The Immediate Future of All Things Technology Related

I don’t have to convince you that technology is the future.

That’s 100% clear by now. And if it wasn’t before, Coronavirus has certainly made it apparent.

I spend a lot of time these days looking into the technology space, but today, I wanted to look at companies that are involved in the backbone of all of these future technologies.

Right now, there is a race to be the first country to have 5G integration. And inside of that is the race to be the first company to have the infrastructure, software and hardware that more people are reaching for.

Why is this so important?

I had to actually think long and hard about life before 4G. It has been ten years since its launch. And as of 2018, you probably couldn’t find anyone that would activate your 3G phone. I hadn’t really thought about the changes to technology that 4G made possible.

It was truly a monumental leap in terms of network capabilities. It allowed for the speed at network capacity we’ve all become accustomed to — the speed that lets us share video content and order food directly to our door through an app.

And 5G is going to pave the way for much greater technologies due to its increased speed and reduced latency.

Speed is the amount of time it takes for a device to download contents, while latency is the time between which you send a piece of data and the other device acknowledges its receipt. In practical terms, speed is the amount of time to load a website. And latency is the time between when you send a text and your friend’s phone receives it.

5G will make latency almost zero. That’s instantaneous transfer.

That’s the kind of backbone that we need when talking about “futuristic” developments like smart cities, self-driving cars, automated factories and even remote medicine including surgery. None of these can be done safely with the latency issues of 4G.

It will be a trend worth watching. The kicker is 5G will need an entirely new infrastructure than 4G. So, the real winners we’re looking for are the companies that are profiting from building the infrastructure.

So, let’s see what companies the Weiss Ratings System is identifying as a “buy” right now.

Our top-rated 5G company is Ciena Corporation (NYSE: CIEN, Rated “B”). The company specializes in networking systems, services and software. It is a provider of 5G optimized routing platforms.

The company continues to add new products aimed at reducing the network complexity for the migration from 4G to 5G, which we’ve already mentioned above, will probably take the next few years. Having the right hardware and software to do the job is the first hurdle.

Ciena has the goal to help its customers simplify, optimize and accelerate 5G network buildouts so they can cash in on the future of intelligent automation.

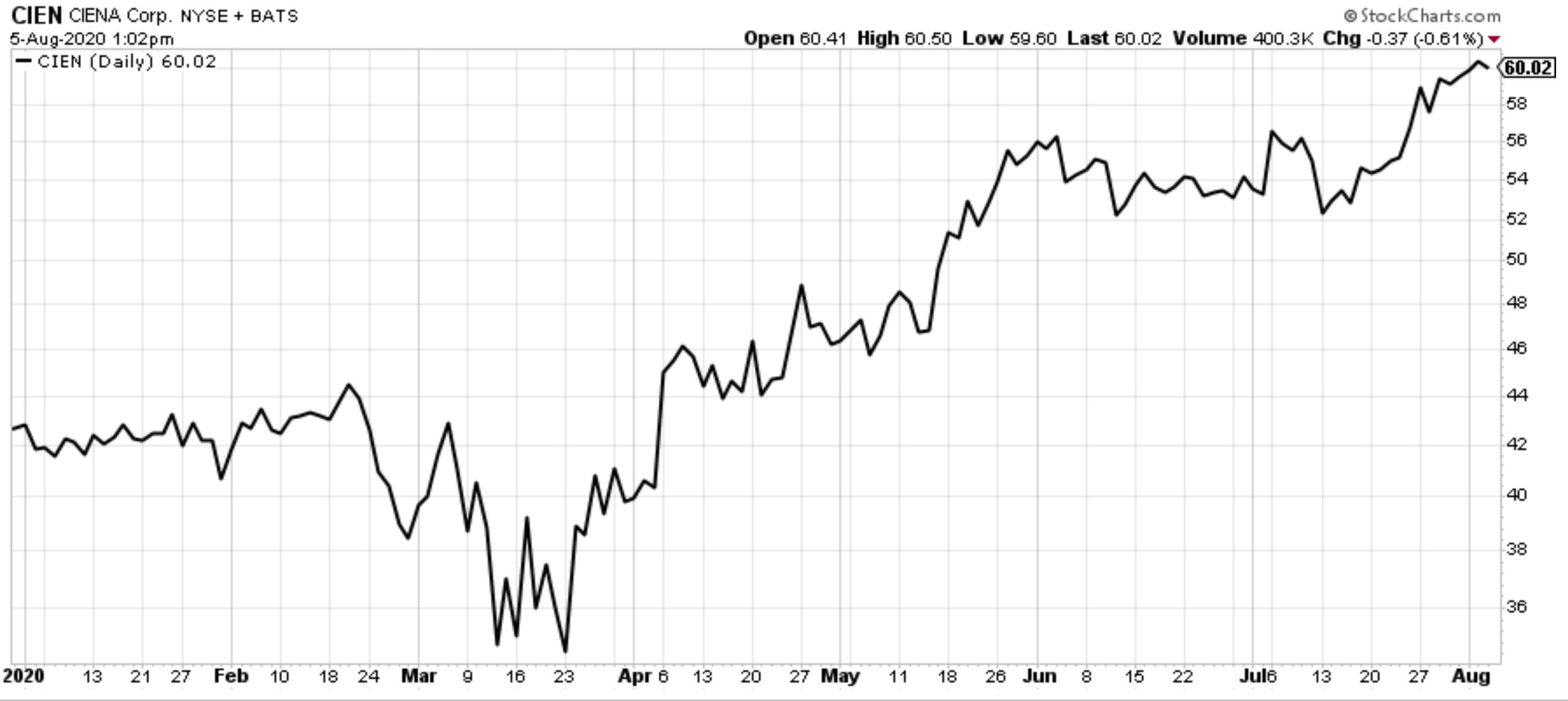

It’s turning that demand into cash of its own. Annual revenue growth for 2019 was 15% and EPS growth was over 50%. And, investors are noticing, just take a look at share prices so far this year.

|

Shares are up 40% in that past eight months, and we’re only in the second inning of 5G adoption.

Who else made the list?

Our first runner up is T-Mobile (Nasdaq: TMUS, Rated “B”). T-Mobile provides wireless service under the Metro, Sprint and T-Mobile brands. On Tuesday, the company said that it officially activated “the world’s first standalone 5G network”. It had previously been tied to the 4G LTE coverage which limited its capacity. This transition brings 5G to an additional 2,000 cities and small towns. It also improved latency by 40%.

Rounding out the top three is Apple (Nasdaq: AAPL, Rated “B”). We all know an Apple brand loyalist who will gladly replace all their existing devices with the 5G equivalent. However, if you’ve been following the most recent press releases, you’ll see that Apple confirmed a delay of its 5G devices due to supply chain issues.

This is just the beginning of the 5G race that we’re going to see over the next few years. We’ll see 5G touch every aspect of technology that you can think of … plus some that haven’t even been thought of yet.

The analysts at Weiss are always keeping an eye out for the next best technology stocks. That’s why we recently released our FUTURE SHOCK 2020 video summit. In it, our founder Dr. Martin Weiss reveals the portfolio strategy that could have earned you an average total return of 159% PER YEAR for over a decade — a period which includes the Great Recession and the COVID-19 crisis.

If you haven’t seen it yet, you should check it out now. It won’t be available much longer.

Best wishes,

Kelly Green