On Tuesday, March 15th, a massive 51 percent decline in Valeant Pharmaceuticals International, Inc. (VRX) wreaked havoc in the stock market and caused hefty losses to many. VRX started the day trading at $69.04 per share and by the time the markets closed it was $33.51, recording a tremendous intraday loss and a huge decrease since achieving its highest stock price of $263.81 on August 6, 2015.

Based on filings, Sequoia Fund (SEQUX) was at the top of the casualty list with 19.3 percent of its assets invested in VRX. In the matter of hours, an estimated $800 million of Sequoia’s investments were gone. Having placed an unusually large amount of assets in one basket, Sequoia Fund was the biggest loser on Tuesday.

This drop in price of VRX demonstrates why diversification of investments is so important to minimize risk and why well diversified mutual funds and ETFs are so popular.

Below is the estimated drop in value based on the latest filings of the top 10 Valeant fund shareholders. The drop is the difference in VRX investment value between the latest filing and March 15, 2016.

| Fund Name | Ticker | Weiss Rating |

Value in $ Millions as of Latest Filing |

Value in $ Millions as of 03/15/16 |

Drop in Value in $ Millions |

| Sequoia | SEQUX | C | 1,301.5 | 429.0 | (872.4) |

| T. Rowe Price Growth Stock | PRGFX | C | 495.9 | 163.5 | (332.4) |

| T. Rowe Price Blue Chip Growth | TRBCX | C+ | 276.8 | 91.2 | (185.5) |

| T. Rowe Price Health Sciences | PRHSX | C | 235.7 | 77.7 | (158.0) |

| Vanguard Total Intl Stock Index Inv | VGTSX | D | 215.0 | 109.5 | (105.5) |

| Davis NY Venture A | NYVTX | C | 200.2 | 71.5 | (128.6) |

| First Eagle Fund of America Y | FEAFX | C+ | 166.7 | 55.0 | (111.8) |

| T. Rowe Price Instl Large Cap Growth | TRLGX | C | 159.3 | 52.5 | (106.8) |

| GMO Implementation | GIMFX | D+ | 156.0 | 58.1 | (97.9) |

| ClearBridge Aggressive Growth A | SHRAX | C | 155.5 | 51.3 | (104.3) |

| (Data source: Weiss Ratings and Morningstar) | |||||

Numerous mutual funds have investments in Valeant, some larger than others. Check out Weiss Ratings’ “Top Holdings” of any mutual fund or select the fund that you currently have and see where majority your money is invested and the Weiss rating for those investments.

Stocks

Bank of America Corporation (BAC), Citigroup (C), BB&T Corporation (BBT)…just a few well known bank stock names that were recently downgraded by Weiss Ratings. Weiss analyzes and rates thousands of stocks every day giving you the opportunity to make better investment decisions.

See all Weiss stock upgrades and downgrades.

Want to find out what is going on with your stocks? Simply sign into your Weiss Ratings account and add them to your Watchlist and we will send you an alert every time there is a rating change.

To add a stock, click on the grey star ribbon next to the stock name, either in the search bar, the summary page or anywhere else where your stock is displayed, and it will be immediately added to your Watchlist.

To remove a stock, go to your Watchlist and click the check mark to the right of the stock name and it will be instantly removed.

Same add/remove process applies to all Weiss Ratings (Mutual Funds, ETFs, Banks, Credit Unions and Insurance Companies).

ETFs

Out of over 1,600 rated ETFs, Weiss Ratings have picked out a handful of best performing, highly rated and cheapest ETFs. We give you a list of 16 ETFs in Weiss BUY universe, with one-year total return of 10 percent or more and expense ratio of 2 percent or less.

This may sound like a complicated list to prepare requiring lots of time and research. Actually, it’s very easy…Weiss Ratings has done all the work for you. Simply sign into your Weiss Ratings account and use our powerful Screener on any of our ratings to narrow down your search and come up with a precise and comprehensive investment list.

Banks

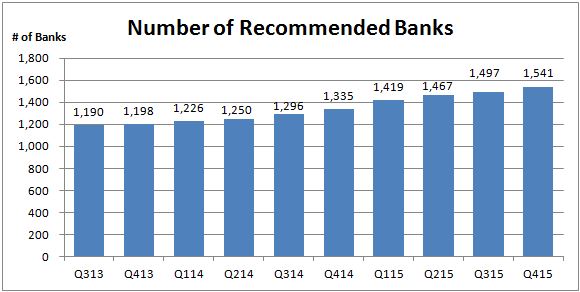

According to Weiss Ratings’ bank trend analysis, the number of recommended banks (rated B+ or higher) has risen from 1,190 institutions in Q3, 2013 to 1,541 in Q4, 2015; representing 25.2 percent of 6,108 U.S. banks as of December 31, 2015.

