|

The coronavirus crap is really getting old. And my highly unscientific polling of my friends shows a roughly equal split between those supporting lockdowns and those opposing lockdowns.

Regardless of what side of the lockdown debate you’re on, there is absolutely no question that lockdowns kill the economy.

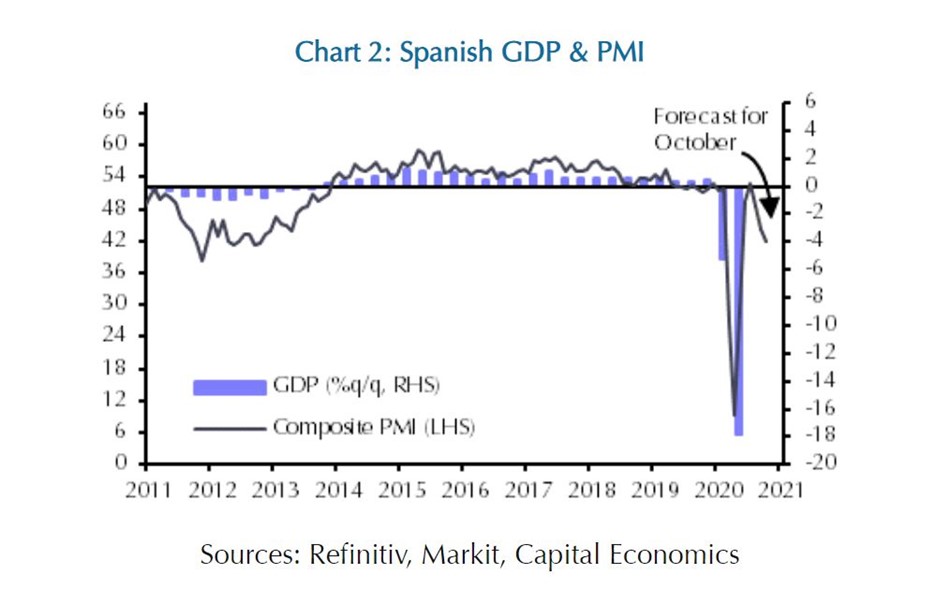

Just take a look at Spain to see how the second wave of lockdown mandates have impacted economic growth.

|

Spain was hit hard during the first wave of the pandemic earlier this year and, at the time, imposed some of the toughest lockdown polices in the world, including home confinement.

Those super-strict lockdown protocols haven’t prevented a second wave on infections sweeping across Spain. As a result, Spain has declared a national state of emergency, reinstated some of the lockdown rules and banned inter-regional travel between most of its regions.

The result will be a double-dip recession, more economic hardship and another coronavirus crash.

|

Spain isn’t alone: Many of its European neighbors — England, France, Belgium, Austria, Portugal and Germany — are suffering the same fate and reinstituting various forms of lockdowns.

Unfortunately, it looks like the U.S. is on the same path with over 100,000 new infections in just one day. Some parts of the U.S. are re-imposing shutdowns on businesses and churches.

We are now staring a second wave of coronavirus infections and a second wave of lockdowns. Don’t forget; lockdowns are on a state-by-state basis at the discretion of each governor and not presidential edict.

What I am fearful of is an accompanying a second wave of 401k-killing stock market declines.

So far, the Federal Reserve and a free-spending Congress have kept the stock market from falling apart. However, a reversion to mean is inevitable. It always is.

The stock market has so far been unconcerned with who our next president will be. What Wall Street has been celebrating is a gridlocked Congress, which means no huge tax hikes and no costly Green New Deal.

The chances of another lockdown in the U.S. is another story. Trump has vowed to keep the economy open while Biden has been clear that he would lockdown the country if his scientific/medical advisers recommend doing so.

I understand that intelligent, reasonable people have widely different opinions about lockdowns, but there is no debate that lockdowns kill jobs, kill income and kill the economy.

What I am saying is that if Biden becomes the president, you better play close attention to what is happening in Europe because that could very well happen in the U.S. too.

And I don’t have to tell you what happened to the stock market when we first went into lockdown mode.

That doesn’t mean that you should jettison all your stocks if Biden wins. It does mean that you better pay close attention to what he says about the coronavirus.

If the economy shuts down again, we’ll get a coronavirus crash.

Best,

Tony Sagami