|

This week, stocks notched a series of record highs. This was a welcome relief after last week's carnage. The Dow Jones Industrial Average kicked off the final week of January with a 454-point loss and ended the month with a 603-point drubbing.

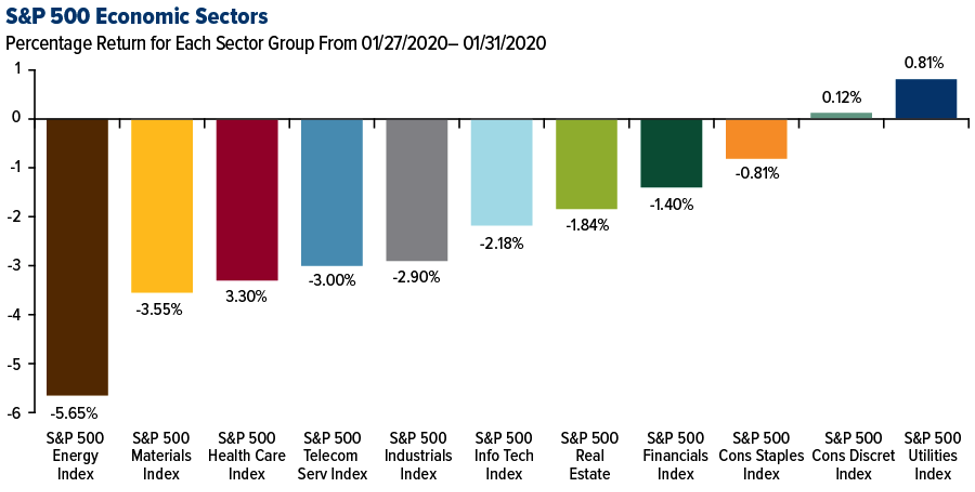

For the most part, it didn’t matter what you owned. The pain was equally distributed, except for one sector that my colleague Mike Larson has been loudly recommending to everybody smart enough to listen to him.

Utility stocks held their own when other stocks were getting slaughtered. And they're doing even better now.

Last Monday, the Utilities Select Sector SPDR Fund (XLU) was essentially unchanged, down 0.2%, and was actually up for the week.

|

|

Source: U.S. Global Research |

That’s right; XLU went up during a crazy week. And Mike believes there is a lot more profits yet to be made from utility stocks. Here’s what he said:

Consider this: The utilities ETF XLU was ALREADY up more than 7% year-to-date as of earlier this week. That was roughly SEVEN TIMES the gain of the S&P 500.

It’s not just a 2020 phenomenon! The XLU has also crushed the SPY by a factor of more than two-to-one over the past TWO YEARS.

And he’s right. These aren’t short-term trends. Defensive, lower-volatility, higher-rated sectors are leading this market and have been doing so for a long time.

I’ve worked with Mike for almost two decades. He is one of the best investors on the planet when it comes to low risk, low volatility investing.

I’m a growth investor, so I love finding home run stocks. Big gains come with big swings. And nothing feels better than when you score a home run. Everybody loves volatility on the upside, but a big chunk of self-described “long-term investors” turn as cautious as Chicken Little when the volatility surges to the downside.

True long-term investors have the stomach to handle swinging and missing every so often.

Last week turned a lot of investors green around the gills as news of the coronavirus kept getting worse. If you were one of them, then the worst thing you can do is let your fear control you. Don’t go selling all your stocks and running for the hills.

The best course of action for any Nervous Nellies would be to:

A) Swap out of high-beta stocks into lower-beta stocks, and ...

B) Load up on the type of defensive, income-generating stocks and ETFs that Mike recommends in his Safe Money Report.

Another option for those uncomfortable with bigger, long-term swings is gold. This safe-haven asset is usually ignored until trouble comes. And then, it’s the hot commodity!

Over a recent six-month period, gold outperformed stocks … by over 20-to-1! It's clear that the next gold rush is upon us right now.

The time to start cashing in is now.

And to help you get started, this coming Tuesday, Feb. 11, my colleague Sean Brodrick is revealing Gold Stock 10-Baggers for 2020.

Sean's also going to show you, step by step, how to use his powerful PROVEN Gold X system to go for quick returns of 370% ... 639% ... 1,186% ... even 4,727%.

Click here now to secure your FREE seat!

Sean will send you more information when you sign up. I hope you do. The markets are going to take a breather at some point, and you'll want to have a safety mask — in the form of gold and gold stocks — to get you through the scary times AND the good ones to come.

And they are coming. I happen to believe that scientists will quickly develop a treatment that prevents the coronavirus infection rate, just like they did for SARS, ZIKA, Ebola and the Avian flu.

In each of those instances, stocks tumbled on fears. With SARS, the S&P 500 dropped 10% in the first quarter of 2003. And in all those instances, market recovery was far greater than any loss. In 2003, after the bulk of the SARS scare was over, the S&P 500 ended up 26% for the year after the virus was contained.

If I’m right, this pullback is another excellent buying opportunity. But if I’m wrong, you’re going to wish you paid very careful attention to Mike and Sean. That's my Rx for profits that I recommend you take very, very seriously.

Best wishes,

Tony Sagami