‘My Portfolio, My Bitcoin and the Price of My House Have Skyrocketed ... ’

|

Yes, fraternity friends and I should have drunk less beer and spent more time at the library during college; that’s true. It’s also true that everyone in my closest circle went on to become very successful in life.

One of them called me last week. “Tony,” he began, “my portfolio, my Bitcoin and the value of my home have skyrocketed. I’m thinking about selling everything and retiring. What do you think?”

I started with this question: “If the stock market dropped by 40% over the next year, how would that affect your life?”

From there, we had a long conversation.

|

I won’t go into my friend’s specifics. I will share that he said he couldn’t afford to retire if he lost 40% of his net worth. That being the case, I told him he should sell enough of his stocks and cryptocurrency so the next bear market won’t wipe out his retirement dreams.

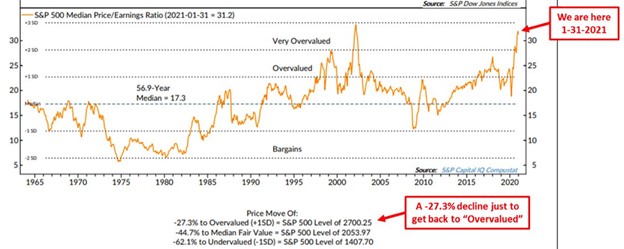

You should ask yourself the very same question: Could you afford to see 40% (or more) of your wealth wiped out by the next bear market?

If you’re in your 20s, 30s, 40s, even your 50s, you’re still working, and you’re making contributions to your 401k and/or your IRA ... you still have time on your side.

In fact, a 40% drop would make it possible for you to buy stocks at much lower prices.

Now, if you’re within a few years of retirement (like my fraternity friend), or if you’re already retired, your focus should shift from capital appreciation to capital preservation.

That’s especially true for cryptocurrency investors. One of the biggest problems with crypto as an asset class is that it’s still so new and untested.

Also, I think many — if not most — crypto types are not long-term investors and will flee or panic when the next industry bear market comes around.

Everybody loves volatility to the upside, but their hatred on the downside is even more intense.

Consider this: Would you sleep better at night if a substantial portion of your net worth was in an asset that routinely swings up and down by 20%, 30% even 40% or more, or in a bunch of bricks of gold locked in a vault?

I’ve been doing this for a long, long time, and I’ve seen investors who own rock-solid, been-around-for-decades stocks, like Walmart Inc. (NYSE: WMT), Microsoft Corp. (Nasdaq: MSFT), The Coca-Cola Company (NYSE: KO), The Proctor & Gamble Company (NYSE: PG) and Johnson & Johnson (NYSE: JNJ) who don’t get their confidence shaken by recessions and bear markets.

They know these stalwarts aren’t going away, that they will recover.

That knowledge creates confidence.

Few investors have that type of long-term confidence in smaller, upstart companies such as Pinterest Inc. (NYSE: PINS), Uber Technologies, Inc. (NYSE: UBER), DoorDash, Inc. (NYSE: DASH), Etsy, Inc. (Nasdaq: ETSY), Airbnb, Inc. (Nasdaq: ABNB), Snap Inc. (NYSE: SNAP), Shopify Inc. (NYSE: SHOP) and Zoom Video Communications Inc. (Nasdaq: ZM) … all of which have fabulously rewarded their early investors.

That said, if any of these lost 40% ... would you have the confidence to hold, or would you dump it and run for the hills?

I mention those hot tech stocks for a reason; my fraternity buddy owned all of them.

But he owned very few of those rock-solid, been-around-for-decades stocks such as WMT, MSFT, KO, PG and/or JNJ.

Here’s what my friend’s portfolio looked like before we talked ...

- 80% Upstart “Disruptor” Tech Stocks

- 20% Bitcoin

And here’s what his portfolio looks like now ...

- 40% iShares 3-7 Year Treasury Bond ETF (Nasdaq: IEI)

- 30% Blue-Chip “Dominator” Stocks

- 15% Upstart “Disruptor” Tech Stocks

- 5% Bitcoin

- 10% Gold/Silver

I’m not suggesting you hurry up and do the same for your portfolio. The “after” allocation is based on a thorough evaluation of my friend’s personal situation, his financial goals and his tolerance for risk.

In short, the allocation is tailored to his — not your — specific needs.

Still, it’s worth asking yourself: can I afford to see 40% (or more) of my wealth wiped out by the next bear market?

That’s up to you to decide.

Best,

Tony