One Percent of Property and Casualty Insurers Improve Ratings. Is Yours Among Them?

Your home, car, business, or your boat, they’re all insured by a property and casualty insurance company. But how do you know which one is the best and will pay up when a disaster strikes? How do you know if it has good financial track record? Well, that’s where Weiss Ratings comes in. One simple letter denominated safety rating can give you a better idea of what we think about an insurer.

In addition to easy understand ratings, we tell you which companies improved and now have a higher rating and which ones took a step down.

Based on our analysis of the second quarter 2016 data, we upgraded 23 property and casualty insurers and downgraded 13. When compared to a year ago (Q2, 2015), the second quarter 2016 had 20 more upgrades.

In Q2, 2015, only three companies received a safety rating upgrade, representing a minuscule 0.12 percent of the property and casualty industry, while in the second quarter 2016, one percent of the industry was upgraded.

There were nine P&C insurers with an upgrade to the B range, 11 moved up to be C rated, and three now have a D rating, moving out of the E range.

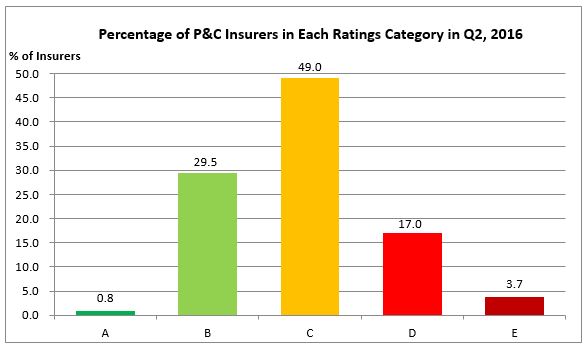

This is what the ratings distribution looks like for all property and casualty insurers.

An insurer can receive and upgrade or a downgrade at any given quarter, so be sure to add your company to your Watchlist, allowing us to monitor it and warn you of any rating changes.