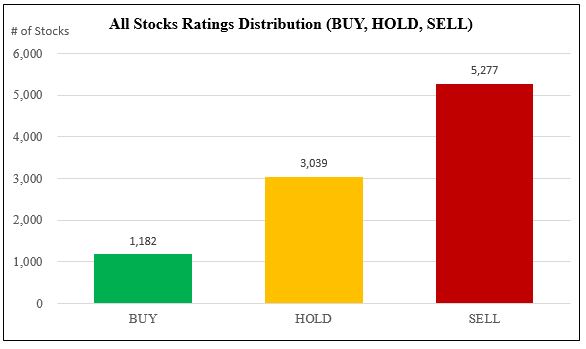

Is the financial uncertainty following the election finally over? As of last Friday, BUY rated stocks were up by 6, to a total of 1,182, delivering the first increase in BUY rated stocks in over a month.

Last week, only one stock dropped out of the BUY range. But in the weeks prior, BUY stocks were dropping by as many as 39 in just one week. It appears the downward trend of stocks dropping out of the BUY range into the HOLD range has not only stopped, but has now turned around.

SELL stocks are also indicating improvement in overall ratings, with the total number dropping by 21, down to 5,277. This was the second consecutive week with a decrease in SELL stocks. At the same time, there was a concurrent increase in HOLD stocks by 21, from 3,018 to 3,039 during the last week.

But don’t get too excited… This minor increase in BUY rated stocks and movement to HOLD from SELL should not be taken as a significant market indication just yet. Yes, it appears positive that the number of SELL rated stocks are down, but in our opinion the movement to HOLD should be taken as an indicator that uncertainty is growing. The stocks are indicating that people are hedging their bets.

There are 9,498 stocks rated by Weiss, and below is their recommendation distribution.

A majority of rated stocks fall under the D rating (SELL), representing 51.5 percent of the entire Weiss Ratings stock universe. BUY stocks represent 12.4 percent, and HOLD stocks 32 percent.

On Friday, Weiss upgraded 419 stocks and downgraded 338.

Future spikes in rating changes are expected, as the political and economic uncertainty continues until at least the president-elect takes office in January.