|

How are you going to spend your Fourth of July weekend? A BBQ with family and friends? Golfing? Boating? Camping? Traveling?

Everybody enjoys a little leisure, but how does 5,000 days of leisure sound?

5,000 days of playing golf, 5,000 days of traveling the world, 5,000 days on relaxing on a beach or 5,000 days playing with your grandchildren.

Sounds great, right? Well, that is roughly how many days you can expect to spend in retirement if you retire at age 65 and reach the average life expectancy of 78.7 years.

|

|

Source: Goodlifehomeloans.com |

The numbers vary by gender; men can expect to live an average of 76 years, while women reach 81 on average.

The challenge is you’ll need a small mountain of money to finance those 5,000 days of leisure. Having fun ain’t cheap!

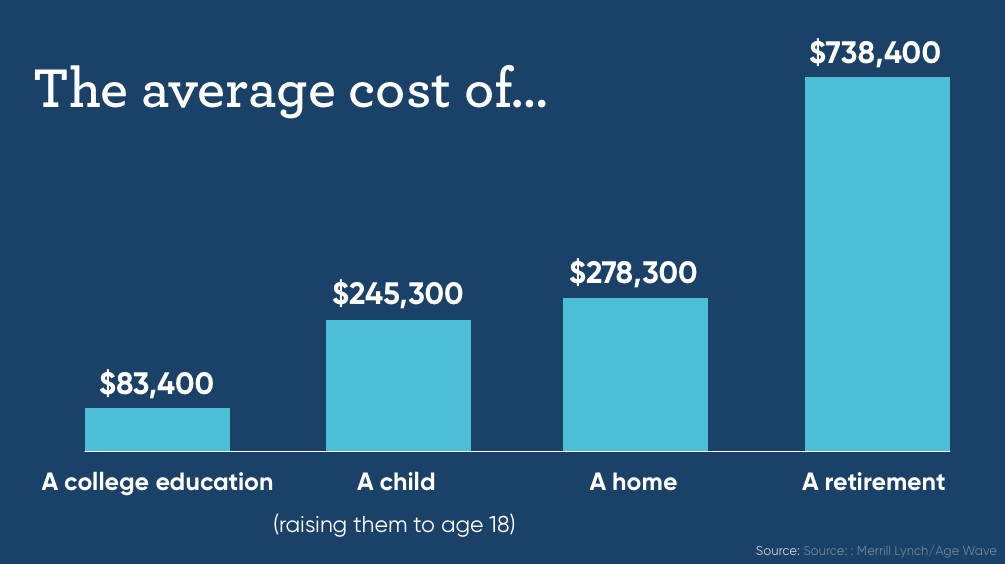

According to the Bureau of Labor Statistics, the average American household spends $49,000 a year during retirement, and a Merrill Lynch study shows that we’ll spend an average of $738,400 during those 5,000 days of leisure.

Those long years of retirement become a problem if you outlive your retirement savings. And too many — if not most — Americans are finding their retirement savings don’t throw off enough income to finance their dream lifestyle because of two reasons: low interest rates and inflation.

I don’t have to tell you about low interest rates. Heck, you’d be lucky to make 1% on your money these days.

Who can live on that?

Moreover, it is important to invest for growth because of inflation. Many of the things that retirees regularly buy — food, prescription drugs, healthcare, travel, real estate taxes, transpiration — keep getting more expensive as the years go by.

Sure, you should invest more conservatively when you retire, but that doesn’t mean that you should completely get out of the stock market. You need to achieve at least some modest growth in your investments.

And you need some growth in your income too. And I’m not talking about the minuscule cost of living increases that you’ll get from Social Security.

I’m talking about the ideal investment vehicle for retirement: dividend-paying stocks.

Unlike a bond whose payout is fixed, dividend payouts have regularly increased and have done so at a pace higher than inflation for the last decade. Many companies have stagnated or cut their dividends entirely in light of the recent economic pressure. But the strong have pushed through, and those dividend-growers are even more impressive now.

Dividends are the Perfect Retirement Asset

Dividend-paying stocks are how you slay inflation and low interest rates. And that is how you successfully finance 5,000 days of retirement leisure.

If you’re more of an ETF investor, there are several dividend-focused ETFs to consider, such as Vanguard Dividend Appreciation (NYSE: VIG, Rated “C”), Schwab U.S. Equity Dividend (NYSE: SCHD, Rated “C”) and ALPS Sector Dividend Dogs (NYSE:SDOG, Rated “D”).

|

However, I think you can do much better with a carefully selected portfolio of individual dividend-paying stocks, which are exactly the type of stocks that Mike Larson recommends in his Safe Money Report.

You don’t have to be a gray-haired senior citizen to profit from this dividend strategy either. In fact, the best time to accumulate an armada of dividend-paying stocks is when you’re in your 40s and 50s.

This way, you can slide into retirement with a ready-made portfolio of retirement freedom assets.

Best wishes,

Tony Sagami