|

Fear has a way of stopping you in your tracks. I say: DON'T LET IT!

Back in high school, I had a crush on a girl. You know this story — head cheerleader, prom queen and absolutely gorgeous. Obviously, the most popular girl in school.

So, I swallowed my fear and clumsily worked up the courage to ask her out. She said “yes!” That date morphed into teenage love and we were boyfriend-girlfriend for two glorious high school years.

|

That was four decades ago. And while we’re not in touch anymore, that girl taught me that great rewards await those who overcome their fear.

And this applies to investing, too. After all, there are a lot of reasons to be fearful of the stock market.

Yes, we are in the longest bull market in history and the financial media. And Wall Street experts are talking like financial Armageddon is right around the corner.

They are as intimidated by the stock market as I was by the beautiful cheerleader. But think about this ...

- The S&P 500, Dow Jones Industrial Average, and Nasdaq hit all-time highs this week.

- The national average of home prices is at an all-time high.

- The U.S. economy is enjoying the longest economic expansion (126 months) in history.

- The unemployment rate is 3.5%, a 50-year low.

- Our economy has had positive job growth for 111 straight months, the longest in history.

Yet the mainstream media and Wall Street experts think the stock market is dangerously overvalued and headed for a tumble.

Don’t listen to those $#%&@ idiots!

The underlying reasons for all those record highs are a combination of the Plunge Protection Team at the Federal Reserve, the Trump corporate tax cuts, an ongoing stream of corporate stock buybacks, business freedom after Trump’s massive deregulation policy, a tsunami of foreign money flowing into U.S. stocks/bonds, and rising corporate profits.

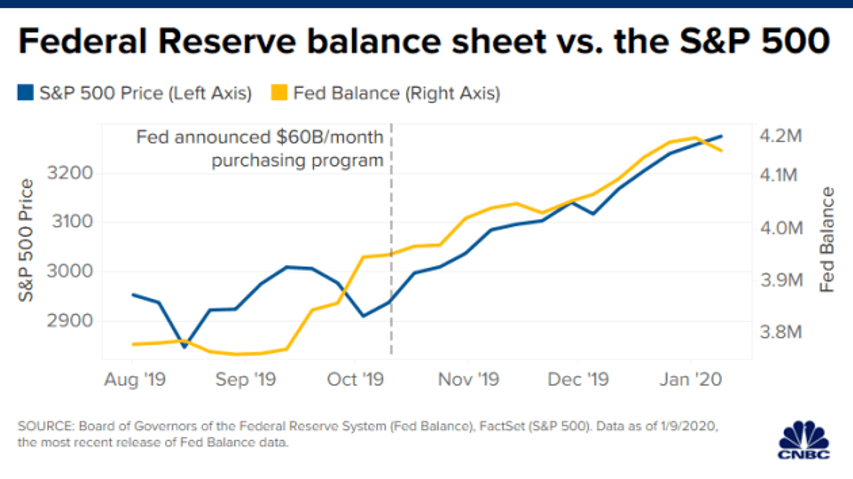

Don’t forget about the Fed’s new bond-buying spree. On Oct. 11, the Fed announced it would begin to purchase $60 billion of Treasury bills a month.

|

That liquidity injection is behind the recent rally. And you simply cannot overlook the VERY direct correlation between the Federal Reserve's balance sheet and the stock market.

That’s $60 billion of monetary steroids being injected in the market every month.

All these economic catalysts didn’t disappear on Jan. 1. All of them are still at work today and, more importantly, will continue to keep our economy and the stock market moving higher.

Don’t be fearful.

Ask the cute cheerleader out, because she just might say "yes."

And don’t give up on this bull market, because it is going to keep going higher.

Best wishes,

Tony Sagami