|

I could almost feel the apprehension in his voice: “Dad, I’m really sorry to ask,” he started, “but can you loan me $1,000?”

I’m pretty unforgiving when it comes to irresponsible spending, but one of my four children is really struggling with the financial damage caused by the coronavirus pandemic.

And, unfortunately, I know my son is far from alone.

Millions of Americans are out of work and have been financially devastated by the coronavirus pandemic, based on research by the Chicago-based consumer research company Highland Solutions.

So devastated that — according to Highland Solutions — 47% of us have completely run out of savings and 82% don’t have the money to afford an unexpected $500 emergency expense.

|

| Source: ZeroHedge.com |

Moreover …

- 49% of Americans say their incomes have decreased;

- 63% are now living paycheck to paycheck;

- and 63% have significantly cut back on their spending.

I hate to see anybody struggle ... but, at the same time, if you learn nothing from it — even someone else’s, even some close to you — it’s wasted.

And, if we look at changes in spending habits brought by the pandemic, there are clues that can help us make investment decisions.

Consider this ...

- 64% are spending less on eating out;

- 61% have cut back on entertainment (concerts and movies);

- 55% are buying less apparel;

- and 52% are spending less on travel.

Those are all consumer discretionary items. And, right now, you won’t find a single dine-out restaurant, movie, clothing or travel stock in my personal portfolio.

But, at the same time, people are still spending money. Not everyone has been waylaid and certain businesses are thriving like never before. So, don’t make the mistake of assuming that any exchange-traded fund (ETF) with the words “consumer discretionary” is a bad investment.

In fact, consumer discretionary ETFs have done very well this year.

The reason is that consumer discretionary ETFs are heavily invested in online retailers like Amazon.com, Inc. (Nasdaq: AMZN), red hot home improvement stocks like The Home Depot, Inc. (NYSE: HD) and Lowe’s Companies, Inc. (NYSE: LOW) and the rocket ship called Tesla, Inc. (Nasdaq: TSLA).

Three of the largest consumer discretionary ETFs are up big in 2020:

- Vanguard Consumer Discretionary Index Fund ETF Shares (NYSE: VCR) is up 42.4% year to date;

- Fidelity MSCI Consumer Discretionary Index ETF (NYSE: FDIS) is up 41%;

- and Consumer Discretionary Select Sector SPDR Fund (NYSE: XLY) is up 26.6%.

|

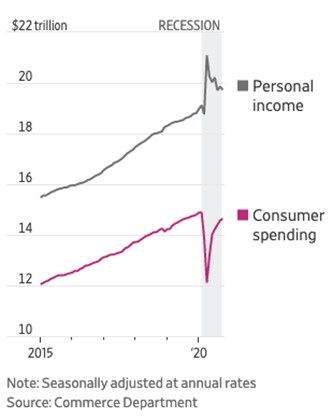

| Source: WSJ |

There’s no question — lots of Americans are cutting back.

But the rest of us who are still working, still making money, still enjoying big increases in the value of our 401(k) plans and still seeing our home values rise are spending enough money to power the profits of the shop-at-home, work-at-home, study-at-home and entertain-at-home industries stocks.

Get this: Consumer spending has gone up for the last six months straight ...

What do all these numbers mean for investors? They mean if you want to make money in 2021, you need to think like a consumer, not an investor.

Where are you spending your money these days?

For me, I’ve done more online shopping in 2020 than I did in the decade-plus before. I’m spending triple or quadruple the amount of time on Zoom Video Communications, Inc. (Nasdaq: ZM) and Microsoft Teams these days and I’m socking away more in my bank and brokerage accounts than ever before.

Where are you not spending money these days?

For me, I haven’t flown on an airplane or stayed in a hotel since March. Other than a pair of flip-flops, I haven’t bought an article of clothing since last Christmas. And I certainly haven’t been to a theater this year.

Case in point: Think like a consumer, not an investor.

In case you were wondering, yes, I did send my son a check for $2,000, which was $1,000 more than he asked for. Not because I’m a softy, but because I expect the jobs market for millennials to take a long time to recover.

Best wishes,

Tony