|

If you’re skeptical about the staying power of the stock market rally, you have lots of company. And by company, I’m specifically talking about the people running the largest companies in the world.

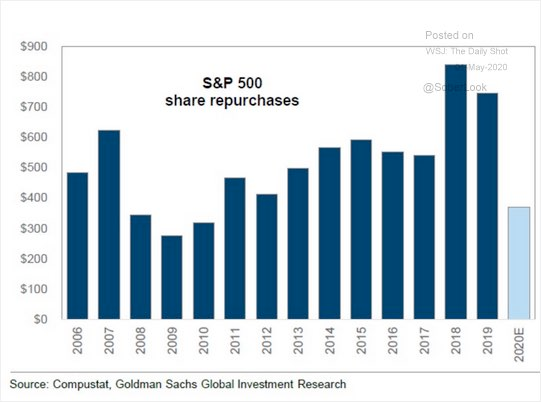

In the second quarter of this fiscal year, the 500 companies that make up the S&P 500 reduced their stock buybacks by 50%. Overall, they’ll buy back the smallest amount in eight years.

|

That’s important because prior to this year, buybacks had been one of the most powerful forces creating the longest bull market in stock market history.

Companies have been wisely preserving capital in the face of the coronavirus pandemic, which has caused revenues and profits to fall like a rock. 90% of the S&P 500 have so far reported their Q2 results, and profits have shrunk by 53% on a year-over-year basis. Ouch!

A small handful of tech companies, however, don’t seem the least bit phased by the coronavirus and continue to buy their stock back in droves.

|

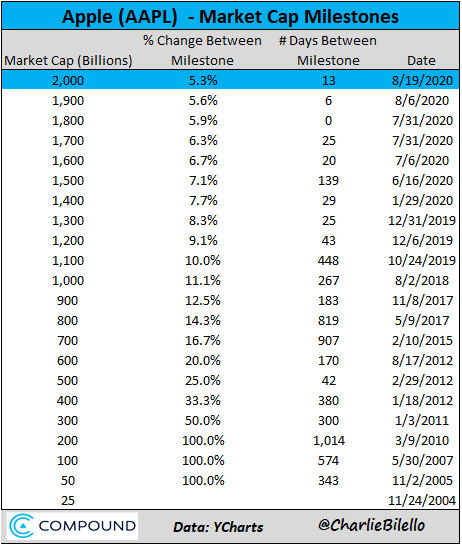

The poster boy of buybacks has been Apple (Nasdaq: AAPL, Rated “B”). Its stock just hit $2 trillion in market value last week.

If you own Apple … congratulations! You’ve made a bundle this year on it.

However, over the past five years, Apple’s revenues have grown just 17%, and net income (actual profits) has increased by a measly 3.5% total. That breaks down to a pathetic 0.9% a year.

How can profits be up by only 3.5% but earnings per share be up by 29%? It’s obvious: stock buybacks.

From 2015 through fiscal 2019, Apple spent $237 billion to buy back 249-million shares and reduced the outstanding number of shares by 20%.

In other words, Apple's earnings-per-share growth has been driven by share buy backs. By comparison, Apple has generated $262.8 billion in profits over the last five years and has spent almost all of its — $237 billion — on stock buybacks.

|

| SOURCE: Seekingalpha.com |

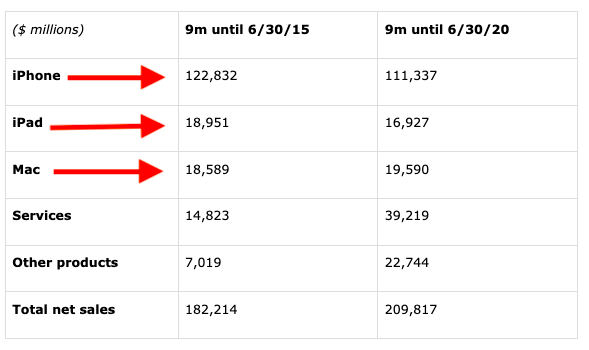

Worse still, Apple has only spent $60 billion on research and development in the last five years. No wonder Apple has failed to come up with any new, revolutionary profits, like the iPhone and iPad.

That’s a problem when your flagship products are showing flat or even negative sales growth in the last five years. As the above table shows, revenues from Mac computers are fractionally higher than five years ago, while iPhone and iPad sales are actually down!

I’m not recommending that Apple should be sold tomorrow morning, but I am suggesting that you should have a clear strategy to protect your gains.

When the market turns, my prediction is that some of the hardest hit companies will be the ones that have failed to organically grow their business and used accounting tricks to make themselves look more prosperous than they really are.

And Apple does that better than anybody else.

Best wishes,

Tony Sagami