|

This shocking megatrend is nothing new.

You’ve been suffering its consequences for a long, long time.

It’s like Chinese water torture. Drip by drip, day after day, year after year, it has gotten progressively worse.

Savers, especially seniors, are the primary victims. But millions of investors also get slammed, especially in bad times like these.

When I tell you what it is, you won’t be surprised. You’ll say, “Heck, we know all about that!”

But have you stepped back to fully consider its sheer magnitude and extreme consequences?

I’m talking about this THING:

|

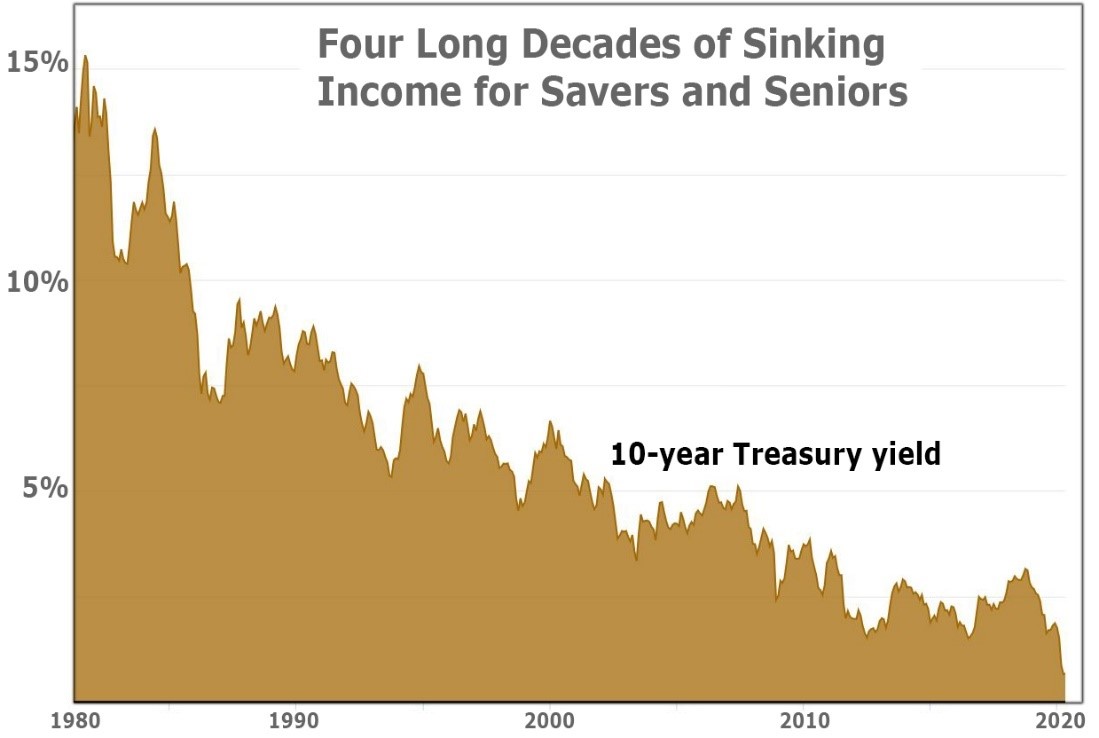

For four long decades, the income you can make from your savings has been plunging.

Not just four years. But four DECADES!

How bad is it? Brace yourself because it’s a lot worse than most people realize …

In the first half of the 1980s, even during periods when inflation was low, the 10-year Treasury note gave you income of at least 11% per year.

In May of 2020, it gave you a meager 0.67% per year.

In other words …

At Least 94% of Your Interest

Income Has Been Wiped Away

Not half. Not three quarters. But more than NINE-TENTHS!

This has very severe consequences.

First, since Treasury yields are the primary benchmark for all interest rates, it has driven down the yields on virtually everything else, even risky junk bonds. So there’s no obvious escape.

Second, it has forced nearly everyone to take more and more extreme risk with their money.

Third, the risk-taking virus has infected everyone and everything. It’s ubiquitous not only among individual savers and investors, but also on Main Street and Wall Street -- among tens of millions of businesses, banks, credit unions and insurance companies … money managers, mutual funds and hedge funds … local and state governments … even college endowments and charitable organizations.

Fourth, needless to say, when 94% or more of their yield is wiped away, it becomes almost impossible for seniors and other savers to earn money on their savings without taking crazy risks with their principal.

Unemployment Rate Down?! Hah!

That’s a Joke, and No One Is Laughing.

On Friday, Wall Street celebrated a much ballyhooed improvement in the national unemployment rate, and Treasury yields rose by a small notch.

Does this finally change the trend for interest rates?

Not at all. For one, the Fed remains committed to flooding the economy with cheap money.

And the so-called “improvement” in the jobless rate is a pure mirage -- a statistical fluke that’s built into the way the government counts unemployed.

According to the Bureau of Labor Statistics (BLS), there were 4.9 million people who were “not at work for other reasons.” So they were counted as “employed.”

But the BLS admits this is an error in their methodology. Based on this alone, the unemployment rate would be 16.3% or three percentage points higher than reported.

What’s worse, the BLS reported a huge deduction in their nation’s work force – 6.3 million American who were “not actively looking for work.”

Darn right they weren’t looking! They were locked down at home. And these 6.3 million obviously could not search for new jobs via the Internet.

We must include them among the jobless. There’s no other way to categorize them.

When we do, suddenly the unemployment rate jumps to more than 20%.

But it doesn’t end there. The government’s statisticians somehow came to the conclusion that a record number of new businesses were formed in May, creating a whole batch of additional jobs.

How is that possible? The reality is, with most of the country still shut down, it was NOT possible.

In fact, their conclusion is based exclusively on a fluky statistical model that estimates business formations based on irrelevant past history.

So, the real unemployment rate is even higher!

End result: Do not expect higher interest income any time soon.

Instead, be sure to follow our Weiss Ratings analysts for alternate investment strategies with a documented track record of success in achieving above-average yields with below-average risk.

Good luck and God bless!

Martin