Shutdown Showdown: Congress Votes to Kick the Debt Can Further Down the Road

|

| By Tony Sagami |

Select small, undiscovered cryptos have potentially great opportunities for massive profits that could even surpass what Bitcoin’s offered investors. And speaking of opportunities, Dr. Martin Weiss is hosting a live Q&A session this Tuesday, Oct. 5, at 2 p.m. Eastern. Best part? It’s completely FREE. Just grab your ticket here.

Now, let’s get to your Weiss Daily Briefing …

Treasury Secretary Janet Yellen just issued a stark warning. It was about the ongoing battle in Congress over America’s debt ceiling.

According to Yellen, “Failing to increase the debt limit would have catastrophic economic consequences.”

Geez, what a bunch of crap.

Another Shutdown Showdown

Congress just reached a deal to avoid a looming government shutdown … for now.

The bill aims to keep the government funded through Dec. 3. As of this report, President Biden is expected to sign it.

Great. But that doesn’t change the fearmongering that led us to this latest near-shutdown.

All this political theater over the debt ceiling – the limit to how much the Treasury can borrow to meet federal payment obligations – is nothing new. Whenever one political party thinks they can make the other party look bad … they do it.

• Yellen has suggested abolishing this debt limit, rather than running into this all-too-common predicament of being forced to consider raising it.

The last time there was a big hullabaloo about the debt ceiling was during Trump’s presidency. The federal government was shut down from Dec. 22, 2018, to Jan. 25, 2019.

National parks were closed, 2.1 million federal workers were furloughed and many federal services were suspended.

Then, like now, the mainstream media bends over backward to scare us.

But get this: There have been 21 government shutdowns since 1976.

• The reality is that government shutdowns are inconvenient … but they haven’t been “catastrophic,” as Yellen claims a new one would be.

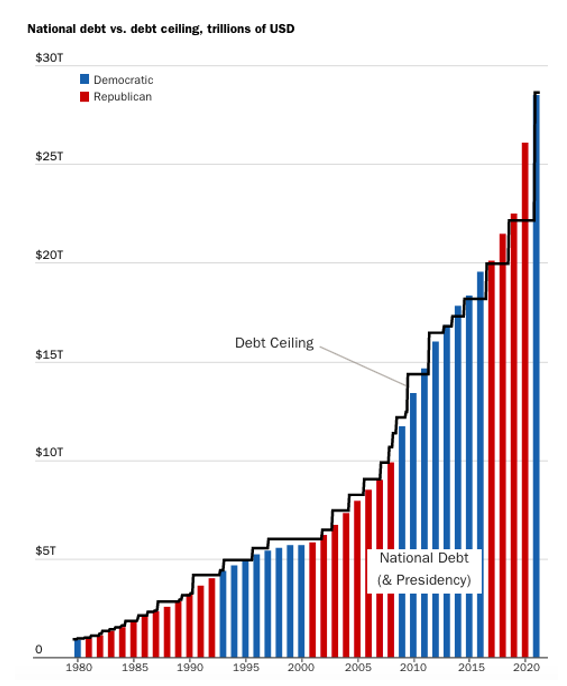

What IS catastrophic is the runaway increase in our national debt every time Congress increases the debt ceiling. Our national debt is now 120% of gross domestic product (GDP), a level not seen since World War II.

Ironically, the debt ceiling has done nothing to put an actual ceiling on our national debt.

• In 1981, after 190 years of federal spending, the national debt was “only” $1 trillion.

• Now, just 40 years later, it’s more than $28 trillion.

It’s not just one political party to blame. Presidents Bush, Obama, Trump and Biden have all spent money like drunken sailors.

In July 2011, the $14.3 trillion debt ceiling was about to be reached but the government averted a shutdown. In the 10 years since, the debt ceiling has roughly doubled to a staggering $28.4 trillion.

|

| Source: Cato Institute |

The only thing the debt ceiling does is provide the occasional opportunity for partisan bickering and name-calling.

For people like you and me, the debt ceiling should be a reminder that our political leadership is running up trillions of dollars of debt on our children.

• More spending … more deficits … and more

And as investors, history shows that government shutdowns generally do not have meaningful impacts on the stock market. In fact, the S&P 500 actually went up during the last shutdown in the winter of 2018.

The debt ceiling drama is just a bunch of cow manure.

So if you’re looking for a way to safely ride out that drama, my Disruptors & Dominators subscribers have had insight to the industries transforming the U.S. economy and the tiny handful of companies that dominate these sectors since 2003.

Consider joining us, and in the meantime, ignore the noise emanating from Washington, D.C.

Best wishes,

Tony Sagami