We’re writing you today with an urgent message on one the greatest technological disruptions in the history of mankind.

This is no exaggeration.

We see it happening all around us. And most of us have experienced it directly in our own lives.

How could we forget it?

When the pandemic and lockdowns first hit, the economy tanked like never before.

But since late March of 2020, the stock market’s enjoyed one of its sharpest rallies ever.

It begs several urgent questions: What gives? Why this disconnect? What are the dangers? What are the best profit opportunities?

The fact is, it’s not just a disconnect.

It’s also a bifurcation — a split between two entirely different worlds moving though time along two divergent paths — the traditional world of brick and mortar, which remains in crisis, and the modern digital world, which is soaring.

• Where people work online from home …

• Where students rely on distance learning …

• Where shoppers buy nearly everything they need with just a few clicks …

• Where millions attend virtual concerts or conventions from the comfort of their living room or from anywhere on the planet …

• Where we see massive growth in telehealth, tele-consulting and much more.

This megatrend was already in motion over a decade ago, when Jon Markman first alerted his readers to the Great Digital Transformation ahead.

Now, the pandemic’s triggered a veritable Big Bang, injecting great new energy into a batch of new sectors that often seemed little more than pipedreams just two years ago.

As we write, their values are exploding higher — not despite difficult economic times, but because of them.

The best news: This Great Digital Transformation is just getting started.

Unfortunately, some people fear these changes. But the fact is, once you understand them, you can relax, embrace them and turn this situation into a serious profit opportunity.

Weiss Ratings Was Years Ahead of This Trend

Weiss Ratings began rating technology stocks toward the end of 1999, when the Nasdaq was reaching bubble-level peaks.

But while Wall Street firms were unanimously touting them, we issued a landmark report called “Seven Horsemen of the Internet Apocalypse.”

Our ratings showed us what should’ve been obvious to everyone: Internet stock valuations were off the charts.

Their share prices were up in the stratosphere. But their earnings were down under ground. In fact, most of them had no earnings whatsoever — just losses.

Even knowing that, we were shocked with the results of our model: Not a single stock on the Nasdaq got a Weiss “Buy” rating! Almost every one was a “Sell.”

Needless to say, we received a good deal of blowback from the media and the Wall Street crowd — some of which was outright mockery.

Then, just two months later in early 2000, the dot-com bubble burst and our model proved to be right on target … despite what all the “experts” were saying.

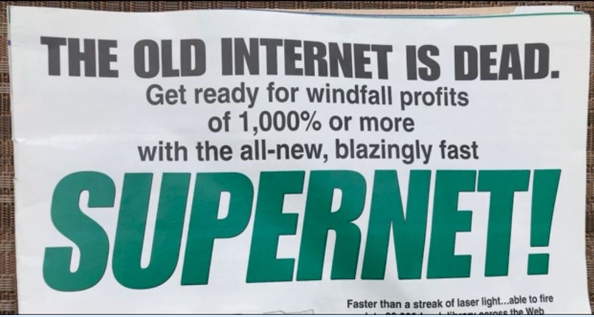

This takes us to the next major report we published, with the bold headline: “The Old Internet Is Dead. Get ready for windfall profits of 1,000% or more with the all-new, blazingly fast SUPERNET.”

This 2003 Weiss report correctly predicted the greatest tech boom of 21st century:

At the time, most investors abandoned tech stocks and most experts said we were promising far too much.

But as it turned out, we greatly understated the true potential. With time, the returns were far larger.

Here’s the key:

• Even while the Internet stocks were crashing and investors were running for the hills, the engineers were still hard at work, making major advances in the speed of the Internet.

In our 2003 report, we predicted:

• Telecom engineers will someday fire gigabytes of data through fiber optic cables.

• “Sophisticated computer software and video games will download in seconds.”

• “Web videophones will give you crisp, full motion video of the people you’re chatting with, instantly.”

Back then, people said it was science fiction. Today, it’s the driver behind some of the greatest profits of our era.

• Now, the questions are: What are the new profit drivers, and which stocks have the best chance of harnessing them?

For our answers — and much more — be sure not to miss upcoming issues of this Daily Briefing.

Best wishes,

Martin and Jon