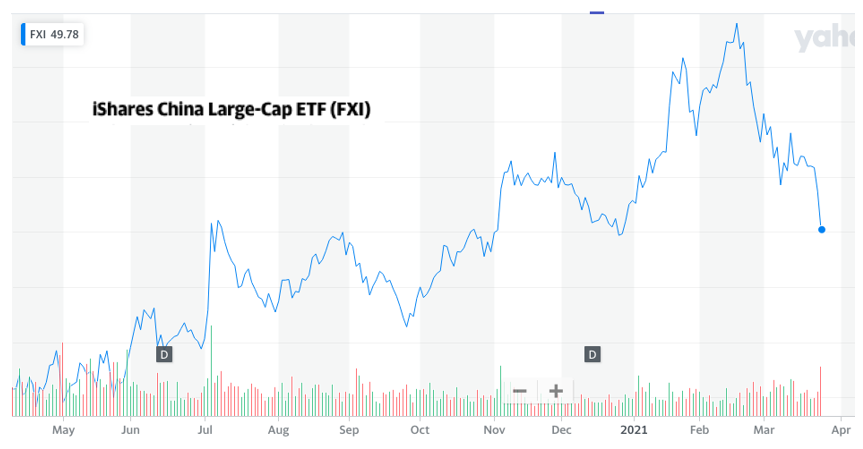

Tech-focused SPACs have struggled recently here in the United States. At the same time, tech-focused mutual funds in China are getting slaughtered.

|

| Source: Yahoo!Finance |

In fact, losses are so bad that the front pages of state-controlled newspapers and famous TV newscasters are urging Chinese investors to stay calm and not panic.

In 2021, Chinese investors poured a record $240 billion into stock-focused mutual funds. That pace accelerated in the first two months of 2021, with inflows of $83 billion. And that pushed the Shanghai Shenzen CSI 300 Index up by almost 20% in January and February.

As was the case with the Nasdaq Composite, things started to turn sour in March. The CSI 300 lost 15% of its value in a matter of weeks, wiping out over $1 trillion of investor wealth. Ouch!

Many of the bandwagon investors borrowed money to invest in Chinese mutual funds, piling into the hottest, most volatile rocket ships they could find.

Sound familiar?

As the losses piled up, Chinese investors started selling off non-stock market assets to meet margin calls.

In fact, more than 200,000 Chinese investors have signed up for online resale platform Xianyu so they can sell precious possessions to offset stock market losses. That includes things like wedding rings and “a watch passed down by their great grandfather.”

For the last six to eight months, FOMO has been driving investor behavior in both China and the United States.

These “investors”/Johnnies-come-lately have been buying things like SPACs, GameStop Corp. (NYSE: GME), AMC Entertainment Holdings, Inc. (NYSE: AMC), non-fungible tokens (NFTs) and cryptocurrencies I’ve never heard of.

At some point, FOMO will turn into “get me the heck out of here.” But there’s no clever acronym applicable here.

Look, I don’t want you to become desperate, like one of the Chinese investors selling off family heirlooms to pay your investment losses.

And there’s one thing you can do that will just about guarantee you suffer that fate.

According to Bank of America Corp. (NYSE: BAC), investors have borrowed a record amount of money to buy stocks. Margin debt hit a record $799 billion in January. That surpassed the previous high set in January 2007.

A short time later, the 2008-09 Global Financial Crisis hammered the stock market and cleaned out overleveraged investors. Don’t let that happen to you.

Folks, this isn’t a game. It can be fun. But let’s keep it simple.

Don’t use margin, and don’t borrow money to buy stocks.

Missing out on that is a smart thing.

Best,

Tony Sagami