This Force Could Replace QE as a Newer, Greater Driver for the Stock Market

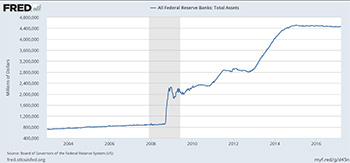

Remember the 2008-'09 financial crisis? I sure do, and it wasn’t pretty. It’s why the Federal Reserve kicked off its bold program of Quantitative Easing in late 2008 with a goal of staving off a complete collapse of the global financial system. It also slashed interest rates to record-low levels, and kept them there for several years.

Indeed, the Fed started buying U.S. Treasuries and government-sponsored mortgage backed securities like drunken sailors. (No offense to drunken sailors.)

For six years, the Fed continued to expand its balance sheet until it ballooned to $4.5 trillion.

However, the Fed has not only stopped buying bonds, but is now shrinking its balance sheet in an attempt to “normalize” its monetary policy. Specifically, the Fed has been running or selling off $10 billion a month in bonds and plans to increase that to $50 billion a month by October 2019.

QE is no more.

At the same time, in March 2018, the Federal Reserve raised the Federal Funds rate by 25 bps to 1.5% to 1.75% — and told Wall Street to expect even more rate hikes.

A lot of financial prognosticators have been predicting doom for the stock market without the tailwind of zero interest rates and quantitative easing. But in the spirit of intelligent debate, I’d counter with this view:

The stock market may go down. But not because QE is over. That's because ...

|

|

Click image for a larger view. |

The Fed Balance Sheet Isn’t Shrinking All That Much: $10 billion a month sounds like a fortune to you and me. But it is barely a bump in the road when you’re talking about a $4.5 trillion bond portfolio.

Yes, the Fed is selling bonds. But it is also earning a boatload of interest on what’s left of its $4.5 trillion war chest. The Federal Reserve said recently that it transferred $80.2 billion in earnings to the U.S. Treasury during 2017 and earned nearly $114 billion in interest income, as well as $1.9 billion in foreign currency gains.

And as the above chart shows, the Fed’s balance sheet is only down slightly from its $4.5 trillion peak.

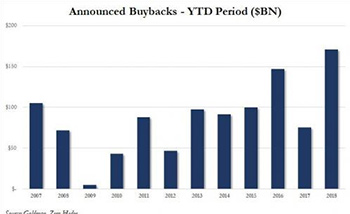

QE, Corporate America Style: No question, QE is responsible for a lot of the gains in this nine-year long bull market. But the Trump tax cuts have also generated a new tailwind to push stock prices higher: stock buybacks.

Corporate America is doing two things with its tax savings: repatriating billions of dollars that it had parked overseas and using those repatriated dollars and tax savings to buy back mountains of its own stock.

|

|

Click image for a larger view. |

Goldman Sachs reports that companies in the S&P 500 have authorized $205 billion in buybacks so far this year. It expects those purchases to hit $650 billion by the end of 2018, up 23% from 2017.

And that estimate was before the massive $100 billion stock buyback that Apple announced last week.

Overall, American corporations have been the largest buyers of shares in the U.S. since 2009. According to the Federal Reserve, American corporations have bought back $3.3 trillion worth of stocks since 2009, DOUBLE the pace of the previous 10-year average.

Here’s some perspective: During that same time, ALL the mutual funds and ALL the Exchange-Traded Funds only bought $1.6 trillion worth of U.S. equities.

What does this mean?

The effects on the stock market from the death of QE have been greatly exaggerated, and a new and perhaps even more powerful source of bull market rocket fuel is being provided by Corporate America in the form of stock buybacks.

Sure, there are lots of reasons to be worried about the stock market. But the Federal Reserve’s actions are not one of them.

Best wishes,

Tony Sagami