|

When I was a 30-year-old newbie retail stockbroker at Merrill Lynch, I thought I knew everything. You couldn’t tell me anything. But looking back, the only thing I really knew was the sales jargon I was taught, which enabled me to talk hundreds of investors into opening an investment account with me.

It didn’t take long for me to find out how little I really knew. On Oct. 19, 1987, aka Black Monday, the Dow Jones Industrial Average plunged 22% in a single day and all my customers got clobbered.

Fortunately, a grizzled old veteran took me under his wing. He told me that if I truly wanted to help my clients make money, I needed to absorb every word of “The Weekly Market Call Put On” by Bob Farrell, the Chief Market Strategist at Merrill Lynch and one of the best investment minds on the planet.

|

| Source: advisoranalyst.com |

Bob Farrell spent 45 years at Merrill Lynch and was so brilliant, so skillful and so right that Institutional Investormagazine ranked him the no. 1 market timer in the country for 16 of the last 17 years of his career. He was also a frequent guest on Bloomberg’s “Wall Street Week” with Louis Rukeyser and was voted into the “Wall Street Week” Hall of Fame.

I treated his weekly market calls like sermons from Moses and he became the most important influence on my investment life. I have reread his “10 Investment Rules” hundreds of times since 1987.

So, with all the turmoil and uncertainty going on in America, I feel like this is a perfect time to share Farrell’s Ten Investing Rules because they can benefit all investors.

Rule 1. Markets tend to return to the mean over time. When stocks go too far in one direction, they revert back to the mean. Euphoria and pessimism can cloud people’s heads. It’s easy to get caught up in the heat of the moment and lose perspective.

Rule 2. Excesses in one direction will lead to an opposite excess in the other direction. Think of the market baseline as attached to a rubber string. Any action too far in one direction not only brings you back to the baseline but leads to an overshoot in the opposite direction.

Rule 3. There are no new eras; excesses are never permanent. Whatever the latest hot sector is, it eventually overheats, reverts to the mean and then overshoots. As the fever builds, a chorus of "this time it’s different” rises, but of course it never is different.

Rule 4. Exponentially rapid rising or falling markets usually go further than you think, but they do not correct by going sideways. Regardless of how hot a sector is, don’t expect a plateau to work off the excesses. Profits are locked in by selling, and that invariably leads to a significant correction. If you own a bunch of tech stocks … don’t get too complacent.

Rule 5. The public buys the most at the top and the least at the bottom. Retail investors, many with zero investment experience (like the Robin Hood crowd), have been jumping into the stock market with both feet. Caution, not euphoria, are in order today.

Rule 6. Fear and greed are stronger than long-term resolve. Investors can be their own worst enemy, particularly when emotions take hold.

Rule 7. Bear markets have three stages — sharp down, reflexive rebound and a drawn-out fundamental downtrend. The short-lived bear market earlier this year and the accompanying rebound suggests that we’re about to enter the third, most painful phase of bear market.

Rule 8. When all the experts and forecasts agree — something else is going to happen. If everybody’s optimistic, who is left to buy? If everybody’s pessimistic, who’s left to sell? Going against the herd, as Farrell repeatedly suggested, can be very profitable.

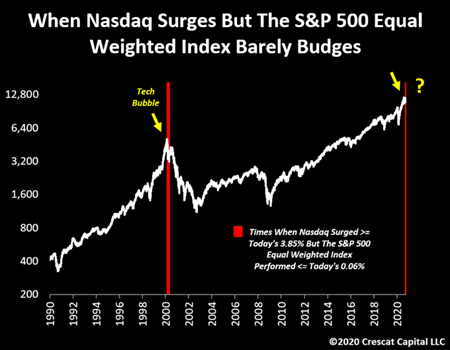

Rule 9. Markets are strongest when they are broad and weakest when they narrow to a handful of blue-chip names. This is especially timely today. The stock market gains have been concentrated in a small handful of tech (FAANG) stocks. Farrell warned that when momentum channels into a small number of stocks … trouble is brewing.

|

Take a look at the equal weighted S&P 500 — it has gone nowhere this year. In fact, last week was the third time in history that the Nasdaq jumped by more than 2% while the S&P 500 equal weighted index was unchanged. The other two times were in April 2000 ... right at the peak of the dot-com bubble.

In other words, don’t let yourself become too bullish.

Rule 10. Bull markets are more fun than bear markets. Of course, but keep your wits about you.

Use these 10 rules to help you learn how to invest, and the Weiss Ratings to help guide what to invest in.

Best,

Tony Sagami