Looser Regulation Could Disrupt Trend of Improving Loan Quality

|

|

Bank deregulation is a hot topic in Washington these days. But while the Dodd-Frank bill is seen as a business killer by some, and there is a movement to dismantle it, the bill may be helping strengthen loan portfolios across the banking industry.

Or stated another way, while reduced regulation could certainly help the banking industry rake in additional profits and make lending easier, it could also negatively affect asset quality. That, in turn, could eventually lead to financial sector troubles.

Let’s start by taking a look at asset quality, a critical concept in determining the overall condition of a bank. Loans are generally the main component of a bank’s assets and carry the most risk. Managing this risk is a big job for many in the banking industry.

Prior to extending credit, a bank researches a potential borrower’s financial background. That’s when, for individuals and small businesses, credit reports and the FICO score often come into play. FICO stands for Fair Isaac Corporation, a company that specializes in “predictive analytics” to help determine ahead of time what’s likely to happen with a given loan.

A loan officer pulls the potential borrower’s credit report to review financial history. It immediately tells whether or not the person pays his or her bills. It shows everything from late car or mortgage payments, unpaid medical or cable bills, to bankruptcies. All of these factors contribute to the overall credit score, which eventually determines how much interest you’ll pay.

Low-FICO-score borrowers get higher interest rates because their banks are concerned about their ability and willingness to pay back the money. However, risky loans still play a role in banking because they bring in more money than perfect credit score loans, and help to grow bank assets.

The trick is not giving out too many such loans, because that can cause major problems during a downturn in the economy. Every bank aims to strike the right balance between the risky, lower quality and high quality loans.

So how can you tell if a bank has a strong book of loans? The level of non-performing loans, or NPLs, is the measure used. This figure tells us what percentage of all loans are no longer making money for a bank. A loan is considered non-performing after at least three months (90 days) of non-payment by the borrower. They don’t bring any cash to the bank anymore.

Industrywide non-performing loan levels can also tell us about the overall condition of the economy. Take a look at the graph below. It shows the banking industry’s quarterly non-performing levels over the last 26 years ending with Q1 2017.

As you can see, levels of troubled loans began rising rapidly at the beginning of the Great Recession in 2007. They didn’t stop until the first quarter of 2011, when they reached a 26-year high of 3.65%.

NPLs have been falling since then, decreasing to 1.49% in Q1 2017. That’s low compared to the prior six years. But it’s still not quite as low as we saw in the pre-recession period, when NPLs slipped below 1%.

In addition to non-performing loans, I also included data on debts that banks no longer expect to collect, known as charge-offs. The overall trend in the graph above shows that from 1995 to 2005, non-performing loans were low because a good portion of them were charged off as losses. The reduced gap between the blue and orange graph lines clearly indicates that.

You will also notice spikes in charge-offs at every year-end. That’s likely due to the fact that banks try to close up the books for the year and write off loans to start fresh the next year. The recent charge-off pattern has been on the decline, just like the pattern for non-performing loans, indicating higher loan quality and better borrower performance. The average industry charge-offs in Q1 2017 were 0.12%, down from the high of 1.62% in Q4 2009.

So as you can see, loan quality has been improving. The only question is whether a push toward deregulation will cause banks to take on more risk again, and whether that will reverse the positive trend.

Only time will tell on that score. But in the meantime, I pulled up ten large banks with some of the lowest NPLs in the industry just to give you an idea of how low this number is for institutions with well-balanced loan portfolios. I built the list using our Banks Screener.

First, I pulled in banks with at least $10 billion in total assets. Then I sorted the list in ascending order by non-performing loans. A column with charge-offs is also included. The lower the percentage, the better off a bank is.

10 Banks with Lowest Non-Performing Loans

|

| Data as of May 12, 2017 |

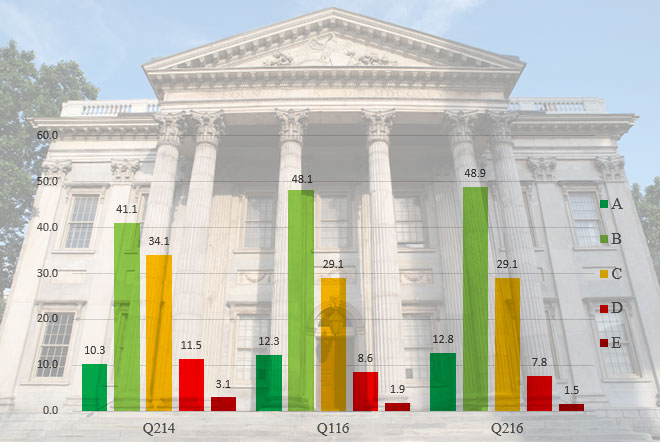

Based on the loan analysis, we developed the “Bank Bad Loan Index.” The Bank Bad Loan Index is a relative indicator designed to indicate the level of bad loans. This is defined as a measure of loan delinquency and losses expressed through non-performing loans and loan write-offs reported by banks.

As you can see, the Q1 2017 Bank Bad Loan Index level has now fallen to the same level it hit at the beginning of the financial crisis. But despite a continuous decrease in troubled loans, we should still keep an eye on it as bank deregulation could change things rapidly.

In the meantime, we can help you keep an eye on your own bank. Simply go to the Weiss Ratings website and find your bank using the search bar at the top. Then scroll down towards the bottom of the summary page, and under “Asset Quality” you’ll find non-performing loans as a percentage of total loans.

Think safety,

Remi Lukosiunas

Money and Banking Edition, By Remi Lukosiunas, Financial Analyst Remi Lukosiunas, a Financial Analyst, joined Weiss Ratings in 2014 with a financial services background in internal audit and the credit union industry. Remi conducts banking, credit union, insurance and investment research. He has also written extensively on stocks and investing using ratings as a guide. Remi is a graduate of Florida State University with a degree in multinational business. |