Student Loan Debt Piling Up; Here’s One Investment That Should Prosper as a Result

|

It’s back-to-school time.

Most kids groan at the loss of their carefree summer days. But my siblings and I couldn’t wait to get back to school.

You see, sitting in class and hanging out with our friends was infinitely more enjoyable than breaking our backs in my father’s farm fields under the hot sun.

And Labor Day was no vacation day on the farm, either.

Grover Cleveland made Labor Day a federal holiday in 1884 as a tribute to American workers who routinely worked 12-hour days and seven-day weeks.

|

But there was no point in trying to tell my father that. He worked those grueling 12-hour (or longer) days and seven-day weeks until his health failed him in his late 80s.

My father truly considered hard work and long hours to be a godly virtue. He thought his sons should do (almost) the same, which is why my brother and I cheered the start of every new school year.

And the greatest cheer of all came when I left our small vegetable farm to attend the University of Washington — because my father couldn’t wake me up at the crack of dawn on Saturday and Sunday mornings.

College wasn’t free, however. But fortunately, the tuition at the University of Washington was only $188 per quarter in the 1970s. Between financial aid and part-time work, I was able to go through college without taking out one penny of student loans.

Tuition is much higher today, though. And millions of Americans are using student loans to finance their education. In fact, student loans are now the second-largest category of household debt in America at $1.4 trillion. They lag behind only mortgages, which are at $9 trillion.

|

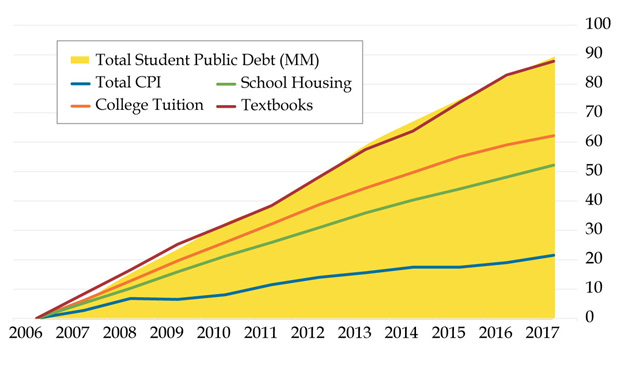

As the above chart shows, the dollar amount of student loans is skyrocketing. A Bloom Economic Research report shows that student loan debt has jumped by 176% in the last decade. Yikes!

A big part of the problem is that college tuition prices have been rising at a ridiculous pace. In the last 10 years, the Consumer Price Index has increased by a modest 21%, but college tuition costs have surged by 51% and the price of textbooks is up 88%.

Today, student loans comprise 10.5% of the total $13.1 trillion of in U.S. household debt. The percentage was only 3.3% in 2003.

Worse yet, a staggering 44.8% of Americans between the ages of 18 and 34 have a student loan with an average payment of $351 a month.

Student loans, along with child support and taxes, cannot be discharged through bankruptcy. So, those payments aren’t going away. In fact, I suspect collecting that mountain of student loans will become a very profitable business.

Debt collectors rank up there with used-car salesmen and IRS agents, but the business of debt collection is very lucrative. There are four publicly traded companies that get the bulk of their revenue from debt collection:

• Asta Funding (ASFI, Rated "D")

• Encore Capital Group (ECPG, Rated "C")

• Performant Financial Corp. (PFMT, Rated "D")

• PRA Group (PRAA, Rated "D")

I’m not saying to rush out and buy any of these stocks first thing Tuesday morning. They currently have only fair to poor Weiss Ratings. But our data refreshes daily and these grades could get upgraded toward BUY territory at any time.

So keep an eye on them if this is a trend you are thinking about getting in on.

As always, timing is everything. But the companies listed above should prosper from financially stressed-out consumers.

Plus, my father won’t put you to work on his farm.

Best wishes,

Tony Sagami