|

Last Friday, the yield on the three-month Treasury bill was higher than the yield for 10-year Treasury.

That may not sound like an earth-shattering development. But we haven’t seen this kind of “inverted yield curve” signal since 2007 — just ahead of the last recession and bear market. So, a tidal wave of stock market boo-birds warned that this means another bear market is right around the corner.

But should YOU worry?

Well, let’s get the basics out of the way first: An inverted yield curve is when the yield on short-term bonds is higher than the yield on long-term bonds with the same credit quality.

Upward-sloping yield curves are what you usually see, especially when the economy is growing. Meanwhile, downward-sloping yield curves are relatively uncommon — and we typically see them ahead of economic contractions.

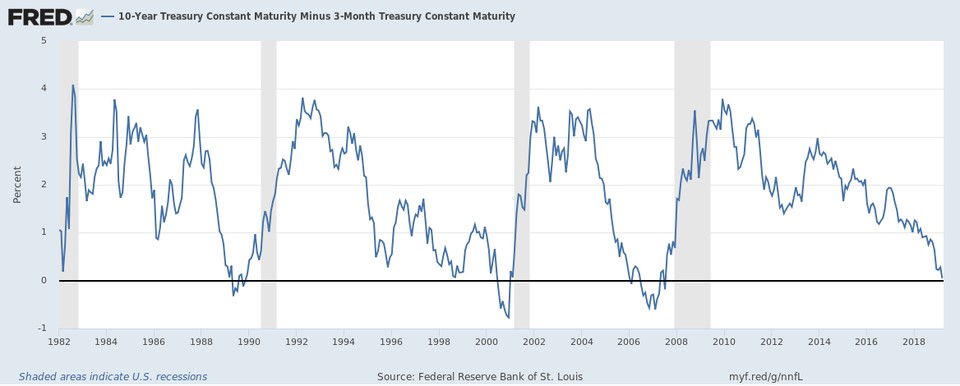

This chart here shows the history of the 3-month/10-year Treasury curve going back to the early 1980s. You can see it only slipped into inverted territory three times — all of which preceded recessions (shown by gray bars on the chart).

|

That said ...

Recessions are not the same as bear markets. Sure, recessions are usually accompanied by bear markets ... but inverted yield curves don't tell you how far in the future those could be.

Bear markets sometimes follow the initial inversions within a few months. But the last recession was in the 2008-'09 financial crisis, and the yield curve inverted almost two full years before the start of it.

In general, recessions typically occur six to 18 months after an inverted yield curve. This suggests we won't see a recession until late 2019, or even 2020.

Plus, a few days of inversion is not as reliable a recession signal as a long-term inversion.

Campbell Harvey of Duke University extensively studied inverted yield curves, and he concluded the inversion needs to last longer than 90 days to provide a solid signal.

Inversions shorter than 90 days merely indicate an economic slowdown, which is a far cry from economic contraction (recession).

The key thing to remember is that inverted yield curves don't cause recessions. Instead, they reflect recessionary conditions.

In fact, I urge you to remember that our economy has enjoyed a rare, dual period of economic prosperity: (1) GDP growth in excess of 2% and (2) 100,000 a month of new job creation.

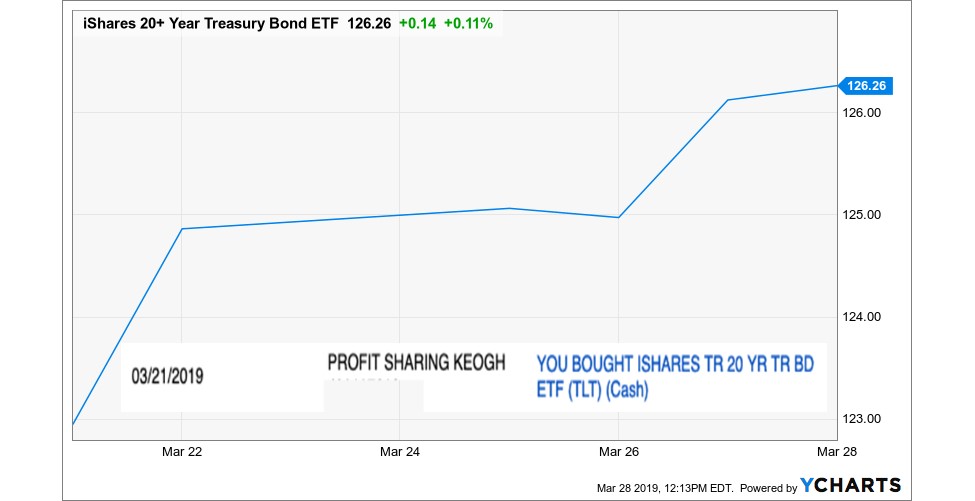

And just as important, there are a LOT of ways to make money than with stocks. Here is a screenshot of a trade confirmation from my retirement account.

|

As you can see, I bought iShares 20+ Year Treasury Bond ETF (TLT) on March 21, the day after the Federal Reserve announced that it won't raise interest rates until 2020, if then.

The next day, TLT jumped by $1.91, or 1.5%. That was the day the Dow Jones Industrial Average lost 460 points, or 1.8%.

Pretty good trade, eh?

That doesn't mean I escaped unscathed last Friday. As I mentioned in my March 15 column — "Inflation is coming. Is your portfolio prepared for it?" — my retirement account is 50% invested in the stock market. Every stock I own dropped in value last Friday.

However, my very large TLT position cushioned those equity losses and ended the day with a mosquito-bite-sized loss of less than two-tenths of 1%.

Bottom line: The fresh inverted yield curve doesn't scare me, and I'm holding on to my stocks. You should too. And be sure to check out my colleague Sean Brodrick's timely take on "The Upside of Falling Bond Yields" for more ideas and strategies.

Best wishes,

Tony Sagami