|

|

“Do you know the only thing that gives me pleasure? It's to see my dividends coming in.” — John D. Rockefeller |

If John David Rockefeller Sr. were alive today, he’d be dancing all the way to the bank.

Even though he died in 1937, he is still considered to be the wealthiest American who ever lived.

Rockefeller built an energy empire, the Standard Oil Company and Trust. But his share of the profits was just one part of the multibillion-dollar fortune he left to his family.

And his family is still among the world’s wealthiest because of another key ingredient to growing that fortune: investments that pay dividends.

Most of the rest of us aren’t going to go out and become oil magnates. But we can use that key ingredient in a “Rockefeller recipe” to build our own wealth … starting today.

• That’s because American companies are increasing their dividends like mad.

When I got my start in investing, dividend-paying companies used to mail checks to their shareholders. What a pleasant surprise it was to find a fat dividend check in your mailbox!

Technology’s made dividend checks obsolete … they’re now instantly credited to your brokerage account. And that automation makes it easy to overlook dividends, which is a shame because they’re a very important part of the stock market’s total return.

|

In 2020, the S&P 500 was up 15.7% … but including dividends, the total return increased to 17.8%.

• Higher returns aren’t the only benefit of dividend-paying stocks: They also deliver significant downside protection during bear markets.

For example, in 2008, the S&P 500 dropped by 37%. But the S&P 500 Dividend Aristocrats — an index of large companies that had raised their dividends every year for the past 25 years — only lost 22%.

In fact, dividend-paying stocks have outperformed the overall stock in both good times and bad … a hard-to-beat combination of all-weather performance.

That’s especially true today with the stock market at dizzying valuations and runaway government spending and borrowing. Lots of my very smart money manager friends expect the stock market to run into an overvalued wall eventually.

|

So far this year, 46% of the companies of the S&P 500 have increased their dividend payout. Those 228 companies that raised their dividends are up by an average of 20.8%, slightly better than the S&P 500.

And some of those are quite large.

Eight companies in the S&P 500 have dividend yields in excess of 4.5%, like Altria Group (NYSE: MO), Kinder Morgan (NYSE: KMI) and Williams Companies (NYSE: WMB), all of which just announced increases to their dividend payouts.

Collectively, dividend payments in the second quarter increased by 26% from the same period last year to $471.7 billion.

That’s a lot of money … but did you know that dividends get special tax treatment, too?

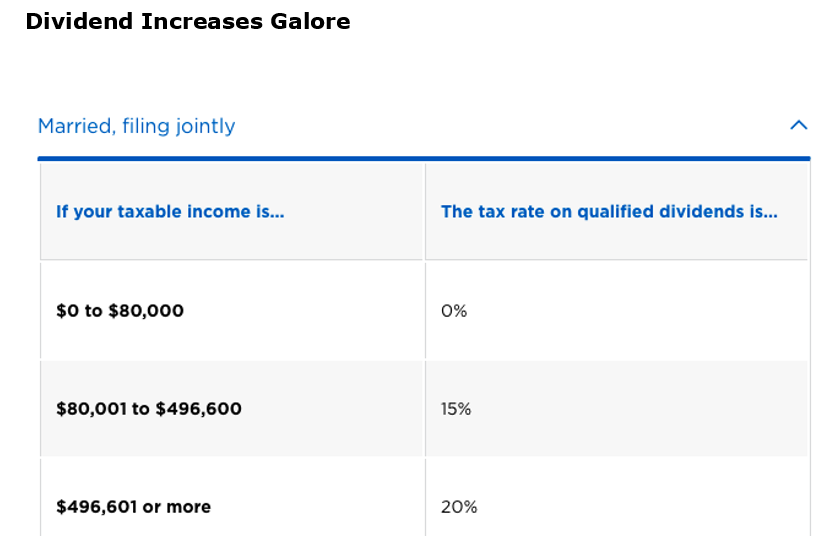

The tax rate on qualified dividends is 0%, 15% or 20%, depending on your taxable income and filing status. For married, filing jointly with taxable incomes less than $80,000 … the tax rate on dividend income is zero.

ZERO!

Taxable income is basically your gross income MINUS 401k contributions and itemized deductions like mortgage interest and charitable contributions.

I don’t know about you, but a ZERO tax rate sounds great to me!

If you’re looking for ways to reduce your risk and portfolio volatility, I highly recommend you give a long, serious look at dividend-paying stocks. It’s safe money …

And one of the best in the business at “Safe Money” investing is Mike Larson.

His goal is to build lasting wealth in a prudent, steady-minded fashion by investing in dividend-paying stocks.

For more information, I highly recommend you click here now. I think you’ll be very impressed with his results.

Best wishes,

Tony Sagami