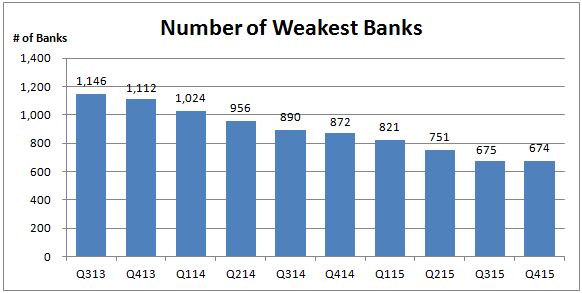

On the other hand, the number of banks on the Weiss weakest list (D and E rated) has gone down from 1,146 institutions in Q3, 2013 to 674 in Q4, 2015 and represents 11 percent of the industry as of December 31, 2015.

Credit Unions

Weiss Ratings upgraded the safety ratings of 466 credit unions and downgraded 417 based on its analysis of fourth quarter 2015 results. Weiss, the nation’s leading independent provider of bank, credit union and insurance company ratings, analyzed over 6,000 credit unions.

Weiss Ratings recommends that consumers do business with institutions rated B+ or better. Currently, 789 credit unions, or 12.9 percent, are rated B+ or better, meriting inclusion on the Weiss Recommended List.

For recommended credit unions with assets of $1 billion or more, see Weiss Largest Recommended Credit Unions list.

Insurance

Under the Affordable Care Act or Obamacare, all health insurance companies are required to comply with the 80/20 MLR (Medical Loss Ratio) rule which dictates that an insurer must spend at least 80 percent (85 percent for some larger groups) of premiums on providing healthcare services and can keep no more than 20 percent as a profit. If less than 80 percent is spent, the remaining amount must be returned to the consumer as a rebate.

The 80/20 rule was implemented to provide transparency on how insurers spend their premiums, create value for the consumers, and to promote better business practices and competition.

But how does it affect health insurance companies?

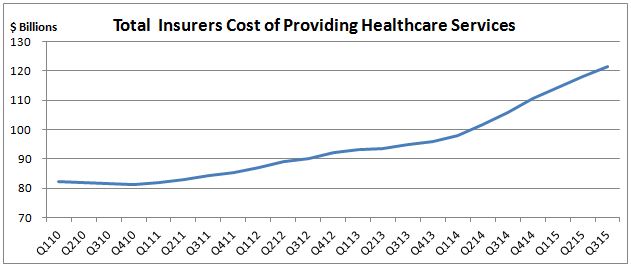

Weiss Ratings Q3, 2015 health insurance trend analysis of over 1,000 health insurers indicates that the average total amount spent to provide healthcare services by health insurers has risen from $82.3 billion in Q1, 2010 to $121.5 billion in Q3, 2015; that’s an increase of $39.2 billion or 47.6 percent over nearly six years. Insurer’s healthcare expenses include paid claims and activities to improve quality of healthcare.

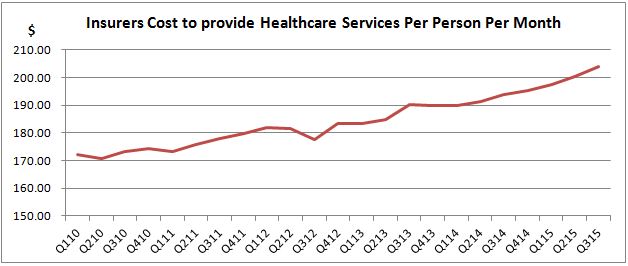

The amount spent on a per-person per month basis went up from $172.1 in Q1, 2010 to $203.8 in Q3, 2015. That’s an increase of $31.8 or 18.5 percent.

Although the insurer expenses are increasing, the premiums charged are also going up, $140 billion in Q3, 2015 up from $95 billion in Q1, 2010, leaving the profit margins almost the same in Q3, 2015 as they were in Q1, 2010.

Based on Weiss Ratings analysis, health insurers in Q1, 2010 were spending 87 percent of the collected premiums on providing healthcare services, this figure was at 86.8 percent in Q3, 2015.

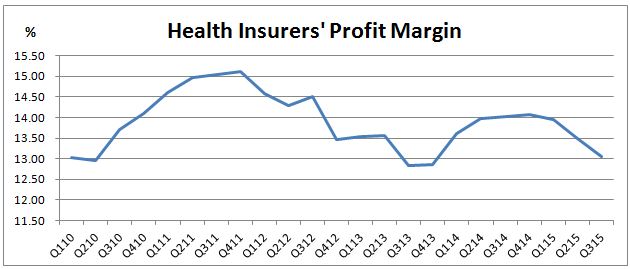

The profit margin in Q3, 2015 was 13.2 percent and 13.0 in Q1, 2010. The trend below shows ups and downs in profit since the beginning of 2010 with an annual average of 13.9 percent.

The data shows that, although with much regulatory change, health insurers have maintained similar profit margins with a chance to make sound investment decisions to boost the bottom line.

Failures

Institution Name |

Industry |

State |

Total Assets in Millions |

| North Milwaukee State Bank | Bank | WI | 67.1 |