|

Growing up, my family was one of the poorest in our town. Despite my father working his behind off on our small vegetable farm in western Washington, he never made much money.

Our family car reflected our situation. The engine of that old Chevrolet knocked so loudly, I always asked my parents to drop me off a block away from school.

Engine knocking was a common problem back in the day. But a brilliant mechanical engineer named Thomas Midgely discovered that adding a chemical called tetraethyl lead to gasoline solved the problem of engine knocking.

|

| Source: Car and Driver |

Lead was known to be a toxic chemical, but as too often is the case, public health took a backseat to profits.

“Can you imagine how much money we're going to make with this? We're going to make $200 million dollars, maybe even more," said Midgley to General Motors Co. (NYSE: GM, Rated “D+”) then-CEO Charles Kettering.

Midgley was hailed as a hero and was awarded the Priestley Medal in 1941 and appointed president of the American Chemical Society.

In addition to its health concerns, leaded gasoline became one of the most environmental damaging chemicals ever invented. Eventually, it was permanently banned in 1995.

The future of fossil fuels is one of the hot topics in politics. And regardless of what candidate you support, there is no question that the world is slowly transforming toward renewable resources, such as solar, wind, geothermal, biomass and hydroelectric.

|

As an investor, that means opportunity if you know where to look.

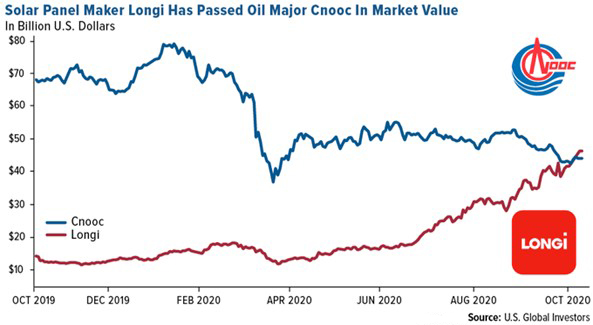

For example, the largest solar panel manufacturer in China, Longi Green Energy (OTC: 601012.SS, Unrated) now has a market cap larger than CNOOC Limited (NYSE: CEO, Rated “D+”), the largest oil and gas producer in China.

Now, that’s saying something when a green energy upstart is more valuable than the largest energy producer in all of China!

The same dynamic will be playing out in the U.S. and you should pay attention to clean energy stocks and ETFs, such as …

- iShares Global Clean Energy (Nasdaq: ICLN, Rated “B-”)

- Invesco WilderHill Clean Energy ETF (NYSE: PBW, Rated “C+”)

- First Trust NASDAQ Clean Edge Green Energy Index Fund (Nasdaq: QCLN, Rated “C”)

- Invesco Solar ETF (NYSE: TAN, Rated “B-”)

- First Trust Global Wind Energy ETF (NYSE: FAN, Rated “C+”)

That doesn’t mean you should rush out and buy any of these ETFs tomorrow morning. As always, timing is everything, so you need to do your own research. However, there is no question that there is big, big money to be made in clean energy stocks.

Best wishes,

Tony Sagami