|

Last week, Trump announced that he will impose a new round of tariffs — 10% this time — on $300 billion of imports from China, effective Sept. 1. This is in addition to the 25% tariff already imposed on $250 billion of Chinese imports.

The result is pretty much everything that we buy from China will get hit with tariff fees. That's true even if he stands by this week's plan -- to delay these tariffs until after the holiday shopping season ends.

In principle, I am a free trade advocate and against all tariffs. But there is no question that China (as well as much of Europe) hasn’t been playing fair.

There isn’t a perfect answer, but doing nothing other than talking tough — which is also what the Obama AND Bush administrations did — isn’t an answer, either.

|

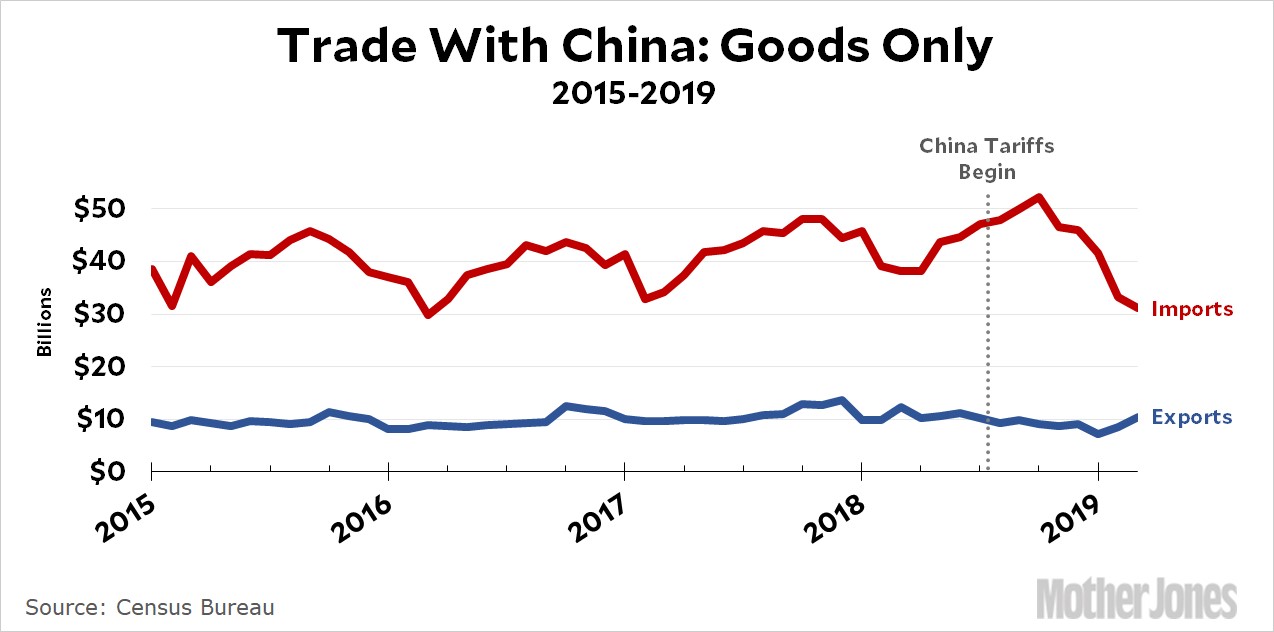

These tariffs are indeed impacting trade between the U.S. and China. Both ways, I might add.

In the first six months of 2019, imports from China dropped by 12% compared to the same period in 2018.

And U.S. exports to China have fallen by 18%.

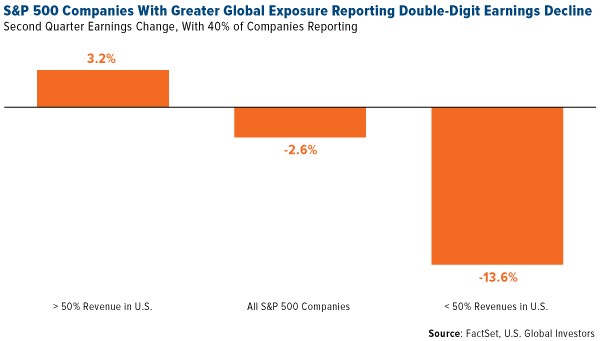

That decrease in trade is impacting the profits of U.S. companies that do a lot of business in China. According to FactSet, U.S. companies that get more than 50% of their revenues from outside the U.S. have seen their profits drop by an average of 13.6% on a year-over-year basis.

At the same time, U.S. companies that get most of their revenues from inside the U.S. saw their profits increase by 3.2%.

|

In short, companies that make most of their money from inside the U.S. are beating the heck out of mega, multi-national powerhouses.

There is a clear, clear message in those numbers; focus your portfolio on companies who do most of their business domestically.

If you’re more of an ETF investor, you should take a look at the iShares Russell 1000 Pure U.S. Revenue ETF (AMCA). This Exchange-Traded Fund invests in American companies that generate at least 85% of their revenues from the U.S.

AMCA’s is up 11.2% year-to-date, even with after this week's volatile market action.

If you prefer a little more control, there’s a carefully selected basket of stocks benefiting from this “made in America” profit trend waiting for you.

Those can be found in my Weiss Ultimate Portfolio service. For example, we just banked a 57.5% profit on Match Group (MTCH) last week. We’re currently tracking open gains of up to 30%. Click here to join and get detailed recommendations that will put your portfolio in position to profit from the Trump tariffs … instead of being damaged by them.

While I suspect the tariff war will ultimately be resolved, the bickering between Trump and Xi Jinping could last for a long, long time. And that means both peril and opportunity for your investments.

Best wishes,

Tony Sagami