The U.S. is dominating global markets – putting you in the catbird seat!

I’m sure you’ve heard the idiom about walking a mile in someone else's shoes. That same saying can apply to investing, especially when it comes to deciding in what country to invest your money.

For the vast majority of Americans, the default country of choice is the United States. But the rest of the world isn’t so parochial. Global investors — especially institutional investors — are willing to move their money to whatever country offers them the highest returns.

Despite the overwhelming negative coverage that our country and President Trump’s tariffs have been receiving not only from the mainstream media in the U.S. but also foreign news services, the U.S. is delivering the best results in the world.

|

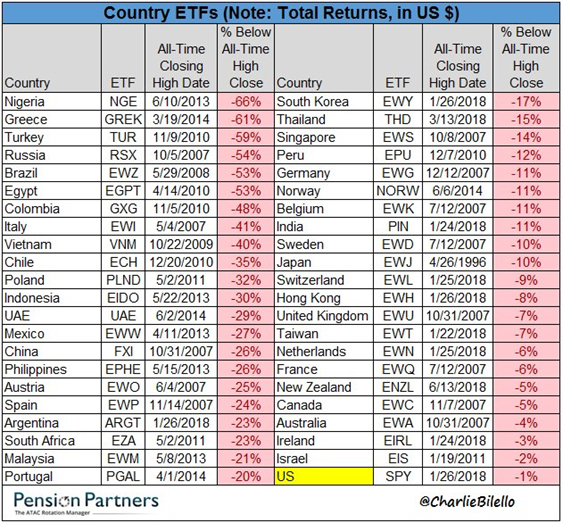

Take a look at the accompanying table and it will be crystal-clear to you that the U.S. is still the place to invest your money.

How’d you like to be Russian investors who find themselves sitting on a 54% loss after being in the stock market for 11 years? Or Brazilian (minus 53%), Chinese (minus 26%), Korean (minus 17%), German (minus 11%) or Japanese (minus 10%)?

Meanwhile, the S&P 500 is only 1% below its all-time high — a high that it set just six months ago in January.

Remember, this is happening in spite of new steel and aluminum tariffs going into effect, as well as threats of retaliatory tariffs from China, Canada and the European Union.

Oh, and don’t forget about the Fed increasing interest rates.

So why is the U.S. stock market doing so much better than the rest of the world? Lots of reasons:

Jobs Galore: The U.S. unemployment rate has been hovering around 4% and our economy has created new jobs for 93 months in a row. In fact, there are more job openings today than there are people seeking jobs.

Heck, the jobs market is so robust that the number of workers leaving jobs of their own free will just increased 212,000 to 3.3 million in May. That boosted the "quits" rate to 2.4%, the highest since April 2001.

Tax Cuts: You don’t hear much about the Trump tax cuts anymore. But I think cutting the top corporate tax rate from 35% to 21% is doing more to strengthen the economy than people realize. In fact, Trump is considering doing another round of tax cuts!

Regulatory Rollbacks: It is impossible to precisely quantify the effect of streamlining regulation. But as a business owner, I can tell you that the most empowering thing a government can do is get the heck out of my way and let me grow my business.

Profit Explosion: Profits for the companies in the S&P 500 skyrocketed by 26% in the first quarter, the biggest earnings growth rate since 2011. Moreover, we are right in the teeth of Q2 earnings season, and the results so far have been very strong.

Larry Kudlow, Trump’s current National Economic Council director, calls corporate profits “the mother’s milk of stock prices.” And under that measure, the stock market is as healthy as an ox.

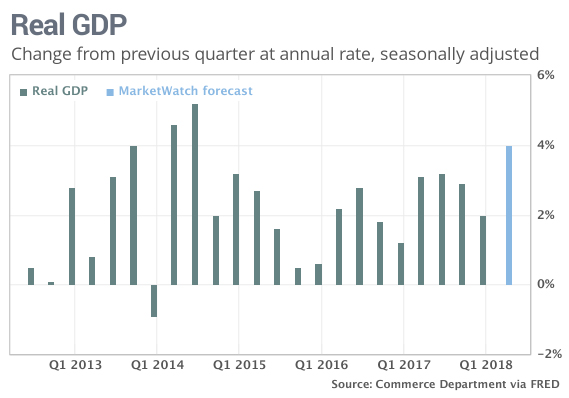

Growth, Growth and More Growth: Second-quarter GDP is expected by some to hit 4%, but the Atlanta Fed is forecasting a 4.5% growth rate. Whatever the Q2 number comes in at, it is going to be a whopper. This means there is no recession in sight.

|

It shouldn’t surprise you that foreign investors are pouring money into the U.S. stock market as a result of all these factors. U.S. equity and bond funds brought in a combined $6 billion in the five-day trading period ending July 18.

Foreign investors have walked a mile in our investment shoes. They love the feel, fit and profits of the U.S. market.

You should too!

Best wishes,

Tony

P.S. My colleague Mike Larson is also hitting things out of the park. The U.S.-focused, higher-yielding companies he’s been recommending in the Safe Money Report portfolio are climbing nicely — with 13 out of 17 winning, closed trades from inception through June. That includes gains of up to 42.5% in as little as six weeks! If you’re interested in joining, click here.