The ‘Nightmare Scenario’ — and What It Means for YOU

|

The “Nightmare Scenario.” That’s what I call it.

It’s keeping Federal Reserve Chair Jay Powell and his cohorts awake at night.

And its risks are something YOU should understand. That way, you won’t miss a moment of shut-eye in case it starts to unfold.

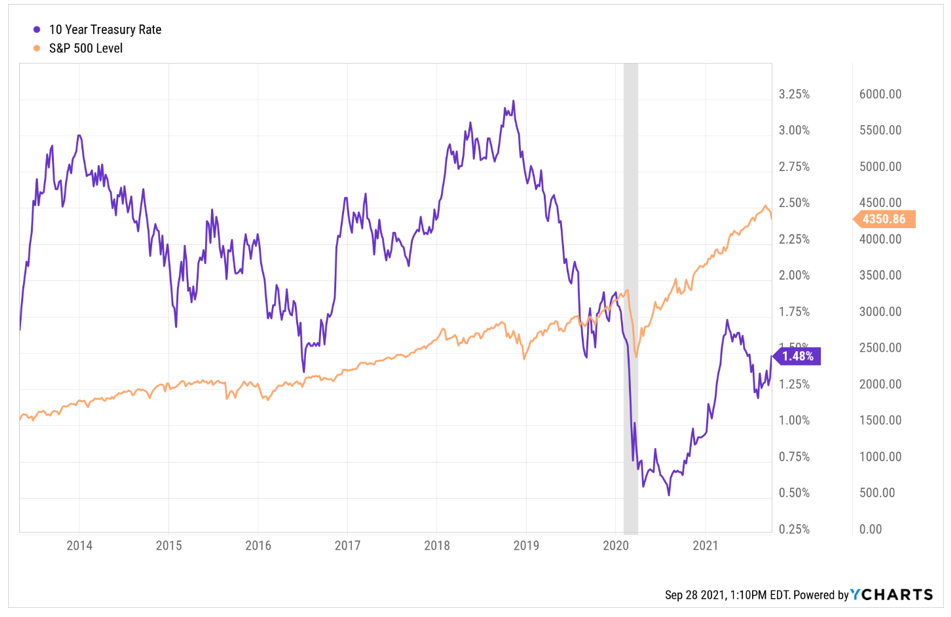

There’s no reason to keep you in suspense any longer. I’m talking about a runaway resurgence in INTEREST RATES ... and an associated “Taper Tantrum” that could make 2013’s chaos look tame by comparison.

Cheap Money Comes With a Hefty Price Tag

What’s the one thing Wall Street has grown more accustomed to than anything else? Cheap money.

The Fed has been all too willing to provide it …

|

It slashed rates back to near 0% during the depths of the COVID-19 crisis. It started buying bonds hand over fist. And it bailed out or backstopped virtually every corner of the credit markets.

The Fed has also tried to be clear, concise and constant when it comes to communication. It has gone out of its way to put its cards fully on the table for everyone to see.

• That’s because it wants to avoid what happened in 2013 at all costs.

If you need a refresher about that mess, the Fed was buying $85 billion in bonds per month that year. Its balance sheet totaled just over $3 trillion.

Then, former Fed Chair Ben Bernanke appeared before Congress in May.

At the hearing, he hinted that the Fed would soon consider tapering — or dialing back — the amount of purchases it was making in the bond markets.

You Can Guess What Happened Next

The news came as a big surprise back then ... and if there’s one thing investors don’t like, it’s surprises.

Interest rates jumped.

Stocks tanked.

The Fed panicked.

The beginning of the tapering process got pushed off all the way until December — and it ended up being done at a very gradual pace.

Now, think about where things stand today.

• The Fed isn’t just buying $85 billion per month in bonds. It’s buying $120 billion.

• Its balance sheet isn’t $3 trillion. It’s $8.5 trillion.

• The S&P 500 isn’t trading around 1,650 like it was back then. It’s trading around 4,400.

• It isn’t trading for 18.3 times earnings like it was back then. It’s trading for more than 34 times earnings.

The stock and bond markets weren’t the only beneficiaries of cheap money.

House prices were just starting to rise after the worst market collapse in modern U.S. history in 2013. Today, thanks in part to the explosion of cheap money, they’re surging almost 20% year over year.

That’s the fastest appreciation rate ever ... even greater than we saw at the peak of the housing bubble!

See where this is going?

Here We Go Again … and the Stakes Are Higher This Time

The Fed is trying to take the first tentative steps toward unwinding its multibillion-dollar bond-buying programs again.

It’s trying to dial back its cheap money drip. But it’s doing so at a time when the stakes are much higher … assets are much more inflated … and Wall Street is even more addicted to its financial sugar rush.

• This is where the “Nightmare Scenario” comes in.

Interest rates are starting to move. The yield on the benchmark 10-year Treasury note just shot up 25 basis points to 1.55% in a few days. The five-year note yield just hit 1.03%, its highest since February 2020.

These are NOT high levels by historical standards. Not even close. But asset prices are also much more richly valued today than in the past. Debt levels are much higher as well.

• In other words, IF this interest-rate move starts to accelerate, then the Fed could have a real problem on its hands.

Powell & Co. could end up with an ugly tantrum on their hands, despite their best efforts to avoid one.

So, what do I recommend investors do?

Well, I’ve been paring back some market exposure in my Safe Money Report. Be sure to take those specific actions if you’re a subscriber.

If you’re not? You can join by clicking here. Or if you’re not ready to take that step, consider some of the more general steps I talked about last week.

No matter what kind of market we are in, you need investments that offer a high degree of safety — along with some hedges and plenty of cash on hand — to help you sleep well at night.

With the chance of a Nightmare Scenario hovering in the background, the time to make sure you don’t lose sleep later is to make sure your nest egg is protected much, much sooner.

Until next time,

Mike Larson