|

Try not to laugh ... I owned a white polyester suit and took disco dance lessons when I was a student at the University of Washington in the 1970s. It’s sad, but true.

|

| Paramount Pictures Corp. |

No question — disco and polyester were two of the very worst things to come out of the 1970s.

But, if you can believe it, something even worse came out of the 1970s.

I’m talking about stagflation.

And unlike disco and polyester, it’s about to make a comeback.

Stagflation is characterized by slow economic growth and relatively high unemployment. In the 1970s, the U.S. went through a period of high unemployment and rapid inflation caused by the OPEC oil embargo.

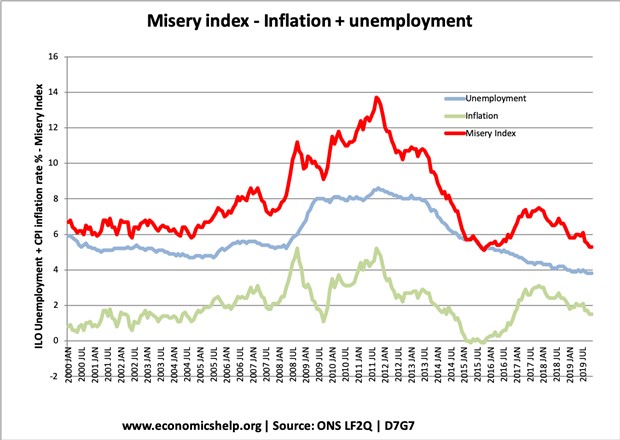

Stagflation is so destructive that a clever economist, Arthur Okun, created the Misery Index, which is the sum of the inflation rate and unemployment rate. That’s a pretty miserable combination. But what’s equally as miserable is that we are about to enter another period of stagflation.

|

Unemployment, while recently improved, has skyrocketed due to the coronavirus pandemic. The official unemployment rate currently stands at 7.9% but would be much higher if it included part-time workers and anyone who has stopped looking for work or left the work force entirely.

According to the Ludwig Institute for Shared Economic Prosperity, only 46% of Americans over the age of 16 have a full-time job paying more than $20,000 per year.

Regardless of what the true unemployment rate is, it’s still only one-half of the Misery Index. So, let’s move on to look at inflation.

Despite what the government tells you — the August 2020 Consumer Price Index showed a year-over-year inflation rate of 1.3% — inflation is much higher.

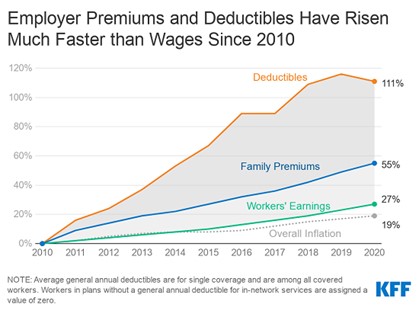

Everybody spends their money differently, but the costs of many things are skyrocketing.

Things like health insurance premiums. According to Kaiser Family Foundation, health insurance premiums have increased by 55% in the last decade.

|

And don’t get me started on college. If you have children or grandchildren in college, I don’t have to tell you how fast the cost of higher education is rising. According to the U.S. Bureau of Labor Statistics, college tuition has soared by 1,412% since 1977, the peak of the 1970s stagflation.

And those looking to buy a home are struggling as well, even in this age of low rates for borrowers.

Home prices are on the rise. That’s good news if you already own a home, but millions of millennials and Gen Xers are finding themselves priced out of the American dream. The Federal Housing Finance Agency house price index is up by 6.5% over the last year. In some parts of the country, home prices are up double that.

Even the prices of many staple foods — eggs, cereal, meat and milk — are much higher as well. And the list goes on.

I blame the numbskulls in Washington D.C. who keep running massive deficits ($3 trillion over the last 12 months) and printing money without a care in the world.

This isn’t a Democrat or Republican problem. Politicians from both parties are irresponsible spendthrifts. That’s why our national debt hit $27 trillion earlier this month.

There’s no doubt about it — we’re about to enter a treacherous period of stagflation. Unlike the 1970s, you won’t find me dancing to “Saturday Night Fever” in a white polyester suit (fortunately), but you will find my portfolio full of the same assets that did well in the 1970s: Health care, food, energy, utilities and precious metals.

Those are going to be your portfolio protectors as the Misery Index rises. Take the time now to utilize the Weiss Ratings and research the best picks in each sector for your portfolio.

Best wishes,

Tony Sagami