REITs Are Trouncing the S&P! Here’s Why and How to Get Your Share of the Income and Gains They’re Spinning Off

|

I was one of the biggest real estate bears on the planet in the mid-2000s. And boy did that sector crater during 2008’s housing bust.

That was then. Circumstances are completely different now. Rock-bottom interest rates, runaway asset inflation, soaring residential rents and the scramble for yield among investors ignited the sector.

As a result, Safe Money subscribers are racking up handsome gains on real estate investment trusts (REITs). But is there still time to join them? Can you still generate juicier income AND capital gains from the sector?

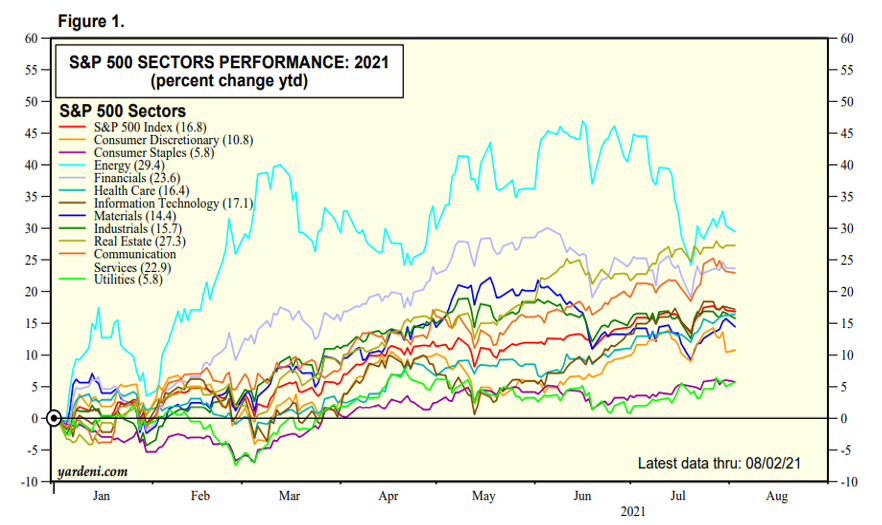

Let my answer begin with a chart showing the year-to-date performance of the 11 S&P 500 sectors along with the index itself. As you can see, the S&P 500 is up almost 17% in 2021. Not bad at all.

|

| Source: Yardeni Research, Inc. |

But the real estate sector is trouncing the S&P! It’s up more than 27% ... and counting. That’s second only to energy in the 2021 performance race.

Things get more interesting when you delve deeper into the numbers. Office and lodging REITs have lagged thanks to the well-publicized impact of COVID-19 on work and travel trends. Just look at the glut of unused/underused office space thanks to the pandemic ... and how long it’s taken for hotel occupancy and room rates to climb back to normal.

But many residential REITs, industrial REITs and specialized REITs have been going gangbusters. Why?

Homeownership has gotten so expensive that many Americans are being forced to rent instead. Increased online shopping activity led to a surge in demand for warehouses and other storage and fulfillment spaces for retailers. Demand for specialized properties to grow cannabis, park recreational vehicles (RVs) and store boats, among other things, has strengthened.

Meanwhile, interest rates are going nowhere fast. That’s continuing to fuel a manic search for yield among institutional and individual investors alike.

Guess who delivers it? REITs! The Real Estate Select Sector SPDR Fund (NYSE: XLRE) sports an indicated yield of 3.4%, far outpacing the 1.4% yield of the SPDR S&P 500 ETF (NYSE: SPY).

Bottom line? I doubt this run of outperformance is over. That’s why I’ve continued to focus on specialty REIT names in my Safe Money Report. You can subscribe and get those kinds of recommendations by clicking here.

Or, if you’re not yet ready to take that step, research REITs on your own. There are still profits — and juicy income — to be had.

Until next time,

Mike Larson