The Trump Tax Cuts Aren’t Just a Giveaway to the Rich; Here’s Why ...

I’m lucky because I have one of the sweetest sisters in the entire world. But our political views are so different that I sometimes wonder if we were raised by the same vegetable-farmer parents.

Here are our differences in a nutshell: My sister voted for Hillary Clinton while I voted for Donald Trump. I will say, however, that Trump was not my first choice out of the 17 Republicans who ran for president in 2016. In fact, there were six candidates that I greatly preferred.

The most recent debate I had with my sister was over the Trump tax cuts. My sister objected to the tax cuts because it “only benefited the rich.”

|

|

Click image for the full article. |

A lot of Americans feel the same way. A CNN poll showed that two-thirds of Americans believe that the Trump tax cuts benefit the wealthy more than the middle class.

My sister, by the way, is a very successful occupational therapist who is married to a Boeing engineer. So, their combined income certainly puts them in the top 5% of all households in the U.S.

|

|

Click image for a larger view. |

But as brilliant as my sister is, I think she watches too much CNN and MSNBC. I say that because the Trump tax cuts are going to result in the wealthy paying an even higher portion of income taxes.

Yeah, you heard me.

The Trump tax cuts are going to make our income tax structure even more progressive. Which is exactly the opposite of what the mainstream media wants you to believe.

First of all, high income Americans in high-tax states are going to pay a lot more.

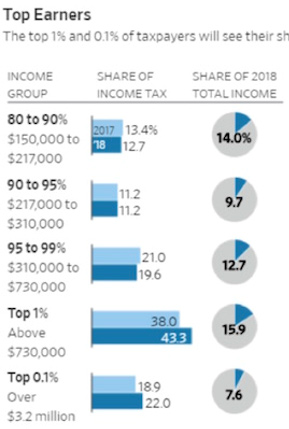

A Wall Street Journal study, authored by Laura Saunders, reported that the wealthy will pay an even higher marginal tax rate than before. The top 1% go from paying 38% of total income taxes to a little over 43%. According to the WSJ:

The results show how steeply progressive the U.S. income tax remains. For 2018, households in the top 20% will have income of about $150,000 or more and 52% of total income, about the same as in 2017. But they will pay about 87% of income taxes, up from about 84% last year.

By contrast, the lower 60% of households, who have income up to about $86,000, receive about 27% of income. As a group, this tier will pay no net federal income tax in 2018 vs. 2% of it last year.

After the income tax, the most important revenue raisers are for social insurance, such as Social Security and Medicare. They will provide about 34% of the total tax take this year, according to the Joint Committee on Taxation. Corporate taxes will account for 7% of revenue, down from 9% in 2017. The rest of the total comes from excise taxes, estate and gift taxes, and other sources such as customs duties.

Roughly one million households in the top 1% will pay for 43% of income tax, up from 38% in 2017. These filers earn above about $730,000.

According to Roberton Williams, an income-tax specialist with the Tax Policy Center, the share of taxes paid by the top 5% will rise despite the fact that people in it were the largest beneficiaries of the overhaul’s tax cut, both in dollars and percentages.

Why are income taxes negative for the 77 million households in the bottom two tiers, which earn 13% of income? In recent decades Congress has chosen to funnel benefits for lower earners through the income tax rather than other channels such as federal programs. Some of these, such as the earned-income tax credit for the low-income workers, make cash payments to filers who don’t owe income tax.

The tax overhaul further lowered the share of income tax for people in these tiers, in part because it nearly doubled the standard deduction and expanded the tax credit for children under the age of 17.

The mistake that my sister and the Destroy Trump media is making is that they are looking only at the reduction in marginal tax rates and overlooking the sharp reduction in deductions.

Disappearing Deductions

You see, Congress didn’t just chop tax rates. In order to offset the lower tax rates, Congress eliminated some large, popular tax deductions. For example:

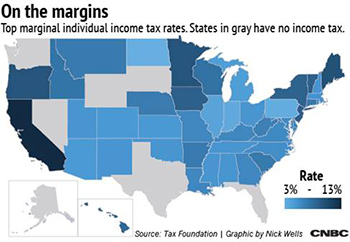

Limits on State/Local Tax Deductions: If you live in a high-tax state like Montana, where I do, you will only be able to deduct up to $10,000 of state/local taxes against your federal tax bill. There are just six states that don’t have an income tax, so this means millions of Americans — especially in blue states — just lost one of their biggest deductions.

|

|

Click image for a larger view. |

Note: That $10,000 cap also includes property tax as well as state income tax.

Mortgage Interest Caps: Homeowners can only deduct the mortgage interest on the first $750,000 of their loans. Given the skyrocketing home values that many areas have experienced, this cap is going to affect a lot of people — especially the wealthy with massive homes and mortgages to match.

Personal Disaster Losses: I don’t get this one. You may no longer deduct personal disaster losses in excess of 10% of your Adjusted Gross Income — and only if the area in which you live is official declared a national disaster, like with Hurricane Harvey. If your home is destroyed in a flood or fire not associated with a national disaster, you are not allowed to deduct your loss. Talk about adding insult to injury!

Divorce and Alimony. I know from personal experience that getting divorced isn’t cheap. Prior to the Trump tax cuts, alimony was a deductible expense for the spouse making the payments — and was included as income to the recipient.

Now, however, alimony payments are no longer deductible for the payor, nor are the payments considered taxable income for the recipient. Instead, the recipient must pay taxes at the rate paid by the person paying the alimony, no matter what the recipient’s actual income is.

Those are the biggest changes that affect the rich. But there are many smaller things that are no longer deductible, such as business entertainment, job relocation expenses and tax preparation fees.

There was one major benefit for the rich: The lifetime estate tax exemption doubled to $11.2 million for individuals and $22 million for married couples.

In short, don’t drink the same mass media Kool-Aid as my dear sister. The Trump tax cuts are NOT the boondoggle for the wealthy that you have been led to believe.

Best wishes,

Tony Sagami