The Fed Wanted Inflation, and Boy Does it Have it Now! Here's How to Protect Your Wealth from this Toxic Force

You've heard the adage: "Be careful what you wish for because you just might get it." That applies to the Federal Reserve, which has been trying for years to goose inflation to its 2% target rate.

Well, the Fed is beginning to get its wish ... but like most government agencies, it's going to shoot itself in the foot.

How so? Inflation is accelerating to the point that it is going too far … and far exceeding the Fed's 2% inflation target.

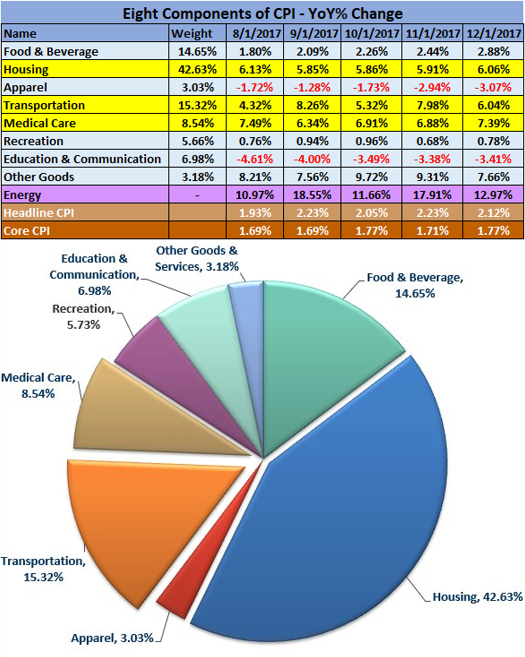

The latest Consumer Price Index numbers came in at the hottest pace in six years — a 2.8% annualized rate.

|

|

Click image for a larger view. |

The increase in the cost of living was spearheaded by increases in gasoline, medical care and shelter — both rent and home prices.

|

|

Click image for a larger view. |

Inflation on the wholesale level — the Producer Price Index — is rising even faster. It hit 3.1% in May. That uncomfortably high increase in wholesale inflation was confirmed by a National Federation of Independent Business survey. The group's members reported that their input prices are at the highest level since 2008.

Moreover, our country is importing inflation from overseas. Import prices are up by 4.3% over the last year. And that number should go even higher as trade wars and retaliatory tariffs kick in.

Rising prices wouldn't be such a big problem if wages were rising at an equal or faster pace. But inflation-adjusted hourly wages are unchanged over the last 12 months.

If prices keep rising like this, and the economy remains strong, the Fed could lift interest rates at least twice more this year.

So, how can you protect yourself — or even position your portfolio to profit — from rising inflation?

Inflation Protection Tool #1: Cash. Cash doesn't pay much. It's boring. And a rise in inflation will gradually erode its value.

|

|

Click image to read article. |

But when you really need it, you'll be glad you have it on hand. Plus, a heathy reserve of cash will protect you when the stock market falls. Think of cash as an option to buy stocks when they get cheap. And a bargain isn't a bargain unless you have the cash to take advantage of it.

Inflation Protection Tool #2: Physical Gold. Gold thrives in many environments, most of which are unfriendly to everything else you own. Think inflation, geopolitical uncertainly, U.S. dollar weakness, or a total collapse of confidence in paper currencies. Plus, nothing beats gold as a reliable storehouse of value.

There are many ways to invest in it, and the person who I think knows more about gold investing than anybody on the planet is Sean Brodrick. His free articles are valuable, mandatory reading.

|

|

Click image to read article. |

Inflation Protection Tool #3: Digital Gold. Digital gold? I'm talking about cryptocurrencies like Bitcoin. Digital gold has several advantages over physical gold, and it should be part of your financial survival kit.

Unlike physical gold, cryptocurrencies are secure, private, can't be confiscated by governments, and can be transported over international borders.

Go to WeissCryptocurrencyRatings.com to access our free library of informative articles from the team behind the world's first cryptocurrency ratings.

Best wishes,

Tony Sagami

P.S. Inflation is a toxic force that threatens to wipe away your wealth. But what's happening in Europe — Italy wanting to leave the euro ... Brexit tensions hitting a fever pitch ... Spain's government collapsing, etc. — can actually provide a big boost to U.S. assets. Find out how in our latest video conference: "The Perfect Storm: Where it Will Strike and How it Will Affect Your Stocks." Click here to watch it now.