|

I can still remember my parents taking me down the street to the Community Savings branch to open my first passbook savings account. Man, did I love that little book and its green-tinted pages!

Every time I’d get some birthday money from my grandparents, or do a few chores for allowance, I’d sock some of the dough away. Those deposits ... dutifully recorded in all their dot-matrix printer glory ... added up nicely with time.

One thing that helped: The yields advertised on the lobby sign were a LOT higher then! You could earn 4%, 5%, 6% or more, depending what kind of account you had.

By comparison, JPMorgan Chase (JPM, Rated “B”) was offering an APY of ... drumroll please ... 0.01% on its basic savings account in my present-day zip code yesterday. Bank of America (BAC, Rated “B”) was advertising 0.03%. Even the national average rate was just 1.25%, according to Bankrate.com.

At that rate, it would take you almost 56 years to double your money!

Why am I bringing this up now? Because this afternoon, the Federal Reserve will announce the results of its latest policy meeting. Policymakers are all but guaranteed to keep the Federal Funds rate target unchanged at a range of 2.25% to 2.5%.

The financial press will talk about how this will impact stocks, the economy, currencies and more. But what they WON’T focus on is that the Fed is doing income-seeking savers and investors zero favors. Zilch!

Rates remain pitifully low. And without another hike, banks won’t feel pressure to raise deposit rates again ... even as many haven’t even fully passed on the impact of past Fed increases.

It’s not just bank accounts, though. Yields on many other traditional income-generating investments aren’t very inspiring, either. The 5-year Treasury note yielded around 2.3% yesterday, while 10-year government paper yielded 2.5%.

As for stocks, the SPDR S&P 500 ETF (SPY, Rated “C+”) sports a dividend yield of just over 1.8%. The Invesco QQQ Trust (QQQ, Rated “B-”) offers less than half that, around 0.8%.

Sure, they’ve appreciated in price on a year-to-date basis. But they’re also basically unchanged over the last seven months. As a matter of fact, the SPY hasn’t really gone anywhere in 15 months. That illustrates how capital gains figures can look either fantastic, or downright mediocre, depending on what starting point you use.

The good news? There ARE alternatives to be found. Much higher-yielding investments that pass several rigorous screens. That includes those designed to identify companies whose dividends aren’t just high, but also sustainable and growing strongly over time.

Unlike a lot of the zero-yielding, infinite-multiple, money-losing, wing-and-a-prayer companies Wall Street is churning out in the IPO market these days, these companies generate actual PROFITS.

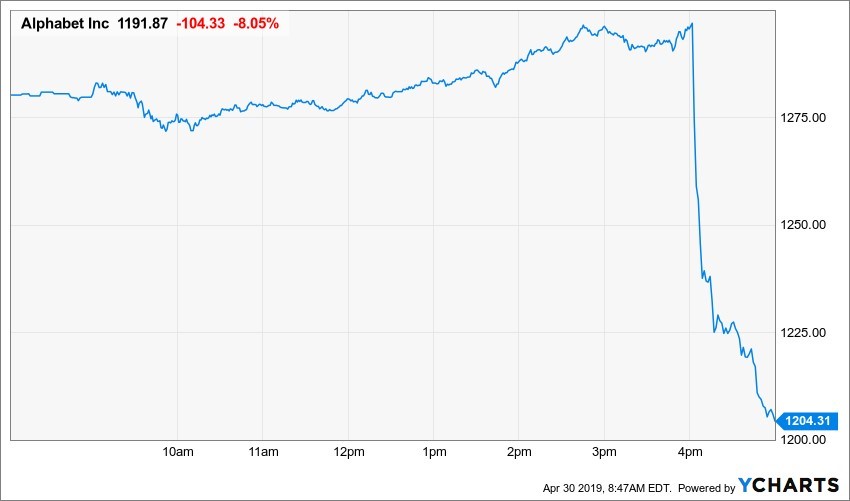

Many are also less volatile than headline-grabbing tech stocks. While they can go up a lot, they can also plunge more than $100 in price or almost $120 billion in market cap in less than 24 hours. That’s what Alphabet (GOOGL, Rated “B”) did at one point yesterday and Facebook (FB, Rated “C+”) did last summer.

|

|

Alphabet shares tumbled 8% after reporting earnings Monday night that showed revenues "only" came in at $36.3 billion in Q1. |

You can find out all about these investments in my Safe Money Report newsletter, which you can subscribe to by clicking here. Or if you’re not quite ready to take that step, just make sure you emphasize yield, safety and lower volatility in your own investing.

My “Safe Money” approach has outperformed many other strategies for more than a year now — and I have every reason to believe it will continue to do so for the rest of 2019 and beyond. (Learn more here.)

One last thing: I’m going to cover my favorite recommendations and investing strategies at multiple live events over the next few months. I’d like nothing more than to see you there so we can discuss how to ramp up your yields and income in person!

Specifically, I’m presenting at the MoneyShow Las Vegas that runs May 13 to 15, and at the MoneyShow Seattle June 15-16. There’s still (a bit) more time to get registered for the Las Vegas conference here. And you can get a head start on registering for Seattle here. Both are free to attend.

Finally, I’ll be traveling to Vancouver for the Sprott Natural Resource Symposium that runs July 30 through Aug. 2. It’s going to have a dynamite lineup of attendees, including specialists in precious metals as well as analysts like myself who are focused on trends in the broader market and interest rates. You can find out more by clicking here.

Until next time,

Mike Larson