|

I was eight or nine years old and had worked all summer on the family farm. My father paid me $20, which seemed like a fortune at the time.

“Don’t be stupid; put that money in the bank for your college,” my father said.

College? What I really wanted was a new bicycle, but I never got a chance to spend a penny of that money. My mother drove me to the local bank and introduced me to an impressive man in a dark suit. The bank manager (who looked like Mr. Drysdale of “The Beverly Hillbillies”) shook my hand, sat me down and helped me open a savings account.

In exchange for my hard earned $20, I got a flimsy book. At the time, it felt like I got robbed.

Once or twice a year thereafter, usually after birthdays or Christmas, my mother would take me to the bank to make another modest deposit. But those modest deposits started to add up, helped by the 5.25% interest payments.

Soon, the hand written notations in my bank book showed a growing stash of cash. By the time I was 16 years old, I had saved over $200. A fortune for kid on a farm!

But then I did something that really disappointed my parents. I withdrew all my savings and bought a car — a 1960 Chevrolet Biscayne. Poof! My college money was gone!

Today, banks don’t want pesky kid accounts anymore, and they certainly don’t pay any interest on tiny accounts. Banks are more in the habit of charging fees than paying out interest.

In fact, banks are starting to charge interest on savings. It’s outrageous. Instead of getting paid zero interest, you have to pay the banks for privilege of doing business with them.

|

The latest example is Starling Bank of Great Britain, which became the first British bank to charge negative interest rates for personal savings accounts. Starling Bank is now charging a monthly rate of negative 0.5% on individuals with a balance of more than €50,000.

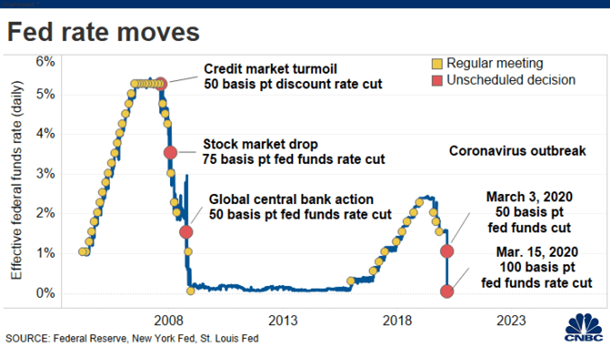

Great Britain isn’t the only country where this is happening. Sweden, Switzerland, Japan and the 19 other nations of the eurozone all have negative interest rates.

I haven’t heard of any U.S. banks charging negative interest rates yet, but thousands of banks levy service charges or some type of account maintenance fee that accomplish the same thing as negative interest rates.

Consumers facing negative interest rates or account fees may decide to take the money out of the financial system altogether. Why use a bank if it is cheaper to stuff your money under your mattress or stash it in a safe/vault.

What should you own? Assets that central governments can’t manipulate, such as paper currency and sovereign (government) bonds.

I expect that real assets — gold, silver, real estate and commodities — will be the biggest winners.

And some cryptocurrencies, which are not governed by any central authority or government. That means …

1. The government has no control over cryptocurrencies.

2. Your transactions are private.

3. There are no bank or government fees.

I’m not a cryptocurrency expert, but Juan Villaverde is, and his free weekly column is a must read.

Go to www.weisscrypto.com to see his top recommended cryptocurrencies.

The friendly bankers of yesteryear are long gone. They’ve been replaced by the modern greedy version of Mr. Drysdale. Stay sharp, and make sure your investments are working for you.

Best wishes,

Tony Sagami